All I wanted for Christmas is a ban on members of Congress trading individual stocks.

Back in 2012 Congress passed the STOCK Act, which requires disclosure of securities trading with a 45-day time lag, with some (extremely minor) penalties for noncompliance.

Based on those disclosures and other reporting, I put together a complete spreadsheet of the Texas delegation’s trading in 2022, year to date, through September.

I’ll get into that description in a moment.

In the meantime, it’s important to understand for context that the correct amount of individual stock trading by members of Congress is zero. The correct way for a member of Congress to invest in markets is to put their investment in either a blind trust or a diversified portfolio of stock mutual funds, preferably not focused on any industry sector.

This is because members of Congress have access to information that the rest of us do not have. They have both public platforms and the ability to cast votes affecting industries and companies that we do not have. We should know with certainty that their support or opposition to industries, companies, and government spending and government regulation come from a sincere belief rather than personal financial self-interest.

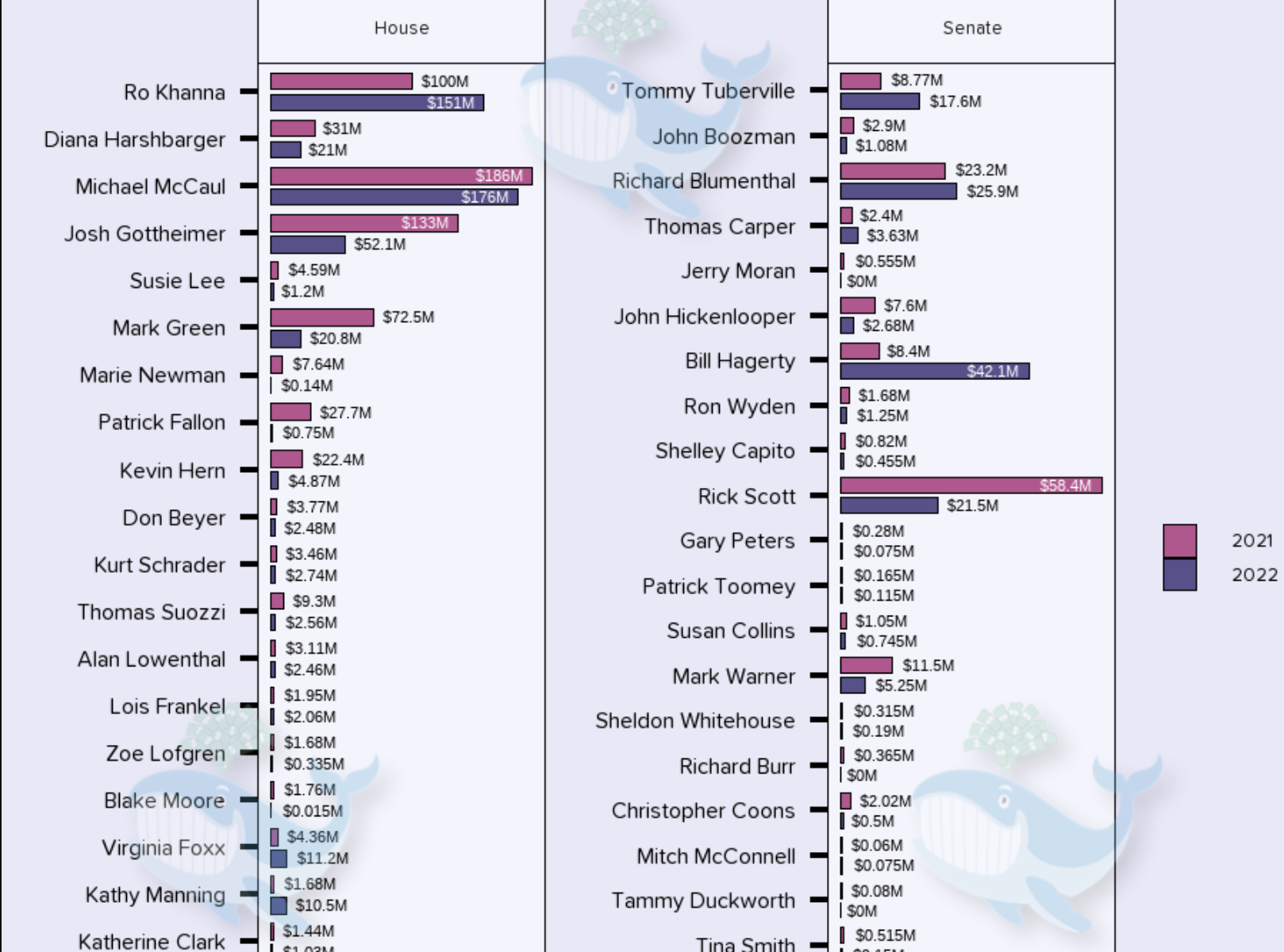

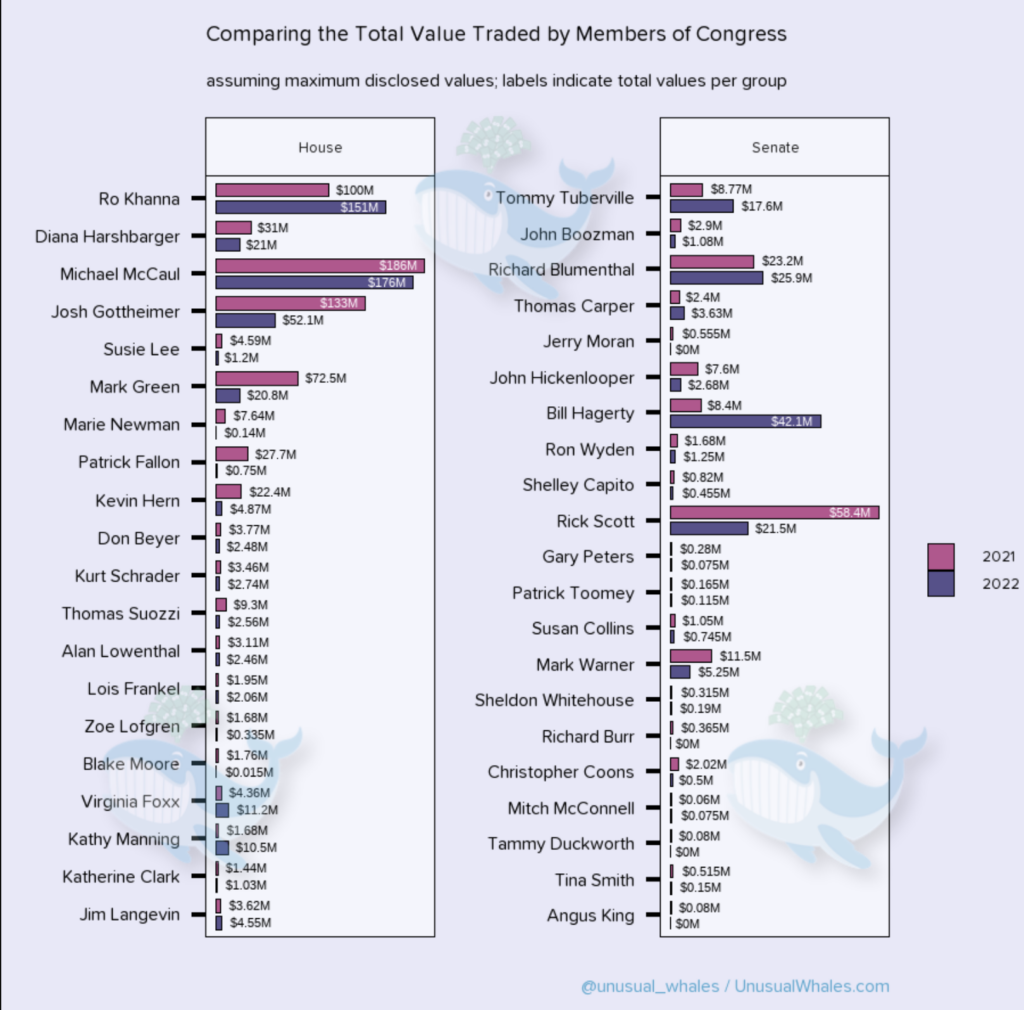

So here’s what the Texas delegation has been up to in 2022 so far. Eight members of Congress bought or sold individual stocks so far in 2022. A New York Times report on trades in the period 2019 to 2021 also supplements my descriptions.

Among the Texas delegation, Michael McCaul (R, TX-10) is by far the most active, buying and selling literally millions of dollars of shares every month, with often over hundreds of trades per month, January through September. His stock portfolio activity makes him, in industry parlance, “a whale.” McCaul is the son-in-law of the founder of Clear Channel Communications, now renamed iHeartMedia, with a net worth ten years ago of an estimated $300 million.

The New York Times reports that in 2020 to 2021 time period, McCaul family members bought and sold IBM, which has major contracts with the Department of Homeland Security, while McCaul served on the Homeland Security Committee. Family members also traded millions of dollars worth of both UPS and Meta shares, at a time when those companies were testifying before Congressional committees on which he served.

Pete Sessions (R, TX-17) was the next most active in 2022, trading 31 times year-to-date through September, in amounts ranging from $1 thousand to $50 thousand at a time, of 28 different companies. In previous years, the Times reports Sessions made trades in Bank of Nova Scotia and JPMorgan Chase after he was appointed to serve on the House Financial Services Committee.

