Visiting with my brother-in-law this summer, I learned that his theory of stock market investing is “science fiction.” His favorite book of all time is Frank Herbert’s Dune. He enjoys picking companies or funds that anticipate where the world is going in 20 to 30 years. He invests in trends like robotics, artificial intelligence, and the blockchain.

That’s all fine and cool and was particularly interesting to me as I had happened to be reading a related book, by investment advisor and author Ric Edelman, The Truth About Your Future: The Money Guide You Need Now, Later, and Much Later.

Edelman’s book is a guide to personal finance through a futurist’s lens. Everything on our planet is about to be different in astonishing ways, so what should you do about it? In the first half of the book he presents a compelling case that our future – even in our own lifetime – will look quite different from the present. His shorthand for this change is that many of the most important things in our world are subject to “exponential growth.”

Reading the first half of the book is a bit like watching highlight clips of a year’s worth of TED talks about everything from nanotechnology to robotics, and from energy production to life expectancy, to pick a few of his examples. When you track trend lines on these phenomena, as Edelman does, the growth isn’t arithmetic over time. It’s exponential.

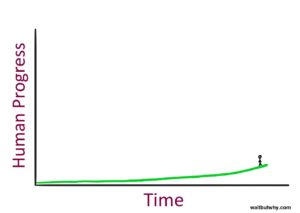

What does that mean? When you track exponential, or compounding, growth over time you see those lines that slope gradually upward in the beginning, then turn a bit steeper, until finally the line becomes nearly asymptotic – pointing straight upwards.

You’ve no doubt seen population growth charts that do this, or the growth charts of the spread of diseases over time. Or if you’re old, rich, and lucky enough, you’ve noticed that happen to your investment portfolio through the magic of compounding.

I happen to agree with Edelman that in finance, technology, and economics we need to understand compound growth rates – whether about computing power or the growth of money, because the end results go further than our simple brains at first expect. We have a tendency to track and predict growth in an arithmetic rather than exponential way. So I appreciate Edelman’s emphasis in his book that everything is going to look different in the future, beyond what most of us have imagined.

But stepping back from the issue of whether the future will be different, a big question implicitly raised by the publication of a new personal finance book is always whether the world has sufficiently changed or is likely to change in the future, such that readers should pay attention to the change, and therefore the new book?

I have strong ideas about this big question in part because I published a new personal finance book myself, just out this summer. (You should put down this column right now and buy it, by the way.) But anyway, my bias, so you know, is that there’s hardly anything new under the sun when it comes to best personal financial practices. In fact most of what should be known about our best personal finance choices hasn’t changed since Benjamin Franklin’s The Way To Wealth, published 260 years ago.

What’s new are ways of reaching people who need the information, or clearer explanations, or updates on new ways of achieving the same results.

Edelman is a well-established financial guru with eight previous books, a radio show, and a large financial advisory practice. I was interested to read how – when he dons the mantle of futurist and claims everything is going to be different in ways we can hardly imagine – he would answer the question of what exactly should we do differently? That’s the second half of his book.

He doesn’t say it this way, but here’s my summation of his advice: Basically, do very little differently. His radical “exponential change is coming and everything is going to be unrecognizably different” thesis leads to what I would still describe as “do mostly all the same things” advice in the second half of the book.

Sure, he tweaks some ideas about long-term care insurance, as that market has evolved somewhat. Also, we’ll all live longer than we expect so we need more money for our retirement years. But, we kind of knew that already.

He highlights an ETF he helped create, an index of companies that will benefit from the exponential growth trend. While I know nothing about the ETF except what he describes in the books, it sounds plausible and something I’ll mention to my brother-in-law the next time we talk. But in a larger sense, I don’t think even that innovative investment product created and promoted by Edelman is essential in any particular way.

One of the more dangerous lies we tell ourselves in personal financial choices is: “it’s different this time.”

Despite the radical transformative TED Talk-ey way he envisions the future, Edelman’s advice is quite staid. That consistency I actually think is a credit to Edelman’s reasonableness, despite his radical-sounding futurism.

Despite the radical transformative TED Talk-ey way he envisions the future, Edelman’s advice is quite staid. That consistency I actually think is a credit to Edelman’s reasonableness, despite his radical-sounding futurism.

If you believe in imminent transformational and exponential growth coming down the pike from nanotechnology, data storage, the blockchain or whatever – and sure, why not, I’ll believe it – that doesn’t necessarily imply transformational changes in the best financial or investing behavior, for most people.

Personally, I’ll just be here saying the same simple things over and over again about finance.

At least until I’m replaced by our robot overlords with a replicant. But then: how will you know the difference?

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

All Bankers Anonymous Book Reviews in One Place!

Clash of the Mortgage Gurus – Edelman versus Ramsey

Post read (654) times.