Dear Banker,

I’m ready to purchase IRAs for my husband and me. We had fun as young 20-somethings and didn’t start saving anything for retirement until our 30s, and even then, sometimes one of us was not always able to set aside money into the 401K/403b offered by employers. So, I figured an IRA would be a good option to help set aside additional funds for retirement. We already have life insurance squared away and are debt-free, apart from our mortgage, and have emergency funds set aside for miscellaneous emergencies (I’m a planner!). I’d rather be taxed now, so I know a Roth IRA would meet that requirement, but what else should I look for? I’m interested in opening the accounts with $2,000 each since I understand we won’t be held to a minimum monthly deposit towards the account that way.

Thanks for any suggestions you might have!

Jessica in San Antonio, TX

Dear Jessica,

I’ll answer some of your questions quickly, and then go back and fill in the details to the same questions below.

Should you do it?

Yes

When should you do it?

Yesterday

Roth IRA vs. Traditional IRA?

Doesn’t matter

How much should I invest?

$2,000 each for you and your spouse is great.

For 2013 and 2014 the maximum amount per person is $5,500

What to invest in?

A low-cost, diversified, equities-only, mutual fund.

With whom should I open the account?

Well, since none of the fund companies are paying me through advertising, I’m reluctant to name…Ok, fine: Vanguard.

Since you may want more details with each of these topics, I flesh out my answers below.

Should you do it?

Yes.

If you have any surplus money available for savings and investment – in your case, $4,000 this year – open your IRAs before doing almost any other savings or investment activity.

Because IRAs offer-tax advantaged investing, it’s virtually impossible to beat the returns in an IRA account when compared to any other investment account.

Why do I say that? There are several reasons, all having to do with ‘after-tax’ calculations.

Tax advantages in the year you contribute to an IRA

If your income tax rate is, for example, 25%, then you need to earn $2,500 in order to have the equivalent of $2,000 available to invest in an account.

For non-IRA investing, right off the bat, $500 goes to the IRS, and $2,000 goes in your bank.

When you invest in a traditional IRA, however, the full contribution amount can be deducted from your taxable income. The result – at a 25% tax rate – is that you have 25% more money to invest.

Another way of saying this is that you got a 25% ‘return’ on your after-tax investment just by putting money into a traditional IRA when compared to investing through a non-IRA account.

Does this matter in the long run? Yes!

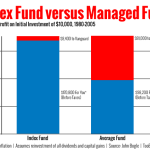

Here are some calculations, using the magical powers of compound interest math, to illustrate the long-term difference in outcomes between IRA investing and non-IRA[1] investing.

- Invest $2,500 in 2013 in an IRA for 30 years and earn 5% per year. Result: $10,805.

- Invest $2,000 in 2013 in a non-IRA for 30 years and earn 5% per year. Result $8,644.

That’s more than a $2,000 differential in the end, an amount higher than your initial contribution amount. The greater the return assumption over the 30 years, the higher the final difference between IRA and non-IRA accounts.

If you invest this way, every year for 30 years, always choosing the $2,500 tax-advantaged IRA contribution rather than the $2,000 after-tax contribution, earning 5% per year on each contribution, you will have $174,402 rather than $139,522, a difference of $34,880.

Tax advantages of transactions inside your account

The tax advantages of IRAs do not stop there.

Or as the late-night television Ginsu Knife Advertisement would say: But Wait! There’s Much, Much, More!

Any time you sell a stock or mutual fund position in a traditional (non-IRA) investment account you must pay taxes that year on any appreciation (or gains) in the investment. If you held the stock for less than a year you will owe your regular income tax rate of 25% on the money you made.

Even if you held the stock for more than a year you would owe long-term capital gains, probably 15% in your case. If you receive dividends or bond payments within your investment account, those will also be taxed at high rates such as 25%. Giving back 15-25% of your investment gains when the stock went up is incredibly destructive to your future wealth-building plan.

For this reason, actively buying and selling stocks in a traditional investment account makes about as much financial sense as stabbing your money with a Ginsu Knife.[2]

If you sell a stock or mutual fund within your IRA, by contrast, you owe no taxes on the gains. This, as the financially-savvy Seattle-based poet Macklemore would say, is f-ing awesome.

If you plan to sell any investments in your account over the next 30 years, you will do yourself a huge favor if those investments remain shielded from taxation within an IRA.

Tax advantages of retirement income from the Roth IRA

I see from your question, Jessica, that you’re oriented toward a Roth IRA rather than a traditional IRA. If you open up a Roth instead of a traditional IRA – and I don’t blame you if you do – you do not reap the income tax benefits in the year you invested. You would instead enjoy tax-free income in your retirement years when you take the money out, which is also quite awesome.

The most important financial comparison is not between a traditional IRA and a Roth IRA, but rather between a non-IRA and an IRA account

In your retirement years, when you sell your investments for income, a Roth IRA is more valuable than a non-IRA account because of the difference in after-tax income.

If you have a 25% income tax bracket in your retirement years, for example, your $10,000 in Roth IRA income is the equivalent of $12,500 in non-IRA income.

Ok, time to move on to the next answer to your questions.

When should you do it?

Yesterday.

I answer “yesterday” in a nod to the old investing saw “When is the best time to invest?” for which the correct answer is always “thirty years ago.”

