In January 2007 I was in the midst of building an investment fund with a growing roster of investors eager for me manage more of their money. The main thing limiting my fund’s growth was finding the diamond-in-the-rough investments that fit my picky criteria within a very niche market.

In January 2007 I was in the midst of building an investment fund with a growing roster of investors eager for me manage more of their money. The main thing limiting my fund’s growth was finding the diamond-in-the-rough investments that fit my picky criteria within a very niche market.

I felt so excited about the investment opportunity from James Tibor.

He had founded Hot Point Marketing in Chicago, but had agreed to separate from his company, and had a judgment and settlement agreement that his company would pay him. My investment was to buy out Tibor’s settlement agreement (or judgment) for an up-front cash payment to him, and have his company pay my fund over a period of years. At the agreed-upon price, my fund stood to make a very attractive return, assuming all went well.

The delightful thing about this specialty investment was how perfectly it suited my fund. It was too small for Wall Street, too idiosyncratic for a typical hedge fund. It was large, but doable, for my growing fund. Importantly, it would allow me to draw down more investment capital from my investors. The whole thing seemed quite safe.

Hot Point Marketing, according to Tibor, had substantial income from work already done, meaning plenty of cash-flow to support future payments. Hot Point had a very strong financial audit from a respectable New York firm as well as a big line of credit from a large regional bank.

By phone, I interviewed Frank, Hot Point’s senior vice president, who had signed the separation agreement. He was taciturn and his voice a bit muffled, but he verified all the terms of the agreement. I left voice mails on a Friday afternoon for the regional bank just to confirm nothing in the company’s letter-of-credit had changed.

Two things seemed mildly off-putting.

I had reached out to the New York-based auditor, but they hadn’t been able to confirm which partner had worked with Hot Point. They owed me a call back. Next, the Dun & Bradstreet report we’d purchased – an online service providing credit reports on private companies – had been created a few days after my due diligence phone call with Frank.

I have to say I was still fired up to proceed, and figured we’d find answers to those issues in the next week.

I remained ready to make the biggest investment of my fund management career when I left for the weekend.

Thank you sweet mercy for my employee at the time – a kid just one year out of college — who wondered over the weekend about the due diligence we’d already conducted.

So he Googled “James Tibor fraud.”

Quite a bit turned up with that simple search.

Tibor had already been caught on charges of theft and forgery. Tibor had also accused a priest of molesting him, only to recant later. An investor, similar to me, said he had lost more than $100,000 to Tibor.

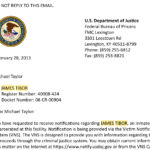

I reached out online to the investor, and then to a friend who worked for the Department of Justice in Chicago. By that point I was safe from being swindled, but shaken by how close I’d come.

The fancy audit that had claimed more than $19 million in revenue and $8.1 million in assets? It turned out that Hot Point never had assets or revenue of more than a trivial amount, according to court documents. The bank line of credit was fake.

In February 2009, Tibor pled guilty to one count of wire fraud for a $100,000 fraud and other attempts to defraud investors, including me. I delivered a victim statement at his sentencing in Chicago in May 2009, where I faced him in his orange jumpsuit. Tibor received a sentence of 77 months in prison.

Here’s the scariest part of the whole episode for me: I do not think of myself as an easy mark, but in retrospect Tibor’s con seemed uniquely suited to me. He used language of secondary debt purchases, which indicated to me he was an insider. He knew the due diligence I would want. The conditions were right, and “Frank,” the fake colleague, hit all the plausible points about the investment when we talked.

Even though something was a bit “off” about the Hot Point opportunity, I wanted to believe. I needed that investment. I wanted the high return it seemed to promise. I wanted to grow my fund.

A con is built on what the victim craves.

Investors should prepare themselves for this kind of mental assault. Well, not just investors. Every day we should apply some skepticism about what we know to be true, and what we just wish to be true.

I don’t know how to offer a “lessons learned” except that when we see something that perfectly confirms what we already want to believe, we should take an extra moment and a few additional steps to verify it. Cultivating skepticism is a key skill of investing, as well as citizenship.

The last communication I received from the Department of Justice was that Tibor was scheduled for release from prison to a halfway house and would transfer to the Salvation Army Freedom Center in Chicago in January 2014.

A recent Google search showed me a website touting his marketing and consulting skills.

My newspaper reached out to Tibor through his website last week seeking comment, but he didn’t respond.

This Post ran in the San Antonio Express News and Houston Chronicle.

Post read (356) times.