School started for my girls this week, so I’m in the mood for new beginnings. New school uniforms, freshly sharpened #2 pencils, and lined notebooks still unblemished with unicorn stickers.

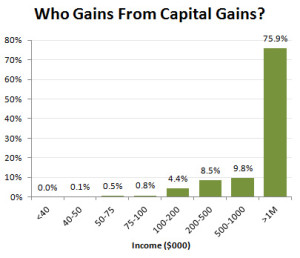

Besides inheritance (obviously the very best way, because remember your first $5.43 Million arrives tax free!) the next two best ways for a person to get wealthy are investing throughout your lifetime, and starting a business.[1]

Neither of these two methods – slow-and-steady investing beginning at a young age or entrepreneurship – require extraordinary talent or prior knowledge. In fact, the biggest common barrier to both methods is simply getting started.

But how does one even do that? Let’s not under-estimate the difficulty of the “getting started” part!

“Let’s start at the very beginning, a very good place to start,” sings my children’s favorite nanny-from-the-movies, Maria.

I have a reader who regularly emails me to the effect (I’m paraphrasing a bunch of his emails) “You need to tell everybody – especially young people – how to call up a brokerage company and how to buy their first stock or mutual fund. They don’t need special knowledge, they just need to get started now, contribute regularly, and never sell. And they’ll end up rich.”

Of course he’s right. You should all totally do this.[2]

Even so, many will resist the advice.

My question back to my reader: How do we get people to start at the very beginning, that very good place to start?

I really don’t know how to fulfill my reader’s wish of inducing people to call up a brokerage firm, open up an account, and buy their first stock or mutual fund. I wish I had the words to express the importance of beginning, like, right now.

The German writer Johann Wolfgang von Goethe didn’t really say, but sometimes gets credit for, this inspirational thought:

“Until one is committed, there is hesitancy … the moment one definitely commits oneself, then Providence moves too. All sorts of things occur to help one that would never otherwise have occurred. A whole stream of events issues from the decision, raising in one’s favor all manner of unforeseen incidents and meetings and material assistance, which no man could have dreamed would have come his way. Whatever you can do, or dream you can do, begin it. Boldness has a genius, power, and magic in it. Begin it now.”

Pseudo-Goethe is very mystical and awesome, but do you want to know what else has “genius, power, and magic” in it? Compound interest! That’s my personal favorite finance topic – and the reason why a lifetime of boring, simple, investing begun in your twenties will make anyone, eventually, wealthy.

My friend David is a 26 year-old public school administrator who recently asked me for financial advice. Like almost everyone his age, David has both student-loans and personal debts. Unlike many his age, he also has the beginnings of both an IRA plan and a 403b plan. He worries about his debts and has kept me updated over the past few months as he pays them down. What I know for sure – and he doesn’t yet fully believe – is that if he continues to contribute to his IRA and 403b, year in and year out, he’s going to end up just fine. Wealthy even.

Simply because he started now, while still in his twenties. (So start now!)

David’s initial $5,500 in his IRA this year, compounding at an assumed 6% annual growth over the next 40 years until age 65, should grow to $56,571.

His annual contributions of $5,500 each year, for the next 40 years, compounding at an assumed 6% growth rate, should grow to a total of $902,262.

That, combined with an employer-matched 403b and teacher pensions plans, should provide David plenty of comfort when he stops working.

But compound interest works best over long periods of time, which means you have to begin now.

To people who wonder – “given all the risks today and all the ups and downs – when should I invest in the stock market?”

The true answer, always, is about thirty years ago.[3]

But the next best answer, for anyone not already in the market is always:

Now. Today.

The hard part: Beginning. Remember that beginning has genius, power, and magic in it.

[1] Another method, rising to the top executive echelons of someone else’s company, requires an unusual combination of talent, hard-work, and luck. In the past few decades the rewards for ‘super-managers’ who did not start out as business owners have been great. But I think the odds are stacked against most people being able to ‘make it’ that way, when compared to simply investing, or starting your own business.

[2] Although I can’t tell you which brokerage to call (because none of them pay me. If you work at the marketing firm of a big retail brokerage firm, it’s you guys who are really the best of the best and my readers deserve to know that. Here, let me send you my PayPal account.)

[3] Just like the truly best way to get wealthy would be via inheritance. But the best way, in both cases, is impossible to do for oneself.

Please see subsequent post:

Getting Started With A Business

Post read (2732) times.