Michael Burgess (R, TX-26) traded 22 times, on 7 securities, in increments between $1 thousand and $50 thousand. The majority of his focus was 12 trades involving Stryker Corporation, a medical device company. His preferred strategy appears to be a call-write strategy, in which he sells 1-month call options. This would mean he ended up selling shares in Stryker when the stock goes up over a short period of time. He also traded Microsoft, Disney, Amazon, Ford, Abbott Laboratories, and Berkshire Hathaway in 2022.

In previous years, the Times reported that 8 of 9 individual trades were in companies related to the House Energy and Commerce subcommittees, on which he serves.

Vicente Gonzalez (R, TX-15) purchased between $100 and $250 thousand of Tesla stock in May 2022.

Patrick Fallon (R, TX-4) purchased between $65 and $150 thousand of Twitter shares in January, and sold between $250 and $500 thousand of Verizon shares that same month. A report by Business Insider found that Fallon had 118 late disclosures in violation of the STOCK Act, making him unusually noncompliant with the 2012 law. The Times reports in previous years that Fallon bought and sold Amazon and Microsoft and Boeing, while serving as a member of the House Armed Services Committee. All three companies had important business with the Department of Defense.

Lloyd Doggett (D, TX-35) has the most programmatic style, making purchases between $1 and $15 thousand worth of a repeating list of 6 companies every month, from February through October 2022: Proctor and Gamble, IBM, Home Depot, Coca Cola, Johnson & Johnson, and PPG Industries.

August Pfluger (R, T-11) sold Microsoft and purchased Warner Brothers and Liberty Media, in April 2022, in amounts totalling $50 thousand or less. He incurred 12 STOCK Act violations for late disclosures in past years, according to Business Insider.

And finally, Dan Crenshaw (R, TX-2) traded in January 2022 with the most apparently “cowboy” trading style. Based on sales reported in 2022, Crenshaw punted on the bankrupt meme-stock of Hertz. He bought and then sold Rivian Motors within a week, just as the shares were crashing, while also selling Tesla, Boeing, Southwest Airlines, and most interestingly a 3-times leveraged ETF on bank shares. Amounts ranged from $1 to $15 thousand. Dan, please step away from your Robinhood trading app before you do yourself any more harm.

Crenshaw had 8 STOCK Act violations according to Business Insider. The Times reported that in previous years he sold shares in Kinder Morgan, while a member of the Energy and Commerce subcommittee on Environment and Climate Change. He had also bought shares in Boeing, as a member of the committee that oversees the Homeland Security Department.

Although she did not have 2022 stock trades and has since decided to cease individual stock trading, the Times reports in previous years that Lizzie Fletcher (D, TX-7) bought and sold stocks including in Carnival Corporation and Fedex, while a member of the Transportation and Infrastructure Committee.

Meanwhile in the Senate, Senator John Cornyn, according to his 2022 financial disclosure statement for calendar year 2021, does not appear to own individual stocks, but rather owns diversified mutual funds – a better choice!

Senator Ted Cruz, according to his 2022 financial disclosure statement for calendar year 2021, owns individual positions in energy companies Exxon, One Gas, and EPD totalling between $165 and $400 thousand. He reported purchasing up to $50 thousand worth of a “Bitcoin Exchange Platform” in January 2022. He also owns diversified mutual funds, as well as up to $5 million in Goldman Sachs stock, where his wife has long worked.

Ok, back to the main point here, of why members of Congress should never trade individual stocks.

It is not enough to think that 95 percent of Congressional votes are honest, or 95 percent of Congress members are honest. The existence of the bad 5 percent (I am making up this number, hopefully it is less than 1 percent) puts the entire rest of Congress into question. It should be deeply in the interest of all members of Congress to reduce financial suspicion about their and their colleagues’ motivations. They should want to ban stock trading by other Congress members to protect their own reputations.

In January 2022, bipartisan momentum seemed to be building within Congress to enact a ban on members trading individual stocks.

The good news is that incoming House Speaker Kevin McCarthy has said that he supports a ban on individual stock trading by members of Congress.

The issue had languished for a long time without outgoing House Speaker Nancy Pelosi’s support, which some cynically thought was because her husband Paul Pelosi (recently in the news as the victim of a home-invasion and attack by a QAnon-spouting person) was a large and active investor in individual stocks. She came around to support the issue by early 2022, but never brought a bill to a vote on a stock trading ban before the November 2022 election.

The bad news is that incoming reformers like McCarthy tend to forget about nitpicky ethics rules like stock-trading bans once they are in power. Financial ethics are not a red meat and potatoes type of issue likely to stir the Republican base.

Still, it’s my kind of issue. Texans should demand their own members of Congress not only stop trading in ways that raise red flags, but also vote to eliminate conflicts – and appearances of conflicts of interest – whenever possible.

A version of this post ran in the San Antonio Express News and Houston Chronicle in December 2022.

Post read (37) times.