A version of this post appeared today in the San Antonio Express News.

A version of this post appeared today in the San Antonio Express News.

People who give financial advice – like me – can be so annoyingly contradictory sometimes.

Some friends of mine with young kids – like me – asked me recently to look over their investment plans, and to give them my opinion on what they were already doing, as well as what they should do next.

They had already embarked on an automatic-deduction investment plan with their financial planner, and they also had an available $5,000, and they wanted to know where to invest it next.

They were doing something I had been urging my fellow parents to do – funding 529 educational savings accounts for their two girls – so, naturally, I told them it was all wrong.

Let me back up and explain.

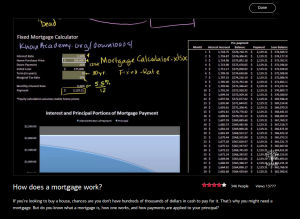

I already wrote about the panic attack I experienced when I visited a useful College Board website to calculate the future cost of college. At the present rate of tuition increases, in ten years from now college tuition will cost the equivalent of checking your little darlings into a 5-Star Hotel in the fanciest building in Dubai.

For. Four. Years.

(*All prices here are my best estimates, using round numbers. Actual results may vary. Always read less than six financial columns in any 24-hour period. If headaches persist, please call your doctor.)

The only way to deal with that impending college tuition catastrophe, of course, is to start eating rice and beans today and send your surplus savings into a college savings account like a State-sponsored 529 Account. 529 Accounts, as you probably already know, typically offer tax-advantages for education savings and investments.

My rice-and-beans-and-529-account advice still holds if you can do it, provided one other condition is already met, which I’ll tell you about in a moment.

So like I said, my friends had set up their 529 account contributions in the name of their 9- and 11-year old girls, complete with automatic deductions.

The problem, however, is that they planned to contribute to these 529 accounts before they maxed out their IRA contributions and 401K contributions.

You see, there’s a clear “order of operations” when it comes to tax-advantaged investment accounts, and it goes like this:

1. Personal IRA – up to $5,500 this year (And more if you’re older than 50)

2. Employee 401K – up to $17,500 this year (and more if your employer matches)

3. 529 Education accounts, or other savings accounts for health or medical expenses

So, I told my friends they have to first contribute $5,500 each to an IRA this year, then make sure they have filled up their 401K bucket to the max. Then – and only then – should they direct any surplus to their girls’ 529 account. Their existing financial advisor had not made this order of operations clear.

Why do I insist they fund IRAs and 401Ks before funding a 529 account?

At least four factors make IRAs and 401Ks a better target for initial investment than 529 accounts.

First, both IRAs and 401Ks offer federal income tax savings on contributions, whereas 529 accounts do not. State-by-state legislation created 529 accounts, and in some states a 529 account offers state income tax relief. Since we all live in Texas, which has no state income tax, their Texas-based 529 account has no income tax advantage. So right off the bat, IRAs and 401Ks beat 529s by somewhere between 20% and 39.5%, depending on your marginal income tax bracket. But even outside of Texas, state income tax relief from 529s pales in comparison to the federal income tax relief of IRAs and 401Ks.

Second, while both a comfortable retirement and a four years college require big chunks of cash, as parents we get the opportunity (misfortune? punishment?) to borrow money for college, but not for retirement.

The student loan industry – all $1 trillion of debt and counting! – stands ready and willing to lend your little darlings what they need to check into Hotel Dubai University (Fight Fiercely Sand Dunes!) at pretty low interest rates too. I know of no similar program to lend to retirees, except halfway-predatory programs like reverse mortgages.

Next, 401K plans often come with an employer match, one of the few real-life examples of free money here on planet Earth.

Finally, compound interest – the secret sauce to the long-term growth of money – works best over the longest time periods. For my friends, they can watch their investments compound for 30 to 40 more years in their retirement accounts, versus merely 10 to 15 years in the 529 accounts for their girls. Always choose the longer time horizon when it comes to investing.

Of course, we know the best option is to fund them all and not have to pick and choose. For my friends, and for most of us, however, we need to choose, and that means picking our investment vehicles in the right order.

In sum: first retirement accounts, then college accounts. Ok? Ok.

By the way, some clever readers will urge maxing-out the 401K first, before the IRA, to take advantage of any employer match. That’s good advice, it just so happens that my friends don’t have 401Ks at their jobs now, so I told them to max out the IRAs first, then pressure the boss to start a 401K plan second, and then fund their 529 accounts third.

Here’s the TL:DR – Place the mask over your own face first, before placing it over your child. Now, just, apply that to investments.

Please see related posts:

College Savings vs Retirement Savings

College Savings and Compound Interest

Interview with College Advisor Part I – The Rising Cost of College

Interview with College Advisor Part II – Is The College Model Broken?

Post read (1919) times.