Dear Banker,

Most months we manage to cover our costs and have a little extra left over. Sometimes I send the bank an extra $500 or $1,000 toward paying down our mortgage balance, which has another 21 years to go. Once I sent close to $5,000. Does this make sense? — Manny T., Chicago, IL

Dear Manny,

Congratulations on doing the first-order hardest thing in personal finance – produce a monthly surplus in your household. Wealth for you – while not inevitable – is made possible by this monthly surplus.

I appreciate your question whether you should – or anyone should — pay off a mortgage early with small interim payments of principal.

This perennial question generates as many strongly held opinions as there are mortgage holders. There’s a thoughtful discussion to a similar question prompted on this personal finance site.

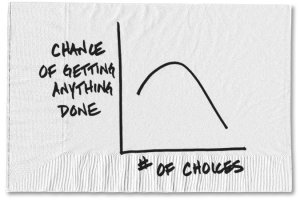

Like most interesting personal finance questions, the answer depends on a combination of personal psychology and finance math. Your own personal relative weighting of this combination may lead you to a different ‘correct’ answer than that of someone else.

My own short answer is that while paying off your mortgage principal in small early increments does not make much sense from a pure financial math perspective, it can be the totally correct thing for certain psychological reasons.

Therefore, while I don’t advocate paying off a mortgage this way, I fully acknowledge that for people with a different psychological approach than me, the incremental payments make plenty of sense.

The math side of things – forward rates

First, it’s helpful to understand mechanically what happens when you make an extra, partial, principal payment on your mortgage.

After making your regular monthly payment, let’s say you send an additional $1,000 to the bank for principal. The bank – actually the mortgage servicing company, but let’s not nitpick – applies that principal to the furthest-away-in-time mortgage payment. In Manny’s case, his $1,000 payment gets applied toward a payment due 21 years from now.

In other words, Manny’s total mortgage principal gets reduced by $1,000, but not in any way that affects his current monthly mortgage costs. He’s still obligated to make regular mortgage payments next month.

You may have read, not entirely incorrectly, that when you pay debt principal early you get a guaranteed return on your money equal to your interest rate. If you have a 6% mortgage, the conventional wisdom goes, you get a 6% “return on investment” when you pay off your mortgage.

But this is not entirely correct either, in purely financial math terms.

I’m going to assume Manny’s mortgage (obtained 9 years ago) has a 6% interest rate. Since he’s eliminated by early payment the obligation to pay 6% interest on his borrowed money 21 years from now, we could more precisely say he’s invested the equivalent of $1,000 at “6% interest rate, 21 years forward.”

That may seem like an odd turn of phrase, except that the bond markets operate precisely this way – on today’s interest rate (you might call this the ‘spot’ rate) as well as tomorrow’s forward rates (incorporating the idea for example, of 1 year interest rates, one year from now, stated as “1 year rates, 1 year forward.”)

We don’t all have to be bond geeks to make good decisions about early mortgage payments, nor do we need to know exactly what I mean with this clarification, except you should understand the following: We don’t know with very much precision what prevailing interest rates will be 21 years from now. As a result, it’s not as obviously a ‘good trade’ to pay off your mortgage at 6%, precisely because it’s not actually true that you’re locking in a “6% return” on your money today.

21 years from now a 6% mortgage interest rate may be extraordinarily high or it may be extraordinarily low (I’m agnostic on the issue) but the imprecision around the question of forward rates makes it less obvious what your effective ‘return on investment’ really is, or what you should reasonably expect to earn on your money 21 years from now.

One major and obvious exception to my clarification on “forward rates” is that if you pay off your full mortgage balance early – entirely eliminating the need to make future monthly payments – then indeed you did lock in a 6% ‘return’ on your money.

Inflation scenario as an illustration of forward rates

To return to the problem of unknown forward rates for a moment, it may be helpful to think of specific, possibly extreme, scenarios. I’ve written before that the combination of home ownership with a mortgage can be a very powerful inflation hedge. One way of seeing that is through the concept of forward rates.

A future high inflation rate can illustrate the ‘forward rates’ problem. If future inflation, say 10 years from now, runs at an annual 15% rate, with prevailing mortgage interest rates around 18%, then it becomes obvious that locking in a 6% return on your money in the final years of your mortgage was not a good idea, from a personal financial math perspective. In my example you might have earned 18% just leaving your money parked in a money market account. That kind of future interest rate can show us why we should be less sure of ourselves that earning a 6% return by paying of a mortgage early is the right decision, from a purely mathematical perspective.

More on the math side of things – comparative rates of return

I have not yet addressed the most common financial math reason why people claim you should not pay off your mortgage in small early chunks of principal payment.

