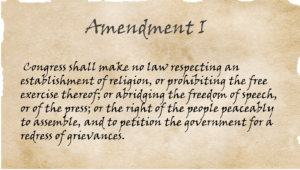

Does Texas Believe in Free Speech?

Texas leaders need to go back to middle school. My sixth grader recently learned, and then recited to me, the 10 Amendments to the Constitution,

Texas leaders need to go back to middle school. My sixth grader recently learned, and then recited to me, the 10 Amendments to the Constitution,

Threats to First Amendment in recent business regulations in Texas

Try to see beyond the Financial Infotainment Industrial Complex to the economic dashboard

I learned about a timely investment tool from an article by Burton Malkiel in the Wall Street Journal this past month. Timely, because observed, economy-wide

The two biggest macroeconomic worries in the US right now are burgeoning inflation and supply chain issues. A plausible narrative for both is that the

If food entrepreneurship were a series of races for prizes, Grain4Grain has proved itself a thoroughbred. They took third prize in the HEB Quest for

I founded Bankers Anonymous because, as a recovering banker, I believe that the gap between the financial world as I know it and the public discourse about finance is more than just a problem for a family trying to balance their checkbook, or politicians trying to score points over next year’s budget – it is a weakness of our civil society. For reals. It’s also really fun for me.

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

We’ll let you know when we have new posts!