A version of this post appeared in the San Antonio Express News.

I’m totally fired up that the Obama administration relaxed travel, trade, and diplomatic restrictions on Cuba last week.

Removing the US embargo will not raise up Cuban people’s lives as much as we hope without the Cuban regime, for its part, embracing more of a market system.

For over 50 years, the Castros took every public speaking opportunity to point their fingers North and blame all of their country’s ills on the US.

By lifting the US embargo, we at least remove the Cuban regime’s primary excuse for the past fifty years of horrific economic conditions of the Cuban people under the Castros.

It’s not the embargo, it’s their suppression of a market economy.

Markets vs. Cuban Socialism

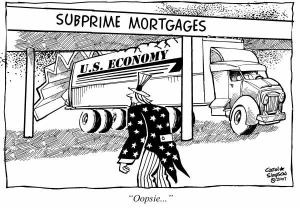

I’ll be the first to declare that our markets-based system has tremendous failures.

Markets are unjust.

Markets – without a safety net – heartlessly leave children, the unemployed, and the elderly in poverty.

Unregulated markets commonly lead to the terrible treatment of consumers and the environment.

But to paraphrase Winston Churchill’s famous quip about Democracy, I would say free markets are the worst form of economy, except for all those other forms that have been tried from time to time.

One thing that made me a card-carrying Adam Smithian Wealth of Nations-thumping pro-markets guy was visiting Cuba under the Castros.

My wife and I visited twice in the 2000s. We’ve visited many resource-limited countries. But nothing compares to Cuba.

In Cuba, everything is illegal

In the absence of any legitimate way for ordinary Cubans to earn enough to get food to eat, corruption envelops every day life.

Everyday. corruption.

Not for anything special, or anything nice. Just to get enough calories in the body.

For us as tourists, simply securing a room in a private home for a few nights in Havana involved a cat-and-mouse game to fool the local police.

“Ok, I’ll arrange it all for you,” the man offered at our café, his eyes scanning for signs of government authorities.

“Follow me down this road. About two minutes after I go, walk to the end of the block, turn right, and I will meet you inside the third doorway. Make sure you do not follow me too closely, as the police are watching.“

This was all standard procedure for renting a room. The homeowners – like thousands in Havana – desperately needed to earn dollars to buy bare necessities. The room cost us about $5 per night.

To further support that family we bought a home-cooked meal from them for another $2. I knew it was the best our host could do, and her eyes asked for a kind of understanding of their difficult situation as she laid the pigs-knuckles plate plaintively in front of us, murmuring “No es mucho pero esta hecho con mucho cariño” – “It’s not much but it is made with a lot of love.”

We wanted to cry.

Later, we slipped into an illegal restaurant –known as a paladar – run out of another private home that was desperate to earn dollars, despite them running the risk of breaking the law and being arrested.

Incidentally, you do not want to be arrested and go to a Cuban prison, as described in Reinaldo Arenas’ memoir Before Night Falls.

The Cuban health care system

On our second visit, my wife lived for six weeks working and researching in a Cuban hospital.

She arrived in Cuba ready to admire their health care system – free, universal, and reportedly successful. Long story, short: You do not want to get sick in Cuba.

The doctors are excellently trained, they have outstanding vaccination rates and access to prenatal care, but the facilities and access to medicines are awful.

When a woman who worked for her hospital needed specific antibiotics for a persistent infection, could she access the vaunted Cuban health care system?

Absolutely not! Appropriate antibiotics were unavailable to her, except through corruption. She ended up paying precious (and illegally obtained) dollars to the limousine driver of a Communist Party member, who had access to scarce antibiotics that ordinary Cubans do not.

With markets for nearly everything outlawed, everybody must cheat merely to gather life necessities.

Spying on everyone because everything is outlawed

Cubans are not allowed to move within the island to seek employment, without permission from authorities – which permission cannot be obtained without corrupt connections.

But hunger is a powerful motivator. People stay at friends’ houses illegally in Havana, for example, hopeful to earn dollars. They have to sneak in and out house, however, fearful all along that neighbors would report them.

The official Cuban Party propaganda since the 1960s has maintained that US sanctions primarily caused the degradation of the Cuban economy.

With US sanctions lifted, that lie at least will be exposed.

Post read (2734) times.