USAA Wobbles

Tell me: do you want the good news first, or the bad news? Fine, we’ll start with the bad news. In 2022, USAA reported its

Tell me: do you want the good news first, or the bad news? Fine, we’ll start with the bad news. In 2022, USAA reported its

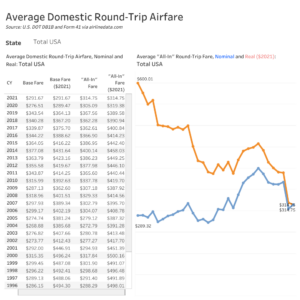

My household inflation experience is unique

I wrote recently that helping Ukrainian people survive and resist the Russian invasion is the most philanthropically worthy project I can think of right now.

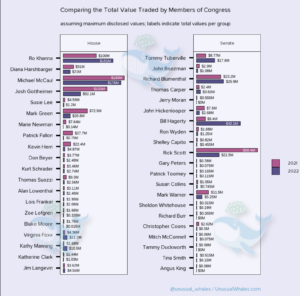

Congress should not be allowed to trade individual stocks, full stop.

I’m trying a new thing with my newspaper. Could you send me your specific personal finance questions, ideally about some decision you are trying to

How can a non-expert based in the US help Ukraine philanthropically?

I founded Bankers Anonymous because, as a recovering banker, I believe that the gap between the financial world as I know it and the public discourse about finance is more than just a problem for a family trying to balance their checkbook, or politicians trying to score points over next year’s budget – it is a weakness of our civil society. For reals. It’s also really fun for me.

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

We’ll let you know when we have new posts!