Up until now I’ve mostly ignored the Millennial FIRE movement, which stands for Financial Independence, Retire Early.

My buddy Justin S. introduced me to some retirement planning strategies I’d never heard of recently, strategies that he is considering using in the next few years as part of his FIRE plan. FIRE is the aspiration of many 20 and 30-somethings, who hope to quit their jobs by age 40 or so. It would be easy – as with all trends involving Millennials – to exaggerate and strawman-ify the FIRE movement.

Justin, a software engineer at a large financial services company in San Antonio, is 39 years young. He hopes to be able to retire within the next five years.

Justin’s FIRE journey began 1.5 years ago when he and his wife began to really examine what role paid work should, and should not, play in their lives. It was at that point that they got serious about trying to accumulate savings enough to let them walk away from work within ten years.

He says his wife had always been a natural saver, whereas he had enjoyed buying nice cars and a motorcycle. In an earlier phase of life he’d bought a condo at the worst time and place (Central Florida, 2007), an experience that left him with wrecked credit and a searing fear of being stuck financially, living paycheck-to-paycheck.

Says Justin, “My primary driver is to not be in a position like that again. Anything can happen at work, anything can happen with houses.”

He’s gotten deep into FIRE-oriented blogs, retirement strategies, and tracks his progress on a free website.

with numerous retirement calculators. His ultimate goal is to have enough saved that he could choose more hands-on work. He seeks something more tangible than software, something that would give him a more tangible sense of accomplishment.

Justin explained to me the many variations on FIRE. To save you some time navigating Reddit threads, finance blogs and YouTube channels, here’s your guide to different FIRE flavors.

Lean FIRE – This is Justin’s plan. This means figuring out the bare minimum income you need to survive on annually, usually by making choices to downsize a home and car, location, and lifestyle. If Justin and his wife can figure out a way to live on $35,000 per year total, for example, and assume a 5% annual withdrawal rate, then theoretically they would only need $700,000 in a nest egg to call it quits in five years. (These are my numbers, not theirs, and just reflects a starting point for planning)

Obviously they (or we) can tweak some assumption about tax rates, rates of return, inflation, and their ability to eat only rice and beans forever, but you can sort of see the initial plan start to come together.

Inherent in Justin’s Lean FIRE planning, he says, is a commitment to live cheaply enough that work isn’t necessary. If that means living in a lower-cost state, or even a lower-cost country, he’s ok with that. Their reward will be freedom from having to work in an office or depend on a paycheck in the future.

Fat FIRE – This is for folks who make a high enough income that they can build a hefty nest egg for later. Generally this also means sacrificing current wants to ensure future luxury. Or as Justin says, Fat FIRE adherents want to live middle class today in order to live upper class in the future. Of course, part of the goal is to build that nest egg as quickly as possible in order to still retire early. A Fat FIRE pile of savings is by definition far higher than a lean FIRE pile of savings.

Barista FIRE – This is for current corporate drones who dream of giving up a career advancement and responsibility and who have seek to have enough money in the bank to just work a minimum wage job with good benefits. Since healthcare costs naturally represent a major barrier to early retirement, the “Barista FIRE” enthusiast may sign up to work for a company like Starbucks, post-retirement, for the generous benefits rather than for the paycheck. FIRE in this case doesn’t mean a full retirement but rather the independence from work that requires long-term responsibility, career, and those jerks from headquarters requesting you come in to finish those TPS reports on Saturdays.

Coast FIRE – This is for folks who have made their “number” for financial independence but don’t actually have an incentive to quit yet. Maybe their spouse isn’t ready to retire early, so it’s worth hanging on to a job. But they can ‘coast’ for a while without the pressure to actually work to pay one’s bills.

All in all, of course, you can criticize and exaggerate these different versions of financial independence and retiring early. Assumptions may strike us as unrealistic. The goal may seem overly materialistic, or not materialistic enough. Personally, my main objection to seeking to retire early is that work is what gives us meaning. If we don’t like work and seek an early retirement, maybe the solution is to seek different work that better suits our skills and interests?

And yet, every responsible financial planner would ask her client to set forth a future plan, make realistic assumptions about savings and investment to get there, and then ask what the client is willing to give up to make the future a reality. That’s what the FIRE adherents are doing. Financial independence always requires some version of these steps, even if some FIRE enthusiasts take it to the extreme.

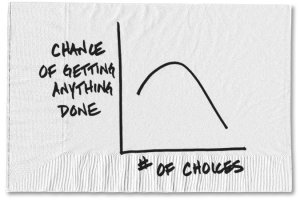

At the extreme, of course, even the financial independence aspect of FIRE can be overdone. Just as body dysmorphia pushes even the thinnest people to cut calories, so can the FIRE movement lead to penny-pinching absurdity. Justin is not in that problematic category, but you don’t have to look hard online to see people maximizing their savings to an extreme that doesn’t make a ton of sense.

What about those specific FIRE retirement account strategies Justin mentioned that I hadn’t heard of before? I looked into them. They aren’t exactly universally recommended – nor is FIRE for that matter – but I’ll describe them in more detail in an upcoming column.

Please see related posts:

FIRE Part II – Some Complex Techniques

FIRE Part III – On the Benefits of Frugality

Post read (821) times.