A version of this post appeared in the San Antonio Express News.

A version of this post appeared in the San Antonio Express News.

I recently wrote about the unfairness of ‘carried interest’ tax breaks targeted to hedge fund and private equity owners. In fact, I’ve covered the topic before as well.

Some readers became angry about my view of this tax break and took umbrage at my lack of sympathy for ‘job creators’ like hedge fund owners.

Among other complaints, readers wondered why I didn’t write about tax atrocities like the ‘death tax,’ known in other circles as the estate tax.

Inspired by that critique, I will offer my thoughts on other taxes that I pay and tax breaks that I enjoy, both from an objective standpoint – taking into account ‘what’s fair for society’ – and from a subjective standpoint – taking into account my own personal situation and ‘what’s fair to me.’

For this post: The Estate Tax.

Fair to Society

Honestly, estate taxes are my favorite ‘fair to society’ tax. When I am declared ‘Lord Of All Catan’ over this entire country I will quickly and happily raise the estate tax rate and lower the exemption for estate taxation. Estate taxes are fair to society because:

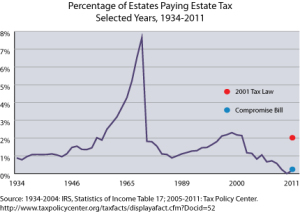

1. They are ‘progressive’ in the sense that they tax the upper levels of wealth and leave less wealthy households unaffected. Half of the estate taxes in this country are paid by the top 0.1% of income earners, and virtually all estate taxes are paid by the top 10% of earners.

2. All taxes distort the efficiency of markets, but estate taxes distort consumption and other economic activity less than other taxes. That minimized distortion makes it more efficient than other taxes.

3. Estate taxes contribute in some (small) way toward ‘churning’ the stratified wealth levels of society, something that is fair in a society that values socio-economic mobility.

4. Estate taxes encourage the creation of philanthropic avenues such as endowments and foundations to avoid estate taxation. In that way the wealthy dedicate funds according to their specific moral choices (education, health, fitness, parks, art, scientific research, whatever) rather than trusting to the government to make those choices for them. A diverse range of non-governmental philanthropic funding streams strengthens civil society.

Absence of Data

While I don’t have the economic statistics to back up statements two through four above – I instinctively feel they apply to any tax on inheritance. Maybe you totally disagree. I’m ok with that. Maybe you’d like to agree, but you’d also like to see some data to back up my statements.

For readers who prefer actual data over pontificating, I offer in reply one of my favorite sayings from former San Antonio Express News writer and faux-philosopher Jack Handey:

“Instead of having ‘answers’ on a math test, they should just call them ‘impressions,’ and if you got a different ‘impression,’ so what, can’t we all be brothers?”

Fair to Me

Since I don’t expect to inherit much from my parents, and I don’t expect to pass on much to my own children, I find the estate tax extremely ‘fair to me.’

I say, bring it on!

So that was easy. But now let me try a thought experiment.

How would my mind alter under different circumstances?

A mental test

What if I had a ten million dollar estate coming my way, and the federal estate tax would take 40% of all the money I was set to inherit over my $5 million estate tax exemption? Would I find it so ‘fair to me’ then? 1

I would like to think that I would be wise and grateful enough not to begrudge the federal government the $2 million estate tax (40% of the $5 million over the $5 million exemption amount) because I would get to keep $8 million in inheritance.

Ah, a cool $8 million for me, that I didn’t have to work for.

“I’m just lucky to be born into a family with $10 million to pass on,” I would think to myself as I inhaled from my Rosemary-Lime scented calming soap I order in bulk from Gwyneth Paltrow’s website.

Frankly, that’s not a bad deal that would leave me impoverished. I’m pretty sure I could just squeak by on a mere $8 million. In that scenario I do think the estate tax would still be ‘fair to me.’

The real test

Ok, but what if I stood to inherit a $100 million estate from my parents? And the federal government could tax 40% of my $95 million, (remember: we all get to keep the first inherited $5 million tax-free!) leaving me with just $62 million?

How do I like that estate tax now?

Well, if you put it that way, now I’m angry.

Because that is totally not fair to me!

Most importantly, how is guy like me supposed to get by on just $62 million? I have rights you know, based on the family I was born into.

The federal government probably just squandered the $38 million death tax it extracted from my deceased hard-working parents and me and gave it away to welfare queens and immigrants!

Gah!

Somebody get the Koch brothers on the line right now and let’s fix this unfair system together!

What?

The Koch brothers said they don’t want to talk to me ‘and my measly $62 million?’

They said I’m a ‘piker?’

Oh, the humanity!

Please see previous posts on taxation such as:

Carried interest tax break seems unfair to me

Shhh…Please don’t talk about my tax loophole

Adult conversation about tax policy

And see this interesting New York Times piece on the estate tax, linking it to wars of the Twentieth Century and ideas of fairness in society.

Post read (1963) times.

- Technically, I would be taxed on 40% of all amounts over $5.34 million – the current exemption for estate taxes – but please humor me, I’m trying to stick to round numbers to keep the numbers from distracting us. ↩

One Reply to “Death and Taxes and Fairness”

interesting