When it comes to saving money, no amount of income is enough to make this easy.

“If I made a million dollars a year,” you might think, “then I could start saving money pretty easily.” Nope, you’re wrong. That’s not easy at all.

Once you make a million dollars, you start living with people who make many more millions of dollars than you. You think weekends in St. Barts and month-long vacations in Bhutan come cheaply? The NetJets membership to hop over to see American Pharoah win the Triple Crown at the Belmont Stakes? No, not cheap at all.

Saving money at a million dollars per year does not necessarily get easier, because lifestyle costs simply adjust upward.

Are the rich different?

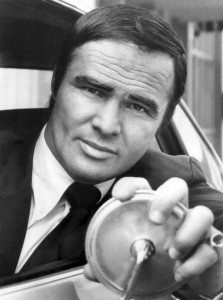

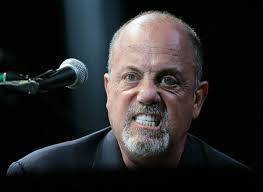

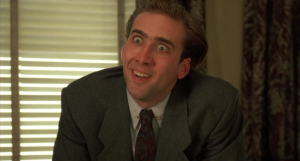

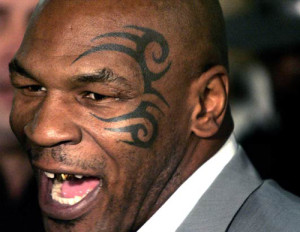

You’ve read about public figures who earn extraordinary paychecks.

Perhaps you remember boxing champion Mike Tyson, who earned $300 million from his fights. Or movie stars like Burt Reynolds, the highest paid Hollywood actor in the early 1980s, and Nicolas Cage, one of the highest-paid Hollywood actors in the 1990s. Or the mega-successful musician Billy Joel. All of those guys declared bankruptcy or were financially wiped out, despite hundreds of millions in career earnings.

What I mean to show by those extreme examples is that, for some people, there’s no amount of money sufficient to cover their lifestyle costs.

But that’s the little secret about saving money: Nobody actually makes enough money to make saving easy.

Bankruptcy statistics

The National Bureau of Labor Statistics did a longitudinal study of randomly-chosen Americans born in the decade around the mid-1960s. That random group ran the entire spectrum of incomes. The study found that 15.7 percent of the group had declared bankruptcy by 2010.

Would you like to know the percentage of NFL players, for example, who go bankrupt? Even though the average NFL player earns $3.2 million in his career, ex-players declared bankruptcy at the same rate as the general population.

The Washington Post reported recently that 15.7 percent of NFL players file bankruptcy by year 12 after ending their career.

That same study showed that 1.1 percent of former NFL players declare bankruptcy in any given year, again roughly the same rate as the general population.

What about us?

Now, I know it’s just good, mean, fun to point at public figures and how they squander huge sums of money. It’s a lot less fun to point the spotlight on ourselves and say the same principle applies.

The key principle is that our problem with saving money really isn’t the amount coming in every month. It’s the amount going out every month.

You may not feel you make enough money to actually save any money. I mean, I know you feel that way. But somebody you know who makes less than you is managing to save money. I don’t know how they do it. But if they can do it, technically so can you.

“Easy for you to say smartypants, I’d like to see you try to save any money living off of this income,” you’re probably saying to yourself right now. And you might be right. I probably couldn’t do it.

But – and here’s a key point that you should understand – if you make $50,000 per year, you probably live on the same street as someone who makes quite a bit less than you, say, $40,000 a year.

Somehow your neighbor making $40,000 has figured out how to pay all the bills and sock away an extra few hundred dollars every month. I don’t know she does it. Frankly, I’m resentful of her success. But I’m also impressed.

Also, she doesn’t understand how the family of four two blocks away can survive on $30,000. And yet, that family does it too.

Meanwhile, in another part of your same town, another family is going completely broke on $120,000 a year. If they could just find an extra 10% more income, they think, the checkbook would balance. They could pay down that ever-growing credit card balance. But each month comes and goes, and the debts grow.

I don’t mean to minimize the struggle of anyone. It’s always hard. It’s hard for the family going broke on $120,000 per year. It’s even hard for Billy Joel and Nicolas Cage.

I mean to point out that the lifestyle cost is the controllable variable. We don’t think we can change that. We don’t want to change that. It’s not easy to change that.

Saving money is simple, but always very far from easy.

A version of this ran in the San Antonio Express News.

See related posts:

My own million-dollar latte effect

Saving money via Jedi mind tricks

Post read (4132) times.

9 Replies to “Saving Is Never Easy”

This article is bullshit. If I made $1 million a year, there is no way in hell I would go broke and not be able to save any of it. As long as you don’t live above your means you’ll be fine. The problem is, once people start to make good money, they feel invincible and start to spend more than they have. I have absolutely no sympathy for anyone who is making good money, and loses it all.

Ok, sure, many of us could manage to squeak by on $1 million per year. But that’s not the interesting challenge. More interestingly, could you manage to save money if you made 10% less than what you currently earn?

The article is on point & is basically saying what you are saying. Live within your means..if you do, even 50k a year is enough. If you don’t, even $1 mil isn’t.

Yes, and thanks!

“The problem is, once people start to make good money, they feel invincible and start to spend more than they have.”

You do realise that after you called the article bullshit, you then proceeded to make the same point it was making right?

Matt – Good point!

Yes, I could live off a 10% cut in my Salary and still save. I make $140,000 a year. I live on $70,000 a year, the rest, after taxes, goes into savings and investments (maximum to 401k, maximum to IRA, then the rest to my brokerage account).

I live quite comfortably, have no debt and own a nice home that I’ve paid off the mortgage on. Not a McMansion, but more then enough for me and my family to live the American dream.

It’s all about priorities. I don’t spend every penny I make. I don’t go on a $20,000 a year vacation, buy a new SUV every 4 years, or get the latest flat screen TV model and a $300 a month cable package.

If that’s your thing then fine, but its all a choice. Don’t make me responsible for your irresponsibility. I prefer to save so I sleep well every night knowing if I go into work tomorrow and was laid off, my family could survive years with what I have saved. You made your own choices, live with them.

Hate to rain on your parade, but it’s *you* who’ll be paying for our choices. Only a small fraction of the population will have even remotely close to enough saved for retirement.

What do you think the government is going to do then, just let the majority of the population starve to death? Unlikely. First, Social Security will be means tested — so you won’t be getting any, so that I can. Once that’s not enough, those of you with 401ks will be taking haircuts to pay for the rest of us.

Don’t think it can happen? Cyprus implemented a 10% take of *bank deposits* and no one blinked an eye. Who’s going to complain about a 401k seizure? The 5% of the population that has them? OK.