I recently visited Las Vegas, NV.

I recently visited Las Vegas, NV.

I did this in part to lose money at the poker tables, and in part to check out the Las Vegas “Downtown Project” that I’ve read about in recent years.

I visited with two questions in mind.

First, how does part of a city die?

Second, how do you revitalize a city downtown?

I’m no urban revitalization expert. I learned the little bit I know about the subject from a fifty year-old book by an author obsessed with Greenwich Village. Jane Jacobs answered the ‘how does a city die’ question by arguing that cities can become victims of their own economic successes. This happens when a profitable industry continues to grow until it metastasizes and wipes out other economic activities in the city. The result is an economic monoculture. And monoculture cities die.

In modern America, Las Vegas represents the archetype of a death-by-monoculture city. Las Vegas offers about 36 hours of tourist gambling fun, then turns sour. Monocultures are not attractive to live in for locals either. Monocultures tend to spread economic death, as residents move away or stay away.

So you can see why I was thinking about this when I visited Las Vegas. The attempt to catalyze an alternative to monoculture is what makes Las Vegas’ Downtown Project, inspired by an entrepreneur named Tony Hsieh, so interesting.

Hsieh – who built and sold shoe seller Zappos.com to Amazon for $1.2 billion – has dedicated his talents and maybe $350 million on an experiment in answering the second question, attempting to bring Las Vegas’ downtown back to life.

Hsieh – who built and sold shoe seller Zappos.com to Amazon for $1.2 billion – has dedicated his talents and maybe $350 million on an experiment in answering the second question, attempting to bring Las Vegas’ downtown back to life.

Hsieh funds startups with a view to creating an inter-connected urban area for Las Vegas locals, an antidote of economic diversity for the city’s downtown area.

How SA is like LV

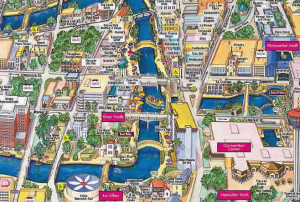

In a related story, I live within walking distance of downtown San Antonio, TX which, while an economically successful tourist draw, offers almost nothing of interest for locals. I know this sounds overly harsh to the few exceptional excellent restaurants and cultural centers there, but those can be counted on one hand as isolated islands, basically unconnected, in a sea of emptiness and tourism. I’ve lived thisclose to downtown for about six years, yet rarely go there. When friends and relatives visit, and they insist on seeing the Alamo and the Riverwalk, I try to warn them. Inevitably they find it as underwhelming as I do.

The ironic thing about this, obviously, is that the San Antonio Riverwalk was originally a stroke of urban-planning genius.

Also, I’m not denying downtown’s financial viability for the hotels, restaurants and Ripleys-style funhouses catering to tourists and conventioneers. I’m just saying that that economic success – the monoculture – has made it by and large an unappealing place to visit, as a San Antonio resident.

Since Las Vegas represents the ultimate monoculture problem, a problem many times bigger than San Antonio’s, I was intrigued to see what Tony Hsieh’s vision and money has wrought, despite the odds.

The Las Vegas Downtown Project

My quick answer: This is freaking awesome.

Further, I hope the myriad folks dedicating their vision and passion and money to downtown San Antonio are paying close attention to Hsieh’s Downtown Project experiment.

In an earlier post I detailed the small-scale pockets of excellence that make up the Las Vegas Downtown Project.

Any one of these Las Vegas places, if only they existed in San Antonio, would be a reason to go downtown, pretty much all of the time.

A downtown pulse in SA

Recent real estate investments by Weston Urban and GreyStreet partners on Houston Street indicate there’s a strong pulse among local developers. There’s no shortage of capital here, ready to deploy in the heart of downtown. That’s really not the problem.

The problems of revitalizing San Antonio and Las Vegas are (among others): Is there housing for residents? Are there non tourist-oriented jobs? Are there attractive public spaces? Are they walkable? Are they connected?

Frankly the Downtown Project in Las Vegas doesn’t have these things yet either, but each of their parts hold strong promise.

Most importantly – and this is what the Downtown Project gets right: Are there locally-oriented sources of urban excellence that would continually draw residents into an urban core? In Las Vegas, I found to my delight, yes.

So far, in San Antonio, not really.

Next I’ll write about the role of the visionary billionaire, haters, geography, and government.

Please see related posts:

The Tourist Problem according to DFW and Downtown Project Highlights, A version of which ran in the Rivard Report.

The limited role of government in curing a city monoculture

Book Review: The Death and Life Of Great American Cities, by Jane Jacobs

Is stock investing like a casino? No. But YES!

A version of this post ran in the San Antonio Express News.

Post read (838) times.