I generally trust markets when it comes to political forecasting, which is why I dabbled in trading contracts on the Iowa Political Markets in both 2008 and 2012.

I’d rather trust in people’s actual money-on-the-line to indicate an aggregated belief in who will win an election, rather than your average poll – or worse – a political commentator. Markets are great at collecting and reflecting back prices that reflect expectations of future results. Markets can be wrong, and markets can be irrational, but generally and in the long run they tend to be right.

I’d rather trust in people’s actual money-on-the-line to indicate an aggregated belief in who will win an election, rather than your average poll – or worse – a political commentator. Markets are great at collecting and reflecting back prices that reflect expectations of future results. Markets can be wrong, and markets can be irrational, but generally and in the long run they tend to be right.

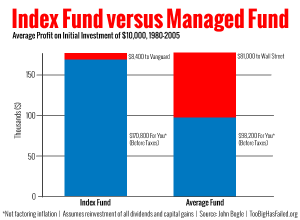

This is a sort of restatement of the efficient market hypothesis, which you can read more about either from Nate Silver or Burton Malkiel in A Random Walk Down Wall Street.

At the very least, you should know what the markets say about the future before you go leaping in a different direction.

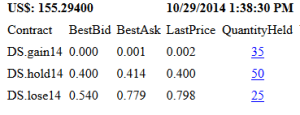

Anyway…I checked back in the Iowa Political Markets Senate race today, and its totally different today – than it has been any time in the last few months.

Conventional wisdom, and the Iowa political markets, had only given Dems a 20% chance or less of holding the Senate after next week’s election.

Suddenly, today, the ‘market’ has jumped to a 40% chance of Democrats retaining the Senate, on the Iowa Political Markets.

The interesting, quirky, thing about the Iowa Political Markets is that they operate on tiny amounts of money in the system – by design – as individuals may only seed their account with a maximum of $500 total. In addition, the markets don’t see much volume much of the time, except in the hottest moments of a Presidential race, which we’re not in now. That has always meant that the Iowa markets could be temporarily manipulated – presumably for political reasons – without a tremendous amount of effort.

And yet…I don’t know.

Nate Silver’s 538.com says that the probability of Republicans taking over the Senate has stayed consistently around 63% for the past month, presumably leaving Dems with a 37% chance of retaining control.

Yet the Iowa market ‘price’ (roughly, the chance of Democrats retaining control) has bounced around well below 20% for the past month. Until today…now it’s at 40%.

Why did the Democrats’ chance of retaining the Senate just double from yesterday to today?

Post read (767) times.