DJT Is Just Perfect

Have you ever seen a more perfect match up between public company Trump Media & Technology Group Corp – aka DJT the stock – and

Have you ever seen a more perfect match up between public company Trump Media & Technology Group Corp – aka DJT the stock – and

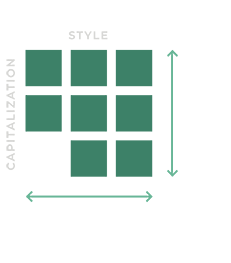

Dear Michael, My interest, as a long-term investor, is in what you have to say about small cap value vs growth funds and value vs

In June 2023 I featured a real estate investor who had made the bull case for Texas that it enjoyed unusual tailwinds as a diversified

Q. We have a number of investments through Vanguard – small, mid and large cap, some real estate and bonds. All have low costs. Our advisor

Weirdly, the Counting House feels like it was written for me? But maybe you’ll like it too.

Digging into the 2023 finances of a small Texas bank

I founded Bankers Anonymous because, as a recovering banker, I believe that the gap between the financial world as I know it and the public discourse about finance is more than just a problem for a family trying to balance their checkbook, or politicians trying to score points over next year’s budget – it is a weakness of our civil society. For reals. It’s also really fun for me.

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

We’ll let you know when we have new posts!