The most important factor for racking up impressive investment returns is the passage of time. Due, as always, to the magic of compound interest.

The good news, however, is that if you open your IRA now, in your 40s, you actually can take advantage of the next thirty years. By the time you and your husband retire and need to live off your investments, you will have invested “thirty years ago.” You will enjoy Madame President Cyrus’ administration in 2043 that much more if you feel wealthy.

So go for it. Today.

Roth IRA vs. Traditional IRA

Doesn’t matter.

Much digital ink has been spilled parsing the advantages of one vs. the other. But do we really have to argue?

Beatles vs. Rolling Stones.[3]

Brady vs. Manning.[4]

Kristen Bell vs. Jennifer Lawrence.[5]

These are all awesome choices.

Both the Traditional IRA and Roth IRA beat any non-IRA option available.

Confidently choosing one over the other would require you to compare today’s income tax rates to future income tax rates in your retirement, something you can guess at, but with no certainty.

Roth IRAs boast a clever feature that allows you to pass on wealth to young heirs which I wrote about before, but income eligibility limits make taking advantage of the Roth IRA harder than a traditional IRA.[6]

How much should I invest?

Your planned $2,000 each for you and your husband is great to start. The more the merrier.

Again, a $5,500 upper limit for you if you’re under age 50. A $6,500 upper limit if you’re aged 50 or older.

The income limits for IRA contributions are maddeningly complex for such a simple investment vehicle, a point which I tried to make last year (probably unsuccessfully) through this purposefully confusing infographic. For your purposes, however, the $2,000 is a great place to start, and I agree you’ll avoid charges from most investment companies with a $2,000 minimum.

A quick aside on the subject of minimum investments:

I taught a personal finance course to college students last Spring, and one of my mandatory assignments for these 18-22 year olds was to open their own IRA. I figured that even if they only had $100, and even if that $100 went into the wrong product, the practical and pedagogical benefit of opening the account and researching the account would more than make up for the inefficiency, cost, and their lack of any actual income that required tax-deferral. My theory was perfectly sound. Just ask me.

In practice, the assignment really pissed them off. They didn’t have $100 extra (so they claimed), and they quickly discovered very limited options for their minimal investment amounts (a bank CD for example), and fees on top of that, if their balance remained below something like $1,000 or $2,000. I endured a few weeks of complaints and hissing with steely resolve until my co-teacher intervened and made the assignment optional. Probably saved my tires from being slashed.

The lesson: I’m a real pain in the ass as a teacher.

Also, IRAs don’t make sense for less than an initial $1,000 to $2,000.

What to invest in?

Jessica, I want to make your life easy. Trust me on this next one.

An entire Trillion dollar industry – known around these parts as the Financial Infotainment Industrial Complex – would like you to pay extraordinary, mostly obscured, fees for a very ordinary financial service.

The industry would also like you to believe that an entire universe of options must be sifted through, parsed professionally, opined upon, and cleverly navigated. You don’t have time for that. You don’t need that.

What you want with your 30-year time horizon until retirement is the chance to receive the returns of broad equity markets. Not beat the market, just get the market returns.

So, your goal is:

1. Pay minimal fees

2. Earn the market return

3. With a 30-year horizon, you need 100% equities. You cannot afford the low returns of anything less risky.[7]

The words you need to know are: “a low-cost (probably indexed) mutual fund covering a broad sector of either US or global equities”[8]

Keep asking for that, and only that, until you get it.

With whom should I open the account?

Vanguard doesn’t pay me to say this (which sucks for me)[9] but they pioneered this type of investing decades ago, and so they deserve credit for doing the right thing, early on. My own retirement account is with them.

At this point, dozens of other mutual fund companies offer a similarly awesome “low-cost (probably indexed) mutual fund covering a broad sector of either US or global equities.”

If you or a friend or family member already has an account or a relationship with any of these other fine companies, by all means open up an account with that other company. I believe in signing up for the fewest number of service providers.

But do not let them talk you into anything more complex (read: expensive and unnecessary) than what I described in quotes above.

Jessica, I hope that helps, and congrats on getting going with your IRAs.

Please see related posts on the IRA:

IRAs don’t matter to high income people

A rebuttal: The curious case of Mitt Romney

The magical Roth IRA and inter-generational wealth transfer

The 2012 IRA Contribution Infographic

[1] By “Non-IRA” I just mean any old investment account that you might buy stocks in. A regular taxable account. Something not tax-advantaged like an IRA or 401K plan.

[2] After which, of course, the knife will remain sharp and cut easily through a ripe tomato.

[3] Beatles.

[4] Brady. Duh.

[5] Don’t make me choose, I don’t want to break either of their gentle hearts.

[6] Incidentally – and not relevant to your original question – if I had plenty of disposable wealth and income and a large traditional IRA, I’d probably convert it to a Roth IRA.

[7] As best explained in this book Simple Wealth, Inevitable Wealth by Nick Murray,

[8] Global is better than US, for a variety of theoretical reasons simply explained in this book I recently reviewed, but investing in a broadly diversified US equity index is also not ‘wrong’ for your purposes.

[9] Hey Vanguard? Throw me a freakin’ bone here!

Post read (8445) times.