Editor’s note: Paul recently purchased The Financial Rules For New College Graduates, then had some followup questions regarding mutual fund investments. Readers of the book…feel free to pepper me with your followups…

Dear Mike,

I’m on board 1000% when it comes to 100% equity mutual funds, the questions in my mind now are: “Which one(s) and how many?”

1) I’m finding many front-end load (5.50%-5.75%) managed funds with anywhere from 0.89% Expense Ratio to 1.40% (with the 1.20% range being the most common). I’m assuming that the lower the expense the better, but am I overstating the importance of this number?

2) Without splitting hairs about what the top 10 holdings are, the turnover within the fund itself, the risk and return vs category, how long the managers have been there and what their philosophy is, what are some of the key things you’d look for before settling on a fund?

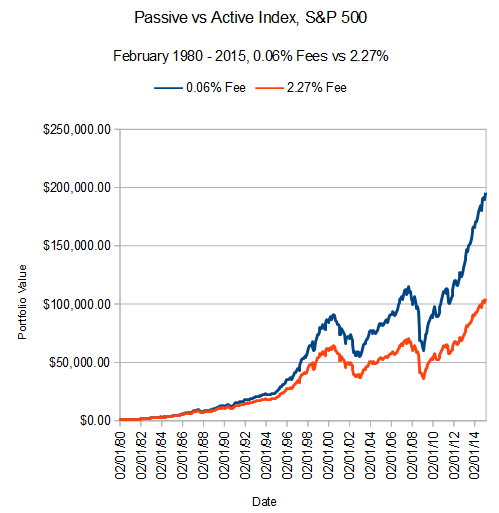

3) I’ve compared the 1 yr, 5 yr, 10 yr and Since inception returns of the funds. Many funds have returned 7-9% while some are well into the 10% and even 11% range. Would you put any stock (no pun intended) in those numbers when comparing and contrasting funds? Are these funds even worth looking into when an Index fund, through Vanguard for example, matches virtually every move the S&P 500 has made, returning the same 10.33% without the commission charge and SIGNIFICANTLY lower expense ratio (0.04%!!!)?

4) And, of course, is 1 fund enough, or would you explore the idea of having several?

Thank you for being willing to even read through this! Hopefully I haven’t strayed TOO far away from the simple approach I’ve attempted to internalize with your teachings.

–Paul F, Boston, MA

Dear Paul,

All great questions, I’ll take them one at a time

1. Front-end Load, Back-end Load – From my (consumer-driven, not industry-driven) perspective, these are all terrible, terrible fees and should be avoided. Never get a fund with them. Basically unconscionable. Can’t justify them at all. Only reason to pay these is if you are totally captive to an employer-sponsored plan and you have no choice of a no-load fund. If you are setting up your own investment plan, just eliminate them entirely.

On the other hand, from an industry (sales-driven) perspective, load funds are great. Makes the salesperson rich at the direct expense of the investor.

About the annual Expense Ratio…at this point 1% is kind of the industry marker. Less than 1% is a reasonable deal for an actively managed fund, over 1% is a little pricey for an actively managed fund. As I say in Ch.14 of my book, I don’t actually think paying for active management makes sense, but if you really want it then 1% is kind of the inflection point between cheap and expensive.

And finally, you are NOT overstating the importance of these numbers. They are – especially in the long run – the absolute key to not turning over between 20% and 50% of your lifetime investment gains to your investment managers. That’s not an exaggeration, its just math you can model out in a spreadsheet.

2. Fund factors to look for – For me (my big bias) the expense ratio is the #1 consideration. After that, of course you want to understand how active versus passive they are (my bias is for passive), how quick turnover is (my bias is for low turnover as it reduces costs and increases tax efficiency), how concentrated they are within the asset class (a case can be made for either diversification or concentration, depending on your overall goals and the rest of your investment plan), where it is in the risk spectrum (for a 20-something person I think you want to maximize risk in all long-term holdings. I still do and I’m in my mid-40s, and I will continue to maximize risk for my whole life, but that’s my bias for all my investments).

3. Time Horizon – For comparing returns, the 10 year and longest time horizons are the only relevant data points. I would ignore 1 to 5 year returns as essentially noise, since the right investment horizon is decades. If the manager is consistent in strategy, the long-term return will be what that particular market sector offers in the long run, which is all I’m looking for in an investment manager.

3. Time Horizon – For comparing returns, the 10 year and longest time horizons are the only relevant data points. I would ignore 1 to 5 year returns as essentially noise, since the right investment horizon is decades. If the manager is consistent in strategy, the long-term return will be what that particular market sector offers in the long run, which is all I’m looking for in an investment manager.

4. On Number of Funds – I’ll suggest a book for further reading by a guy I like: Lars Kroijer “Investing Demystified.” He doesn’t agree with me on my “risk maximization” point, but he and I agree on the efficient market hypothesis as a good starting point for most people. The reason I bring him up is he makes a case for owning a single “All World Markets” fund, which should be available from major discount brokers. After reading Kroijer you’d have a better sense of how many funds you’ll need. Whether just 1, or more.

4. On Number of Funds – I’ll suggest a book for further reading by a guy I like: Lars Kroijer “Investing Demystified.” He doesn’t agree with me on my “risk maximization” point, but he and I agree on the efficient market hypothesis as a good starting point for most people. The reason I bring him up is he makes a case for owning a single “All World Markets” fund, which should be available from major discount brokers. After reading Kroijer you’d have a better sense of how many funds you’ll need. Whether just 1, or more.

As for me, I have just 3 funds in my 401K retirement account. All 3 are 100% equities:

1. US Small Cap,

2. Non-US Developed markets (Europe, Japan, NZ), and

3. an Emerging markets fund

I’m pretty happy with that and will probably never change it. Maybe I’ll re-balance once in a while if one starts to get too big relative to the others. But again, Kroijer’s book will probably explain well why that view makes sense to me.

I hope that helps!

Post read (627) times.

On the other hand, from an industry (sales-driven) perspective, load funds are great. Makes the salesperson rich at the direct expense of the investor.

On the other hand, from an industry (sales-driven) perspective, load funds are great. Makes the salesperson rich at the direct expense of the investor.3. Time Horizon – For comparing returns, the 10 year and longest time horizons are the only relevant data points. I would ignore 1 to 5 year returns as essentially noise, since the right investment horizon is decades. If the manager is consistent in strategy, the long-term return will be what that particular market sector offers in the long run, which is all I’m looking for in an investment manager.

4. On Number of Funds – I’ll suggest a book for further reading by a guy I like: Lars Kroijer “Investing Demystified.” He doesn’t agree with me on my “risk maximization” point, but he and I agree on the efficient market hypothesis as a good starting point for most people. The reason I bring him up is he makes a case for owning a single “All World Markets” fund, which should be available from major discount brokers. After reading Kroijer you’d have a better sense of how many funds you’ll need. Whether just 1, or more.