In my favorite movie of all time, Rob Reiner recalls the two-word alliterative review of Spinal Tap’s unsuccessful second album “Shark Sandwich,” as simply “Shit Sandwich.’

The band members react to this shocking review with resentment, but also with a sense for what newspapers are allowed to actually say.

David St. Hubbins: “Where’d they print that?”

Nigel Tufnel: “That’s not real!”

Derek Smalls: “You can’t print that!”

Which bring me to my two-word review of an extremely popular ‘investment’ product known as the variable annuity. For variable annuities, I’ve got the same two-word review: “Shit Sandwich.”

They Can’t Print That

As I wrote this, I knew the newspaper I write a column for wouldn’t carry my real review of variable annuities.1

Of course they won’t let me print a traditional four-letter word. But, for the record, I really don’t think scatology is why most media “can’t print that’ when it comes to my review.

No, they really ‘can’t print that’ because insurance companies are really important media advertisers and variable annuities are really profitable for insurance companies. Hence, you will rarely see an honest review of variable annuities in traditional media.

I’ve been a faithful reader of the Wall Street Journal for nearly twenty years. They are the best daily newspaper when it comes to finance. Just about every three months or so the ‘Retirement’ or ‘Investments’ section of the Journal has a special on annuities, including ‘variable annuities.’ Alongside these sections of course are a slew of brokerage and insurance company advertisements. (If you didn’t already know, that’s the point of these special sections. This is the nature of the Financial Infotainment Industrial Complex.)

That’s where the fun begins. The writers of the Wall Street Journal are smart, and they are also commercially sensible, by which I mean they know where their bread is buttered. So they do this funny tortured-writer’s dance when describing variable annuities. “New annuity guarantees raise questions,” mumbles one ambiguous headline, or “They’re changing our annuity!” writes another, in which, buried in the heart of the article, we learn of many things that can go wrong with these things, without the writer coming out and saying the one thing he or she clearly knows, which is “stay away from variable annuities if you plan on having enough money in retirement.”

Up until this point I haven’t really explained: What is a variable annuity? Also: why should you care?

I’ll start with the second question first. You should care because an overwhelmingly large number of people who don’t know any better have followed their investment advisor/insurance broker/retirement specialist’s advice and bought this shit sandwich, to the tune of approximately $660 Billion. And this overwhelmingly large number of people plan to use it as a main vehicle for their retirement. Don’t know if you have one? Check your retirement plan. Do you use an insurance company for your investments? If yes, chances are, sadly, you bought one of these.

But back to the first question:

What is a variable annuity?

The insurance companies claim that a variable annuity is an investment product that offers both things that every investor wants, namely ‘safety’ plus ‘good returns.’ The variable annuity appears to offer ‘safety’ via a guaranteed income in retirement. The variable annuity also appears to offer ‘good returns’ by adjusting the guaranteed income upward if stock markets do well during the investment period of the variable annuity.

Ok, so…safety and good returns sounds pretty nice…What’s the problem? The biggest problem is extraordinary fees. Like, probably, all-in fees of 3.5 percent per year on your portfolio, which is a serious drag on your money (but great for the insurance company!)

All appearances to the contrary, insurance companies are really not magical wand-wavers that offer the mythical unique combination of safety and good returns. They pretty much just invest your money in stock and bond markets (plus real estate and some derivatives I guess) just like you can directly, except instead of offering you the actual returns of the blended portfolio you bought, they offer you the returns of a blended portfolio minus decades of huge fees. A really dumb combination of stocks and bonds invested over decades will beat a similarly-invested variable annuity every single time. Because of the fees.

Other problems

There are some other problems with variable annuities which I’ll list here for completeness’-sake.

- Once in a while, but more often than we’d like, insurance companies totally miscalculate variable annuity payouts and throw themselves into receivership (a kind of bankruptcy for insurance companies.)

- State insurance regulators know this, so they really like to see heavy fees to accompany these products, to keep up the capital base of insurance companies, to avoid receivership. That’s not good for you.

- The other way insurance companies avoid receivership is to change the rules governing payouts after you’ve already bought in to the variable annuity. Yes, they do this, and that’s not good for you either.

- States typically charge a special tax on payouts from variable annuities, possibly to compensate states for that future receivership problem. Also not good.

- You owe ordinary income tax (meaning, top tax rates) on variable annuity income. Regular investments in taxable accounts, held for over a year, offer better tax treatment than this.

- Variable annuities are roach-motel investments. You can get in easily, but it’s hard to get out, typically unless you pay hefty “surrender charges” if you try to get out within a 5 or 10 year “surrender period.” This is, basically, unconscionable. My advice: Just make like the French army,2 take the pain, and move on to a better investment.

- Variable annuities come to you accompanied by unreadable documentation, incalculable payouts, and small-print ‘disclosures.’ Nobody buying into these things can actually explain to themselves how they work.3

- That lack of understanding includes your insurance broker. Ask him some time to explain, in plain language, why this is a better deal than a simple blended portfolio of stocks and bonds. Whatever his moving lips appear to say, the real answer is “my fat commission,” which runs about 5 percent of the amount you invested.

As I’ve written here before, I don’t sell any investment product for a living, and no investment company or insurance company is paying me, so I don’t benefit whether you follow my advice or not.

Variable annuities are good for the insurance company because they make excessive fees from them. They are good for your insurance broker/retirement specialist because of the commission.

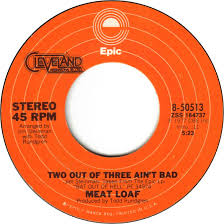

They are not good for you. But hey, as Meatloaf sang, “Two out of three ain’t bad.”

Newspapers of the world: I challenge you to print honest reviews of variable annuities.

But as Derek Smalls said, “They can’t print that.”

A version of this post, without the scatological reference, and with a toned-down version of my critique of how the Financial Infotainment Industrial Complex really operates, ran in the San Antonio Express News.

Please see related posts:

Very simple, final word, on how to invest

Guest Post: The Simplest Investing Approach Ever

Insurance Part 2 – The Good The Optional The Bad

Insurance Part 1 – Risk Transfer Only

Post read (1087) times.

- I’m not so much concerned with the vulgarity. (Although my editor was!) After all, let’s talk truth for a moment: you can’t read the national or international news section of any ‘respectable’ daily paper without worrying that your curious ten year-old will glance over your shoulder and ask you for definitions of ‘beheadings,’ or ‘pedophile,’ or ‘systematic rape.’ I mean, we’ve got worse problems than a little scatology. ↩

- Surrender immediately, obviously ↩

- Except apparently this guy at www.annuityreview.com who offers, for an initial $150 fee, (and who knows after that, maybe more?) to analyze your variable annuity and give you a ten page report on all of its features, pluses and minuses. I don’t have any ties to the service myself, I only saw it referred to in the WSJ, but it strikes me as a good idea for people already stuck with these roach motels. Also, note the fact that if you need a ten-page report to describe your investment product then that investment has violated the “Keep It Simple, Smarty” rule of investing. ↩