How do I hate thee? Let me count the ways.

I hate the way you are sold. I hate the way timeshares give the appearance of an ‘investment,’ when they are in fact the opposite of an investment. I hate the way financially distressed people buy you.

I’ve previously urged readers to never buy a variable annuity. Last fall I broke my self-imposed rule to never even mention the word bitcoin. I’ve also written about never buying gold. Taken together, time shares, variable annuities, bitcoin and gold are the Four Horsemen of your Personal Financial Apocalypse.

All four share the common characteristic of being packaged and sold as sound investments, when really they’re expensive, money-soaking, tricks.

For your benefit, I signed up for a timeshare pitch last week. I sacrificed an otherwise pleasant afternoon to multiple aggressive and manipulative sales techniques packed into 90 minutes. You’re welcome. I deserve a medal for bravery.

Roberto, my personally assigned salesman at Wyndham Resorts, asked me for fifteen minutes what kind of vacations I usually take, what place I like to go, and what people I go with. As I warmed up to describing past skiing and camping trips with my daughters, he asked me to share what kind of “feelings” I experienced with my daughters while on vacation. Oh, Roberto, thank you for asking.

Plunging deep into the hazy mist of emotions and family, I learned that timeshares are a legacy to pass on to my daughters. They promise “ownership” in perpetuity, yet every month charge “maintenance fees” which never go away. My editor at the newspaper is an heiress who “inherited” a Hilton Disney World timeshare from Dad. Hey, thanks Dad! It costs her $1,500 a year to maintain. With a handsome legacy like this, she may never be able to retire.

Plunging deep into the hazy mist of emotions and family, I learned that timeshares are a legacy to pass on to my daughters. They promise “ownership” in perpetuity, yet every month charge “maintenance fees” which never go away. My editor at the newspaper is an heiress who “inherited” a Hilton Disney World timeshare from Dad. Hey, thanks Dad! It costs her $1,500 a year to maintain. With a handsome legacy like this, she may never be able to retire.

Once made dizzy by this emotional journey, Roberto began to bludgeon me with the fuzzy logic of timeshares. Since I already spend a certain amount of vacation money per year on my family – as he scribbled some numbers on a page – wouldn’t I like to “own” rights to vacation spots rather than “rent” as I have been doing up to now through traditional hotels? What if I could do that at less cost? More number scribbling followed, plus I would gain “Deed and Title” to vacation ownership. Roberto wrote “D & T” on the page and underlined it twice, so I’d really grasp the solidity of this type of ownership.

“Deed and Title?” That is such garbage. Ask anyone who has ever had tried to book timeshare vacations with points and you will quickly enter a world of “exchange fees,” added fees for “guest certificates,” fees for membership in the points exchange company, and heavy restrictions on usage. Can’t book your vacation with one and half years’ lead time? Sorry, all the places you want to go, at the listed “points” price, are blocked.

Have you ever noticed that carnivals and video game centers always work on a tokens or tickets system, rather than money? Timeshare venders use points for the same reason.

But back to my afternoon with Roberto:

He repeatedly used the classic “anchoring” sales technique of saying the full price of their vacation point package would be $100,000, only to eventually offer a very similar package for around $27,000. Wow, I should have been thinking, what a huge discount. All just for me?

He repeatedly used the classic “anchoring” sales technique of saying the full price of their vacation point package would be $100,000, only to eventually offer a very similar package for around $27,000. Wow, I should have been thinking, what a huge discount. All just for me?

Actually, he made two offers, a bigger price and a smaller price. Given those two, he asked, which one seemed more attractive to me? This is the sales technique of making me feel like I’m cleverly in charge and actively choosing a smart, low-cost, option.

Were the offers made affordable? Well of course they were, because I can make a low down payment and borrow the rest. Wyndham offered to “finance” part of my purchase of the “Deed and Title” to their vacation points, at 13.99% interest. So that was really nice of them, assuming I don’t mind paying sub-prime mortgage interest rates.

When he heard I was in finance, my salesman focused on the clever “inflation hedge” aspect of these timeshares. Since the cost of hotels would be increasing by 10-14% in coming years (an #AlternateFact, but whatever) I should know that my points would always be worth the same amount forever, so I’d be better off buying today rather than waiting for another day.

Speaking of today, in a classic red-flag sales technique, Roberto would not allow me to take any of their marketing materials or specific offers home to “think about it.” The offer, of course, was “this day only,” with assurances that on any subsequent day I came back the offer would likely be worse.

After I had declined to purchase the package, I was sent to an exit interview with a new person. Following a few cursory “how was your experience today” questions, she hit me up once again with an offer to purchase a smaller package, at an even lower price. Today only, of course.

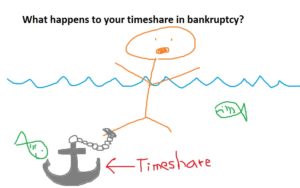

In an earlier professional life, I networked with bankruptcy trustees, the people who sell off valuable assets of the estate of a person who goes bankrupt. You’re not going to believe this but trustees always, always, always had timeshares to offer.

The simple problem for bankruptcy trustees is that timeshares are worth nothing. No, that’s not quite right. Timeshares are worth less than nothing. They have negative value, because they cost money every year to maintain.

This is why Ebay is full of offers for timeshare vacation weeks, and hundreds of thousands of “points,” for $20, or $1. Or even $0.01. Check it out.

Caveat Emptor, or buyer beware, on any particular offering on eBay, obviously, but a scan of timeshare message board confirms that paying full price for a timeshare is a complete mug’s game.

All bankruptcy trustees become inadvertent experts in timeshares, and not just because they can never seem to sell these so-called “assets.” There’s clearly a positive correlation between people who go bankrupt and people who are tricked into believing timeshares are a good investment. Bankruptcy trustees tell a quiet joke amongst themselves that, by law in the United States, nobody is allowed to go bankrupt unless they have first purchased a timeshare.

All bankruptcy trustees become inadvertent experts in timeshares, and not just because they can never seem to sell these so-called “assets.” There’s clearly a positive correlation between people who go bankrupt and people who are tricked into believing timeshares are a good investment. Bankruptcy trustees tell a quiet joke amongst themselves that, by law in the United States, nobody is allowed to go bankrupt unless they have first purchased a timeshare.

The slogan of the entire industry should be: “Timeshares: All the costs of renting, none of the benefits of owning.” Catchy, no?

See, that’s why I don’t work in marketing.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Variable Annuities: Shit Sandwich

Vacation camping with my daughter

Post read (890) times.