The Wall Street Journal’s review this morning of the rise and fall of Brazilian (ex) Billionaire Eike Batista’s business empire contains excellent, timeless points about entrepreneurship, investing, and the madness of crowds. I really recommend reading all of it.

The bare facts – Batista dropped from a Forbes estimated $36 Billion net worth and business empire last year to somewhere between $1 Billion and zero net worth right now (I’m guessing the latter), amidst a dizzying series of fire sales, liquidations and bankruptcies. The article has enough details to match up his failure with established patterns from earlier spectacular, unexpected, and outrageous failures.

The strategic role of incentives and greed

Batista loved using the phrase often heard on Wall Street – “Feed the ducks while they’re quacking” to urge his team to provide as many opportunities as possible for investors, journalists and PR people to engage with his empire, hyping it, investing in it, lending to it, pumping it up. You never know when investors, journalists, and PR people will lose interest, so do everything right now to satisfy their demand, regardless of whether it makes any business sense.

Early backers and enablers made money

Credit Suisse made tens of millions. Ontario Teachers made tens of millions.

Create the appearance of inside information

Batista founded his oil exploration company OGX and raised $500 million from Ontario Teachers by attracting top Brazilian oil exploration talent from state oil company Petrobras, and then marketing his “dream team” of oil insiders as uniquely poised to bid on the most attractive deep water oil fields being auctioned off by the Brazilian state. OGX had no operations and the deepwater fields were a risky play, but Batista had the best talent including Petrobras’ “Dr. Oil.” The implication of all that well-connected talent of course is that Batista’s company would find the inside track to the good fields. What could go wrong? ps. They never really found oil.

Bernie Madoff’s genius appears to have been to convince investors that although he was a little bit dirty – possibly front-running his options trading market making business – that his “victimless” front-running benefited his fund investors. The fact that Madoff was not front-running his options trading business at all, but rather just making up numbers out of whole cloth, appears to have taken his fund investors by surprise.

Batista presumably actually intended to find oil with all his hired talent, but I suspect the appearance of the insider track on the ‘good oil fields’ was a purposeful strategy as well.

Guarantee one side of your empire with another side of your empire by selling puts

A year ago in October 2012 Batista guaranteed the bailout of his oil enitity OGX by allowing investors to sell him $1 Billion in puts, forcing Batista to purchase his own company’s shares above market if things went badly in OGX.

Pro tip: This never works out. Enron executives created perverse incentives to shore up special purpose vehicles with puts on Enron stock. When Enron started slipping, these SPVs added to the momentum by forcing Enron to lose money buying its own shares above market.

