I was on vacation on Cape Cod this summer, staying with my parents in the house where I grew up. Most days or nights we walk, bike or drive to the homemade ice cream shop down the hill. My chocolate sundae tasted especially sweet a few weeks ago because I received a $1 bill in change with intriguing red, stamped, markings. “Track This Bill” said the stamp, like a mystery message from Louis Carroll, followed by a URL for the website www.wheresgeorge.com.

But oh joy! Unlike Alice puzzling over the White Rabbit’s invitation, I knew just what to do.

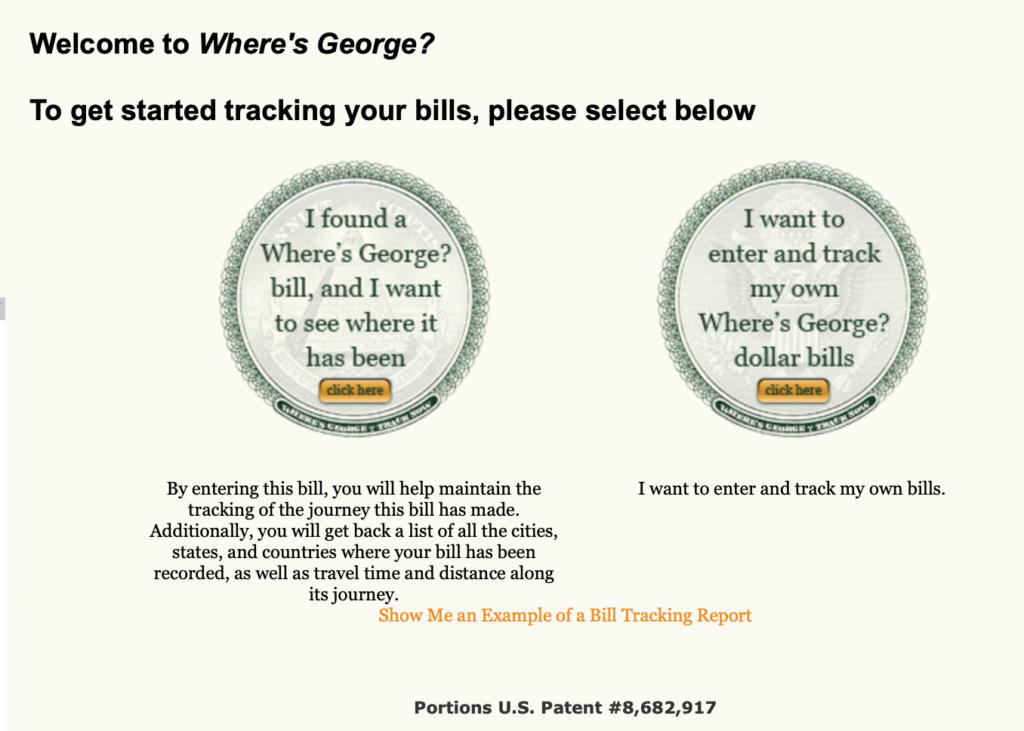

The “point” of that website – if there is something as prosaic as a point here – is to upload and track individual paper bills as they move around the country.

My ice cream store-acquired bill with serial number G55…..H (2006) had been first entered into the WheresGeorge website just 35 days earlier, in upstate New York. For each bill ‘found’ and uploaded by another person the site reports the distance traveled and “average speed.” After uploading the info, I learned the bill in my hand had travelled 306 miles and 8.6 miles per day.

In addition to uploading a specific bill’s serial number, the site prompts you to enter a few lines of description about where you found your bill and what condition it is in.

