Please see New Highs in the Dow Part I – Indifference and Inevitability

Please see New Highs in the Dow Part I – Indifference and Inevitability

And New Highs in the Dow Part II – What’s going to happen?

———————————————

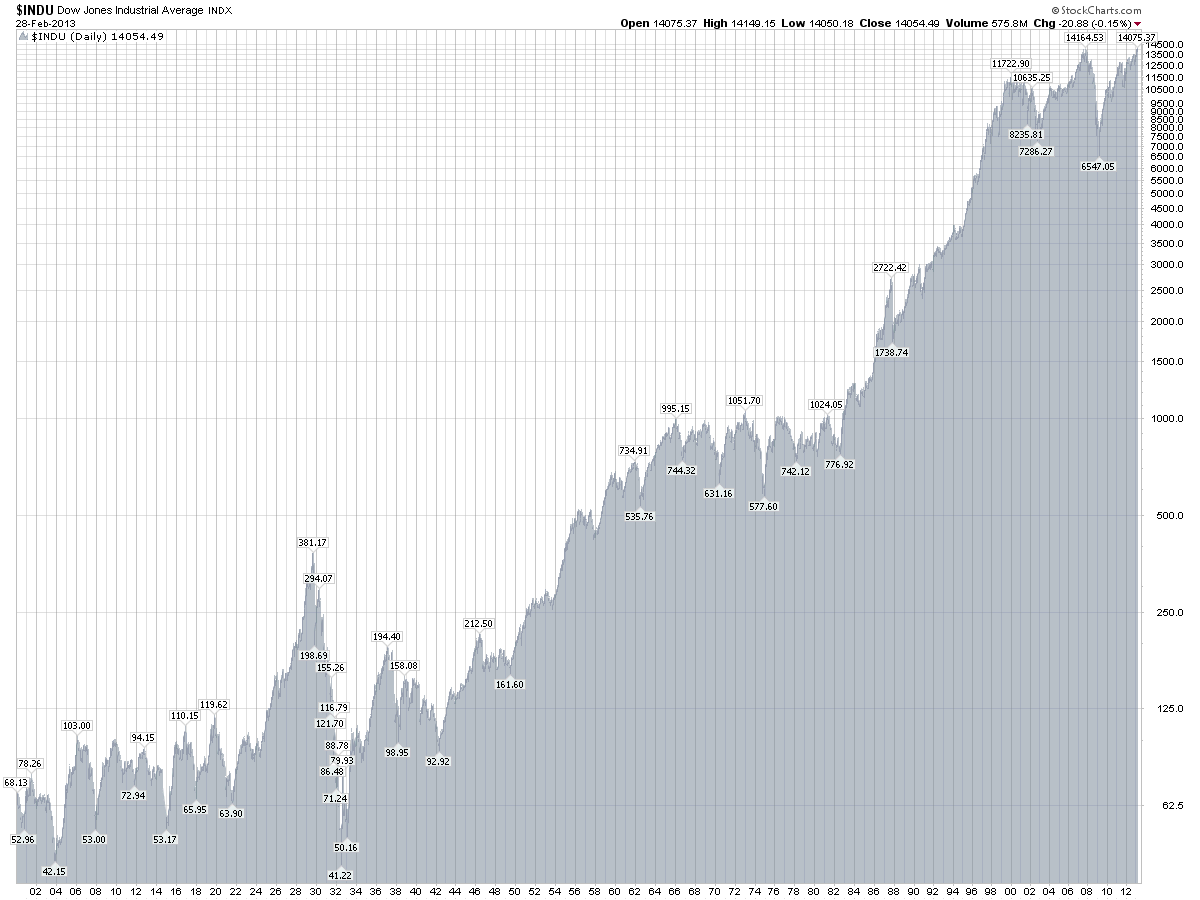

First, if you’re actually an investor1 in public securities2, take a moment to be sad about these past two weeks and all the new highs hit in the Dow Jones Industrial Average.

All that it means when an equity index hits a new high is that it costs you more to purchase shares in the equity markets. If you’re an investor and you plan to buy stocks ever again – in your life – these new highs are not to be celebrated, but rather be lamented.

Unless of course you like paying more this week than you did last week for the exact same product. I know I don’t.

After you recover from your sadness, do what you should always do under any circumstances, which is blindly and reflexively take the monthly surplus you can reasonably afford to dedicate to long-term investing, and purchase low-cost, diversified, stock mutual funds.

And never sell until you absolutely must have the money to cover your lifestyle costs.

And that’s pretty much it.

For 95%3 of individual investors, 99.5%4 of the time, the rest of what passes for investing advice amounts to noise.5

Please understand I’m saying this as a guy who

1. Is not an investment advisor and I’m not selling mutual funds. I can’t benefit in the least from you taking my advice.

2. I’ve been a bond salesman of credit default swaps, CDOs, RMBS, CMBS, ABS, IOs, POs, Inverse IOs, calls, puts, swaps, and swaptions. I’ve sold sovereign emerging market debt and corporate emerging market debt. I started and ran a distressed debt hedge fund. I’m a fiduciary for a school endowment invested in hedge funds and mutual funds. I know the products out there. They have their place and their usefulness in the institutional investing world, or the ultra-high net worth world.

I’m saying all of that sophistication – outside of low-cost, broadly diversified, long-only equity mutual funds – is mostly irrelevant to personal investing.

So, embrace the simplicity that’s beyond sophistication. Be child-like in your humility about what and how you invest.

Again, take the monthly surplus you can reasonably afford to dedicate to long-term investing, and purchase low-cost, diversified, stock mutual funds.

Do this when the market goes down. Do this when the market goes up. Do this when the market goes sideways.

Do this with a Fox.

Do this with a Peacock.

“But I would not, could not, with these stocks.

“But I would not, could not, with these stocks.

I would not, could not, with a Fox,

I would not, could not, with a Peacock,” you say.

When Fox and Peacock like Charlie Gasparino and Jim Cramer tell you to do other things, just do this.

Just try it. You’ll like it. You’ll see.

Please see my previous posts in this series

New Highs in the Dow Part I – Indifference and Inevitability

And New Highs in the Dow Part II – What’s going to happen?

Post read (4491) times.

- Just to be clear: my statement is aimed at people who intend to be investors in their life, in the future. If you’re a retiree drawing down on investments rather than adding to them, you of course celebrate new equity index highs like we’ve seen in the past week. But in that case, you’re not an “investor” in the sense I’m using the word. ↩

- Another caveat: Plenty of successful, wealthy, investors ignore public securities and do just fine. I’m really just talking about one’s involvement in purchasing stocks and bonds. Essentially, the kind of people who care about the Dow. ↩

- I rounded down to be conservative. ↩

- Ditto ↩

- For the fuller explanation from a great book on why this is all you need to know, read this review of Nick Murray’s Simple Wealth, Inevitable Wealth, and then go buy the book. ↩