Breaking My Own Rules To Teach My Kid

Roblox, direct listings, and breaking investment rules in order to teach lessons

Roblox, direct listings, and breaking investment rules in order to teach lessons

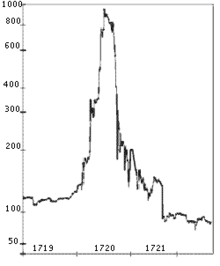

Nominations are still open for the craziest frothy finance stories of 2021. Strong cases can be made (and I have made them!) for bitcoin and

You’ve been writing me a lot lately, wondering about bitcoin. What is this technology? What is it used for? Should you get involved? But also,

I didn’t want to do this. Talk about GameStop, Reddit, Stonks, short-squeezes, hedge funds and roaring kitties. And yet, here we are. I didn’t want

I received a question from a long-time reader, noting the multi-year underperformance of non-US stocks relative to US stocks. Over a 10-year interval, he noted,

I founded Bankers Anonymous because, as a recovering banker, I believe that the gap between the financial world as I know it and the public discourse about finance is more than just a problem for a family trying to balance their checkbook, or politicians trying to score points over next year’s budget – it is a weakness of our civil society. For reals. It’s also really fun for me.

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

We’ll let you know when we have new posts!