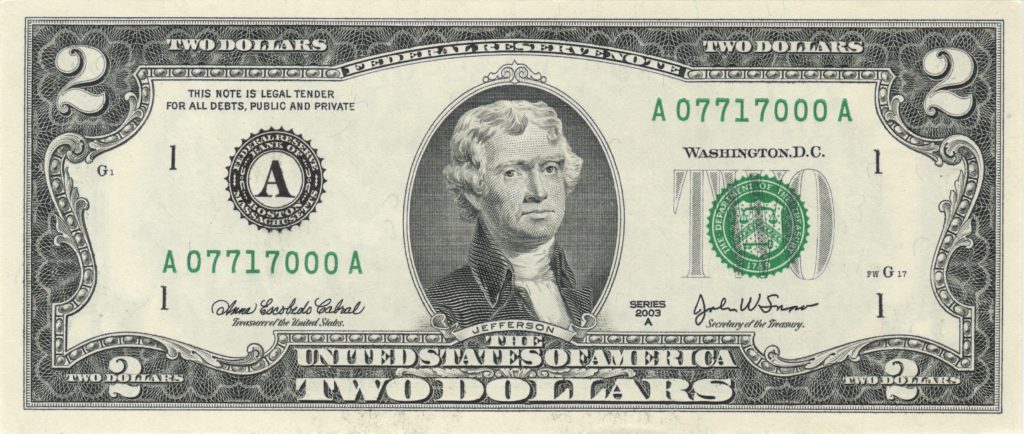

The “George” in the title is of course President Washington, the handsome dude whose visage adorns the $1 bill, but you can just as easily upload serial numbers for Jeffersons, Lincolns, Hamiltons and Jacksons, all of which I have done over the years. I have never uploaded Grants or Franklins to WheresGeorge, as I don’t traffic in these as often.

The WheresGeorge site launched in December 1998.

I created a profile there nearly twenty years ago, and entered my first few $1 bills in December 1999. I recall reading a newspaper story that year about WheresGeorge. Even then it appealed to my money nerdiness.

But also, I remember in 1999 the site represented a cutting-edge use of the internet, a kind of cloud-based social media site built around numismatics. Remember, this was five years before MySpace, six years before Facebook.

I distinctly remember feeling the WheresGeorge site was pretty darn exciting, allowing everyone to upload disparate data points to create an accessible but personalized profile. It’s an activity that Facebook made universal and therefore banal. It still had the power to excite back then.

Funny enough, the site hasn’t much updated its format since 1999. It looks just how you’d expect a 1999-era website to look. Which is to say, pretty clunky. But, I learned, it still does the job in 2019. And if you’re the type of money weirdo who likes to track data, as I am, there is a lot going on here.

According to my personalized stats, I have entered 56 bills for a total value of $201. Three of these have had ‘hits,’ meaning another user has found my bills in the wild and uploaded the serial number to the site. I have, in turn, found 12 bills previously marked by other WheresGeorge users. My ice cream shop bill was the first one I’ve seen since 2016, and as a result it’s the first time I’d logged onto the site in 3 years.

“That’s really cool!” my 9 year-old exclaimed enthusiastically when I showed her my profile with earlier notes on dollar bills that I’d uploaded over the past 20 years. Her enthusiasm made me so happy because – obviously – no need for a paternity test, right? That kid’s clearly mine.

I reached out to Brian Brummer, in La Vernia, TX, known as “Big B” on WheresGeorge. He’s the highest-ranked Texan on the site, and the 20thmost active user overall. Big B’s dedication to the site is, well, astonishing.

Big B’s stats, as of this writing:

305,150 bills entered.

51,802 bills that have ‘hits.’

While Big B’s bills flit around the country, he himself is the most travelled person I’ve ever corresponded with. He’s been to 117 countries. Since retiring in 2002, not only has he uploaded bills from all 50 states, he’s managed to upload bills from all 254 counties in Texas, as well as having others report ‘hits’ from his bills from all 254 counties in Texas.

I wasn’t wrong in thinking that WheresGeorge serves as a key social media site for its active users. The socializing has moved from on-line to in-person. Big B has attended 117 in-person gatherings of fellow WheresGeorge enthusiasts. And counting. The next Texas get-together will be in Austin in October, followed by one in La Vernia in 2020.

Joe Causey of Cullman, Alabama is ranked as the third most active user and known by the WheresGeorge handle MrNiceGuy. He replied to my query through the site and said he used to stamp nearly 20,000 bills per month, and would distribute them through his friend’s 10-plex movie theater, through change at the box office and concessions. The site, and affiliated forums, is by far his most active social media outlet.

I asked Big B what participants shared in common. He replied, “Most Georgers do have an interest in statistics and many have an interest in Geography. Many folks claim we are all weird and having met more than 680 of them I will not argue this point too much. Like any hobby people carry it to extremes and others just enjoy it as something to fill the passing time.”

That sounds…right. I can relate somewhat. I am the guy who orders $1,000 worth of $2 bills from my bank just so that I always have a bunch to buy my daily coffee with, or for my weekly poker game buy-in. So, yeah, I’m a little quirky about my money hobbies. But I recognize Big B and MrNiceGuy have taken the game to a whole other level.

About my ice cream sundae dollar: I spent it, releasing it like a prized fish back into circulation. If you find it – my $1 bill with a red stamp on it – please upload its info to WheresGeorge.com so that I can track its travels from Cape Cod in the summer of 2019 to across the country, and beyond.

Please see related post:

Post read (678) times.