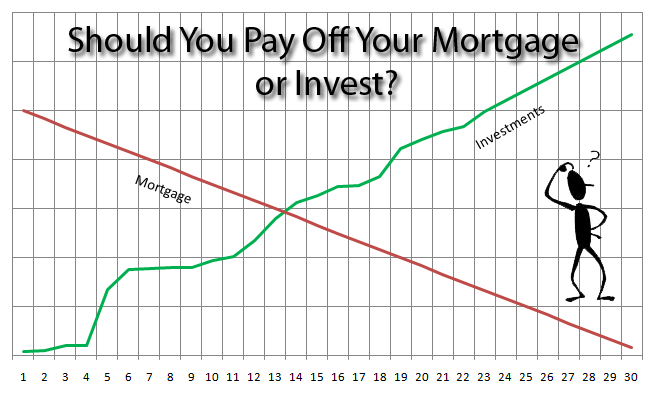

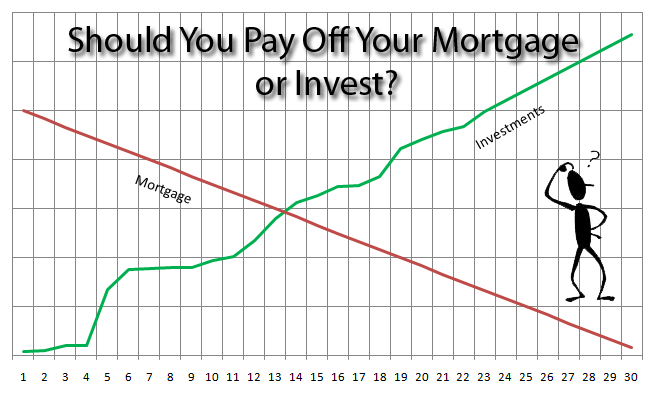

Specifically, many argue that you may be able to earn a higher return on your money “in the market” than you can by eliminating personal debt and locking in the rate of return of your mortgage’s interest rate.

This is possibly true, although it depends on specific scenarios, like the following:

· If you are talking about credit card debt – with interest rates between 9% and 29.99% – it’s clear to me that paying off your debt offers a better return than you could reasonably expect from another investment “in the market.”

· If instead you are talking about current prevailing mortgage rates – like my newly refinanced 15-year mortgage at 2.75%! – then I heartily agree that a better return is quite likely available “in the market” rather than through paying down personal debt.

· If you are able to invest in a tax-advantaged 401K or IRA vehicle, and you have a sufficiently long time horizon to invest in risky assets, then you can stack the odds mightily in your favor to earn a better return “in the market” rather than paying down debt.

The Psychological approach – Arguing against myself

So I’ve made the case that locking in a specific return on your money – by paying down mortgage debt – is not as clear-cut as it first appears, from a purely finance-math perspective.

However, I do think the psychological aspect of making early mortgage payments should not be forgotten. We are all humans, responding irrationally to myriad inputs. For many of us, money left on a monthly basis in the checking account gets spent, so the key to not spending is to not leave extra money lying around.

If Manny’s realistic choice every month is between sending $1,000 to the bank to pay his mortgage early or instead – like many of us – to spend $150 more on Amazon Prime downloads, $300 on jewels in Farmville and $273 on One Direction concert tickets, leaving just a $277 surplus at the end of the month, then the choice is clearer.

All the possible market returns in the world cannot undo the simple fact that paying off debt guarantees an incremental increase in net worth. If you can’t stop yourself from spending your surplus – and this really comes down to the psychological imperative: “know thyself” – then paying off the mortgage in small extra increments makes total, perfect, unassailable sense.

And then there’s risk tolerance

In addition, there’s the “know thyself” imperative applied to risk tolerance.

Investing money in the market – instead of paying down debt – makes an increase in net worth possible, even likely, but has no guarantee. If you hate losing any amount of money ever, then by all means pay down all of your debts before investing in anything risky.

Earning a 6% return by paying off your mortgage early may sound much better than shooting for a possible 10% compound annual return but with a possibility of a 25% sudden loss in any given year.

Few investments in the long run are worth 3AM insomnia. A fully paid-off mortgage may do more for encouraging restful sleep than all the Posturepedic mattresses in the world.

Please see related posts:

On Mortgages Part I – I Am a Golden God

Part III – 15 yr vs. 30 yr mortgages

Part IV – What are Mortgage Points? Are they good, bad or indifferent?

Part V – Is mortgage debt ‘good debt’ A dangerous drug? Or Both?

Part VI – What happens at the Wall Street level to my mortgage?

At this point further math geeks will point out that the tax-deductibility of mortgage interest means that your effective interest rate is probably closer to the 4% than 6% rate, making your effective ‘return on investment’ lower than it seems.

Post read (70703) times.

A version of this post ran in the San Antonio Express News.