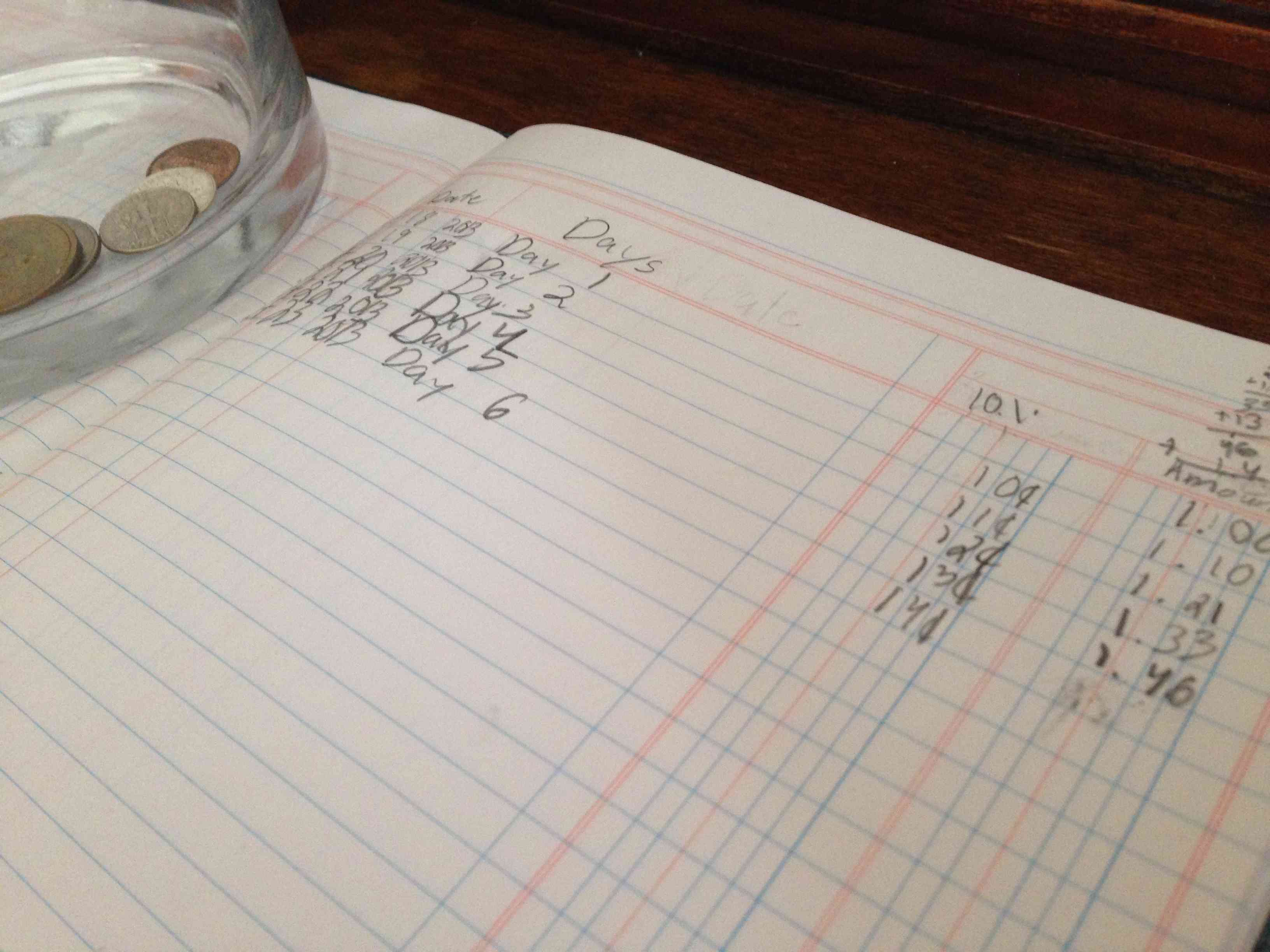

Leverage

In a spectacular fall as fast and furious as this, it’s always, always, ALWAYS the leverage from debt. Brazilian state development bank BNDES provided $3 Billion in loans. BlackRock and Pimco and the Abu Dhabi sovereign wealth fund bought billions of Batista company bonds. Debt leverage is a great synthetic hormone for miraculously growing companies, but it’s also a drug that can bring down empires quickly when the worm turns.

Focus on the flashy

The Brazilian sex-symbol Playboy wife. The $1 million Mercedes-Benz SLR McLaren parked in his living room in Rio de Janeiro. The party boat business called the “Pink Fleet.” The constant claim to journalists that he would soon pass Gates or Buffett or Slim as the richest man in the world. I mean, that’s all great, and more power to him, if it all makes him happy.

The problem is just that the Forbes-list folks I’ve met in my own life tend to be earnest and understated, and they work too hard to have time for that kind of flash. It takes time to woo supermodels and purchase the coolest gadgets, and that’s time away from actually building successful businesses.

Donald Trump has a similar approach to his ‘business.’ In a related story, Trump’s businesses declare bankruptcy on a regular basis.

The lack of responsibility

Of course Batista was misled by his own executives, “I gave out the information people gave me,” he claims in his defense for this sudden and catastrophic collapse. The assets he still controls, he claims, will bounce back any day now.

He is being attacked by enemies: “No one can withstand a bank run. And with all those people talking, how many of them wanted to take control of the assets for themselves?”

See? It’s not his fault, it’s all the haters.

Post read (8588) times.