May 11, 2022 was a financial watershed for my friend Laura Davenport. A teacher at Alamo Colleges in San Antonio, on that day she received an email from the Department of Education informing her that her $155 thousand of student loan debt had been suddenly forgiven – from one day to the next – through a program called Public Service Loan Forgiveness (PSLF.) She couldn’t believe it at first.

She had been working for years to qualify for just this event. She described to me a Kafka-esque journey with her loan servicer and the Department of Education, in search of a way to take care of the loans she took out for her Master’s degree and PhD in creative writing. Between 2009 when she completed her degree and now – despite more than 10 years of payments – her loans had grown from $119,921 to $155,399.

I bring this anecdote up in part to call attention to the PSLF. If you or someone you love has student loans and has or will accrue ten years in public service work or non-profit work, they may qualify for this massive debt relief. There’s an October 2022 deadline for getting your case for loan forgiveness reviewed by the Department of Education, with relaxed standards for qualifying, compared to the past.

I also bring this up because the Biden Administration has strongly implied that it will soon forgive $10,000 of debt (or more!) in a kind of blanket amnesty program for student loan borrowers. A progressive movement has grown to a crescendo in the past few years in favor of broad-based student loan forgiveness.

I’m the kind of jerk that thinks this type of amnesty is a big mistake. I don’t really enjoy writing financial opinion pieces that I know will garner a lot of hate mail. Ah well, I’m still going to state my unpopular view. Regular student loan forgiveness currently contemplated by the Biden administration (of $10,000, or more!) is a bad idea.

The pro-student loan forgiveness movement makes the following points.

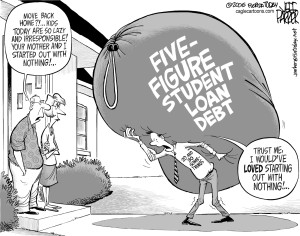

- The cost of higher education has become outrageous. Tuition Inflation has run at an average of 6.2 percent for the past 20 years, well in excess of the rest of the economy, and certainly of wage increases.

- State universities used to be an affordable option, but no longer. Over the past 20 years the cost of public education has nearly tripled on average. The children of middle class families cannot afford public education. Despite robust public university systems, the average student borrower in Texas has over $31,000 in debt. The average!

- Unlike nearly every other type of personal debt, student loans are not dischargeable in bankruptcy, making it a harsher debt burden than credit cards, home, car, or business loans.

- Student loan debt balances are bigger than credit card debt balances, roughly $1.7 trillion compared to $840 billion. About 13 percent of Americans have student loan debt, making it a widespread burden.

- Wealthy countries in Europe do not make higher education unaffordable like we do. It’s typically free or very affordable there.

I agree with all of this. And yet, I still don’t think the Biden administration should offer $10,000 or more in student loan amnesty.

I oppose wide-scale debt forgiveness from two angles. First, student debt forgiveness is inequitable.

In part because of the demographic of who enrolls in higher education, and in part because of high debt balances that accrue to high-income potential degrees like medicine, law, and business, academic studies all conclude that debt forgiveness plans are regressive. That means that the higher benefits of this public good goe to higher income populations, while the lowest income populations enjoy less benefit. Understood similar to a regressive tax policy, broad debt forgiveness doesn’t pass the fairness smell test.

Second, it’s bad politics. Here’s a partial list of people who have good reason to resent broad based higher education loan forgiveness:

- Americans who have not studied for a higher degree. (This is a majority of Americans, by the way. Only 48 percent of people 25 or older have completed an Associate’s, Bachelor’s or higher degree).

- Americans who took out higher education loans and who have paid their debts back one way or the other. They did the hard thing, and now they will feel like suckers.

- Americans who will take out higher education loans in the future but who will not receive loan forgiveness. When my girls go to college, by an accident of birth, they will most likely not get their debts forgiven.

This is a recipe for political resentment. Of course we may anecdotally know or be somebody “deserving” of debt forgiveness, but as a matter of policy it’s not a good idea.

So what kind of relief should we offer? I’m very pro debt forgiveness for people who have done public service. The military, government service, public education – these all seem like worthy ways to earn debt relief. You earned less with your degree than you could have in the private sector, but you contributed to society, and then society pays you back. A fair deal, and politically palatable.

As for Davenport, who qualified after working 10 years in public service, I’m thrilled for her. During the last administration, PSLF approvals dropped to nearly non-existent, to the point that the Government Accountability Office found that a mere 1 percent of applicants qualified by 2019.

A shift in policy in the past year however has suddenly opened up borrowers for massive relief.

A second group that should get relief are people scammed by higher education. On June 1st the Education Department wiped out $5.8 billion owed by 560 thousand student borrowers to Corinthian College, which went bankrupt after 20 years of dubious promises and under-delivery. Seems right to me, but it would have been even more satisfying if the Corinthian College leadership had been prosecuted for costing the public billions of dollars.

The Biden administration’s plan to simply forgive loan debts – not linked to service – seems unfair and politically unwise.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts:

Past Student Loan Forgiveness Failures

Not Holding my breath on Student Loan Forgiveness

Post read (59) times.