The US Treasury department, reportedly is wrestling with a plan for the re-capitalization and re-privatization of the Federal National Mortgage Association (aka FNMA, aka Fannie Mae) and the Federal Home Loan Mortgage Corporation (aka FHLMC, aka Freddie Mac), two entities at the center of the $10 trillion US mortgage bond market.

As a former mortgage bond salesman, Fannie Mae and Freddie Mac give me painful flashbacks. Their weird past, and current status, represent one of the last unresolved issues of the 2008 mortgage crisis.

Since their $187.5 billion bailout and effective nationalization in September 2008, virtually all profits from Fannie and Freddie have been remitted to the US Treasury. The first quarter 2019 profits sent to the Treasury from Fannie and Freddie were $2.8 and $2.2 billion, respectively. Over the last 11 years, the firms have returned more in profit to the US Treasury in the form of dividends than they received in the bailout.

The Obama administration inherited the problem of these companies from the Bush administration in 2009 but could not figure out a way to move forward on a permanent resolution of their status. The Trump administration appears poised to announce their “recap and release” plan soon – meaning raise enough private capital to make the companies fail-proof, and then turn the companies back into private entities again.

If they truly become private, well then, fine. But I have my doubts. My worry is they will revert back to the public/private hybrid monstrosities they were before the 2008 crisis. Bloomberg reported that Treasury Secretary Mnuchin would like the privatized companies to retain a government guarantee. Ugh. That’s the part I don’t like.

Forget Left Vs. Right

If we see the Fannie and Freddie problem and their resolution through the simple dichotomies of left/right, nationalized/private, socialism/capitalism – we’ve forgotten the weird history of these companies.

Like many policy issues when seen up close, the question of what to do with Fannie and Freddie defies easy characterization and solutions of the left versus right variety, or our ideological or aesthetic preference for more government or less government in our lives.

Now, I like government. I think it does some wonderful things. I also like private companies. They also do wonderful things. Governments have their important functions, and private companies have their important functions.

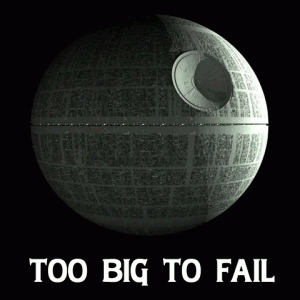

But also: What I don’t like are companies that straddle the hybrid line between public and private. What I really don’t like – and here’s what Fannie and Freddie always represent to me, as the worst of the 2008 crisis – is the hybrid company problem which, most succinctly stated, is “privatize the gains, socialize the losses.” By existing in their in-between status as “government-sponsored entities,” Fannie and Freddie were the ultimate “heads-I-win-tails-you-lose” companies.

In the 2000s, bond buyers loved owning Fannie and Freddie debt, known as “agency debt,” because of this in-between status. They were private, for-profit companies, sure, with private shares trading on the New York Stock Exchange. But they had the implicit backing of the federal government, because they had been originally Congressionally chartered and because they played such a systemically important role in the mortgage bond market. So they could issue more debt, at cheaper rates of interest, than any fully-private company. With that cheaper-than-anyone financing, they could build up larger-than-annual mortgage bond portfolios.

The federal government tried to claim, numerous times, that it didn’t fully backstop Fannie and Freddie agency bonds. They were “government-sponsored” but not “government guaranteed.” But of course in the end they did. It was a distinction without a difference.

Top executives paid themselves like rock stars more than $14 million and $12 million in 2006 and 2007 for Fannie Mae CEO Daniel Mudd, before he drove his government-sponsored entity off the cliff in 2008. Freddie Mac CEO Richard Syron collected nearly $20 million in 2007 before similarly destroying his company the following year.

Those rock stars took over after both Freddie Mac CEO Leland Brendsel and Fannie Mae CEO Franklin Raines left within a year of each other, in 2003 and 2004, for inflating portfolio values and smoothing earnings in accounting scandals.

Meanwhile, Washington has happy because DC regulators could periodically order the government-sponsored entities to loosen lending standards for new programs to encourage further home ownership, even among folks with dicey credit and fewer resources to weather any financial storm.

Government-guaranteed, but paid like the private sector! Totally malleable to government political pressure! Borrow at below-market rates to grow your balance sheet without limit. What’s not to love? Good times! Back in the 2000s National Public Radio played near-constant public service announcements that they were supported by Fannie Mae, ‘We’re in the American Dream Business” of homeownership.

The Risks of the GSEs were known

Two years after I left Goldman’s mortgage desk in 2004, but two years before the mortgage crisis, I remember a dinner conversation in 2006 with a table full of bankruptcy trustees – folks who like to be alert to financial catastrophes and their causes. One asked my opinion of what the source of the next market crash would be. I confidently answered: Fannie Mae or Freddie Mac. They were too large and levered (indebted) and they ran the essential plumbing of the mortgage bond market. Any loss of confidence in them could trigger a tsunami of losses.

I mention this not to brag about my prescience, but rather to point out how obviously problematic Fannie and Freddie were to many people, years before the crisis blew up. The systemic risk posed by Fannie and Freddie wasn’t my original idea. Among people who understood the mortgage bond market it was a major fear. Hedge fund manager, author, and irascible financial philosopher Nassim Nicholas Taleb concluded similarly in his 2007 book The Black Swan: The Impact Of The Highly Improbable. He wrote in a footnote criticizing poorly-designed risk-management models, “…[T]he government-sponsored institution Fanny [sic] Mae, when I look at their risks, seems to be sitting on a barrel of dynamite, vulnerable to the slightest hiccup. But not to worry: their large staff of scientists deemed these events ‘unlikely.’”

In the end, Fannie and Freddie didn’t cause the crisis. They were further kindling caught in the firestorm of housing-based over-indebtedness. After investors and executives collected the profits, the taxpayers were left with the liabilities.

Let’s hope Mnuchin’s Treasury Department comes up with a better plan for the future.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post:

Book Review: Black Swan – The Impact Of The Highly Improbable, by Nicholas Nassim Taleb

Post read (326) times.