Please see related introductory Post: Options Trading Part I – NFW Edition

How Wall Street thinks about options trading

Non-professionals who engage in options typically do not understand the ‘currency’ in which they’re trading.

By ‘currency’, I don’t mean option-users remain unaware of their US dollars.

I mean that professional options traders use a mathematical valuation called ‘volatility’ which your average retail[1] options speculator does not even consider.

What is volatility?

Volatility – not the price of the stock or the price of the option – determines the value of an option. Volatility measures the underlying value of an option. Volatility also is how an options trader comes up with the price of an option in dollars.

In math terms, volatility is expressed as a single number describing the frequency and magnitude of price changes over any given amount of time.

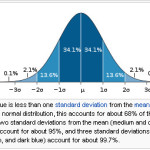

The mathematics of volatility – the single comparable number that describes the frequency and magnitude of price changes over any year – involve assuming a standard model for the distribution of prices. Some traders may use a ‘normal’ bell curve distribution of probable prices, but others can use ‘non-normal’ probability curves in sophisticated options trading.

Technically, the “annual volatility” of a stock is the standard deviation of yearly logarithmic returns on that stock.

A high ‘volatility’ number means the stock price spends significant periods of time outside of your ‘normal’ expected distribution. If the stock price lands on the outside ‘tails’ of a normal bell curve, the ‘vol’ number will be high. If the stock price trades within the high-probability tight band of a bell curve, the ‘vol’ number will be low.

If you buy or sell an option with a high ‘vol,’ the premium, or cost, of the option will be high, to reflect the expectation that the stock prices over time will land on the ‘tails’ of a normal bell curve. If you buy or sell an option with a low ‘vol,’ the premium or cost of the option will be low, reflecting its expected narrow trading band.

Did I lose you yet? That’s fine. You only need to remember one thing.

The important thing to remember is that if you don’t know how to calculate the mathematics of volatility then you have no idea what you are buying and selling when it comes to options. I’m fairly certain the author of the “sell puts!” newsletter did not explain the mathematics of ‘vol’ trading[2] to his audience.

Please see related Posts:

Option Trading Part I – NFW edition

Options Trading Part III – Delta hedging options from a trader’s perspective

[1] By ‘retail’ in this post I mean non-institutional investors. I mean: you and me.

[2] Come to think of it, trading options without understanding vol leaves you as blind as an individual who purchases stocks based on the ‘price’ of the stock, without modeling the underlying future cashflows of the company. Now wait, that would describe 99% of all individual stock investors. Hmmmmmm. What does that say about whether most of us should buy individual stocks? Let me think about that…

Post read (1890) times.