Note: A version of this post appeared in the San Antonio Express News

Here’s one of my first principles:

Everybody who works in the for-profit world should own or start a business.

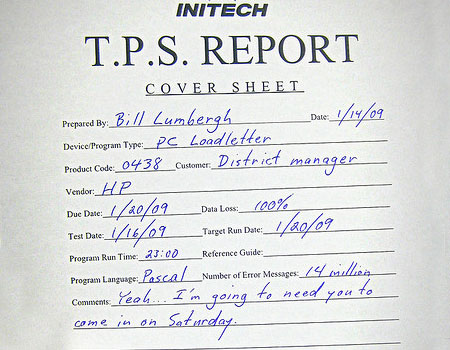

Now that I’ve said that, I’d like to spend most of the rest of this post describing all of the terrible things about starting or owning your own business. Entrepreneurship requires ignorance. Entrepreneurship induces anxiety and insomnia. It attracts terrible students. Entrepreneurs are people who are clearly running away from something.

Interestingly, entrepreneurs are the only people who have a chance to get super-duper rich.

Ignorance

A friend who started his business during the first Dot-Com boom and bust told me the most important key to starting a business is ignorance. Specifically, you have to be really clueless about how difficult starting and building a business will be. If first-time entrepreneurs knew how hard it would be, they would never start in the first place! Ignorance truly is bliss.

Anxiety

Anxiety appears to run in my family genetic code, although that ailment mostly missed me.

Genetic predispositions, we learn more and more, often need an environmental trigger. Well, for me, starting my own business in 2004 induced my first panic attack.

Meeting for lunch with friends one afternoon, I could not stop blurting out about all of the things that might go wrong with my business. I couldn’t read the menu, I could hardly sit down. No eating. Twitching. I don’t remember what my friends planned to talk about. All I could do was tell them how freaked out I was.

Insomnia

Insomnia, another thing I had hardly ever experienced, also kicked in after I started my business. It’s 2:45AM and I’m wide-awake.

You know, somebody should really start an Entrepreneur’s Insomnia Late-Night Diner.

Hey, that’s a good idea. Should I do it? Like, right now? Let’s see, first I should…Wait, no, just stop. Try again to sleep.

Goodnight Room. Goodnight Moon. Goodnight Nobody. Goodnight Mush. Ugh. Please, Sweet Mercy, let me sleep.

I mention the insomnia and anxiety because a friend sent me a text recently “Hey, can we meet for coffee? I’m kind of freaking out right now.”

Unfortunately, I diagnosed her problem before we even spoke: she’s an entrepreneur.

Weaker students

One of the most memorable parts of Thomas Stanley’s book The Millionaire Mind is his thesis that most successful entrepreneurs suffered as mediocre students. Students who achieve all As throughout their school years gravitate to highly academically selective professions such as medicine and law.

The C students, meanwhile, are forced to struggle. Without a clear path to academic success and a prestigious well-paid profession, the C students rely on a more improvisational approach that may lead them to start their own sandwich shop, out of desperation. Ten franchises later, they’re the ones hiring the straight-A Harvard Law attorney to work through the weekend to prepare the documents for their next business acquisition.

For that C student, entrepreneurship may be a decision forced by circumstance rather than a fully formed plan.

Unhappy and running from something

Speaking of forced circumstances, I can’t prove the following claim, but it seems anecdotally true in my life.

Before launching, all entrepreneurs are unhappy about something, and that something forces them to start their business.

Do you hate your boss? Are you desperate for a better work-life balance? Are you dying to be rich and its just killing you that you’ll never be paid more in your current job?

Contented people, the people happy to go to work and collect a paycheck, never feel the urge to jump into the parachute-less abyss of entrepreneurship.

Before I started my business, I was desperately unhappy and I said to my Dot-Com friend that it must be great not to work for The Man. He replied that most days he wished he could count on The Man for a paycheck.

Ok, fine then. But still, I didn’t listen to him.

The key to extraordinary wealth

For all its drawbacks, business ownership is not one path to riches.

It’s the only path.

All of the folks in the Forbes 400 list are business owners.[1] None of them got there by performing a large number of open-heart surgeries or preparing the legal documents for a leveraged buyout – as highly compensated and academically exclusive as the top of the medical and legal professions may be.

I’m not saying getting filthy rich is the most important life goal, nor am I saying it will make you happy. And, I also think there are more reasons to start a business than simply to get rich.

But! I do think people should understand that all of the most wealthy folks in this country are entrepreneurs.[2]

The steep path to extraordinary wealth goes to one group only: The ignorant, the anxious, the insomniacs, the C students, the discontented ones.

In short, the entrepreneurs.

Please see related posts:

On Entrepreneurship Part I – Equity v. Fixed Income

On Entrepreneurship Part II – Ownership v Salary

On Entrepreneurship Part III – The Air, The Taxes, The Retirement

Book Review of The Millionaire Mind

Book Review of The Millionaire Next Door

Video for Entrepreneurs – Personal Financial Statement

[1] Or heirs to business owners. Because inheriting wealth is increasingly a great tax-advantaged way to get wealthy.

[2] If you don’t own your own business, the next best thing to do – in order to be wealthy – is to start purchasing public stocks with any of your excess cash, and never sell. Pouring excess cash from your salary into the business ownership of stocks provides some wealth-building for the world’s employees.

Post read (2808) times.