In my last post I mentioned the terrible scores Houston and San Antonio governments received for transparency in their economic development programs, according to a report by Good Jobs First.

One reason the stakes for transparency are high is because the amounts of subsidy are so big. How big? Well, we’ll soon find out. In 2017, for the first time, cities and counties nationwide will have to disclose how much in total subsidies they provide to private businesses, due to a new accounting standard known as GASB 77.

A study by the New York Times in 2012 found that governments in Texas provided the most economic subsidies to private business of any state in the nation, at $19.1 billion.

Texas Monthly writer Erica Grieder makes the point in her book Big, Hot, Cheap and Right: What America Can Learn From the Strange Genius of Texas, that “free-market capitalism” in Texas has, ironically, long relied on strong government intervention and subsidies for private business.

But with that high subsidy comes – I would argue – a heightened duty to keep the public informed of programs and results.

The current way of reporting on economic development subsidies, officials in each of the City of Houston, City of San Antonio, and Bexar County all told me, is that, once a year, the economic development department sends a spreadsheet over to someone at the newspaper, either the Houston Chronicle or San Antonio Express News. Beyond that once-a-year data dump, either an enterprising citizen or more likely a bored reporter on a fishing expedition working on deadline would need to submit a specific request to the economic development department of the city or county.

Since the information is deemed public, this request presumably would be fulfilled with little muss or fuss. All of the officials with whom I spoke reiterated that no formal “Freedom of Information Act” request (a “FOIA” for the cool kids) needs to be filed.

But you can probably see why, although that constitutes a minimum standard of public disclosure, it falls far short of what we should reasonably expect in 2017. What if the reporter or editor at the respective paper had a full plate of stories that week and didn’t really want to make use of the information? What if – as is likely every year – no particular economic development deal jumped out as worthy of newspaper coverage? What if – as shocking as this will sound to all of you reader-types – a citizen doesn’t actually read the newspaper? How would they learn about this? For each of these reasons and more, an annual newspaper data dump isn’t the right level of transparency at this point in time.

All of the economic development officials I spoke with agreed with me in theory on this point, but obviously it will take some effort and resources in their respective departments to improve the situation.

All of the economic development officials I spoke with agreed with me in theory on this point, but obviously it will take some effort and resources in their respective departments to improve the situation.

And we can agree that improving searchable websites for ease of transparency can be difficult. Bexar County’s Executive Director of Economic Development David Marquez pointed out to me that certain (not to be named) newspaper websites can be notoriously un-searchable. That’s a fair point, my man. A fair point.

Anyway, I hope they will all take a look at Austin’s searchable database, to see what good disclosure and transparency looks like.

Beyond the amount of money involved, why else do we need a high degree of transparency with respect to economic development deals? Just this. There is nothing quite like conferring a public good – a generous tax break – to a private company that gets my spider sense tingling about potential conflicts of interest. You don’t have to be paranoid or a cynic like me (although I invite you to be) to believe that a natural symbiosis exists between public officials who need money and have the ability to award valuable subsidies and private enterprises who would happily return the favor.

We – not just writers, but also citizens – should be able bring up an online database showing, just to pick an example, political campaign contributions, and compare that database to public subsidies of private companies. Are there any connections? Does a company that contributes to a campaign show up as a beneficiary of public subsidy? That’s the very definition of conflict of interest, and we need the tools to prevent that. If there are any dots to connect, everyone should have the power and ability to connect them, from the comfort of their own laptop. If there are no dots to connect, then we all sleep better at night.

We – not just writers, but also citizens – should be able bring up an online database showing, just to pick an example, political campaign contributions, and compare that database to public subsidies of private companies. Are there any connections? Does a company that contributes to a campaign show up as a beneficiary of public subsidy? That’s the very definition of conflict of interest, and we need the tools to prevent that. If there are any dots to connect, everyone should have the power and ability to connect them, from the comfort of their own laptop. If there are no dots to connect, then we all sleep better at night.

This is in no way a Republican or Democratic Party issue. But if you want to see it that way, just consider the importance of making sure officials from that other party (the one you most distrust) can’t get away with it. We need you on that wall, people, guarding against that other party’s nefarious conflicts of interest!

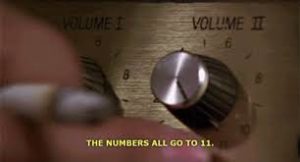

I believe the right volume of transparency for economic development tax breaks for private companies is a “SHOUT IT FROM THE ROOFTOPS, CONSTANTLY” level of transparency. On a scale of one to ten, I want transparency that goes to eleven. Because you see, it’s that one bit louder, isn’t it?

The next best thing to a transparency volume turned up to eleven is an online searchable database. Properly understood, that’s strongly in the interest of public officials and private corporate recipients as well. They also want and deserve the legitimacy that goes with transparent economic development plans, free from charges of influence peddling or conflicts of interest.

Please see related posts:

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Need for Transparency in Economic Development Part 1

Economic Development Subsidies: Turtles All The Way Down

Book Review: Big Hot Cheap and Right, by Erica Greider

Post read (95) times.