Higher education costs too much, that’s a given.

The preferred solution to the problem of paying for the extraordinary cost of higher education is scholarships. Because free money is the best kind of money.

The central problem with scholarships, however, is maximizing your return on investment. Investment of your time, and investment of your effort.

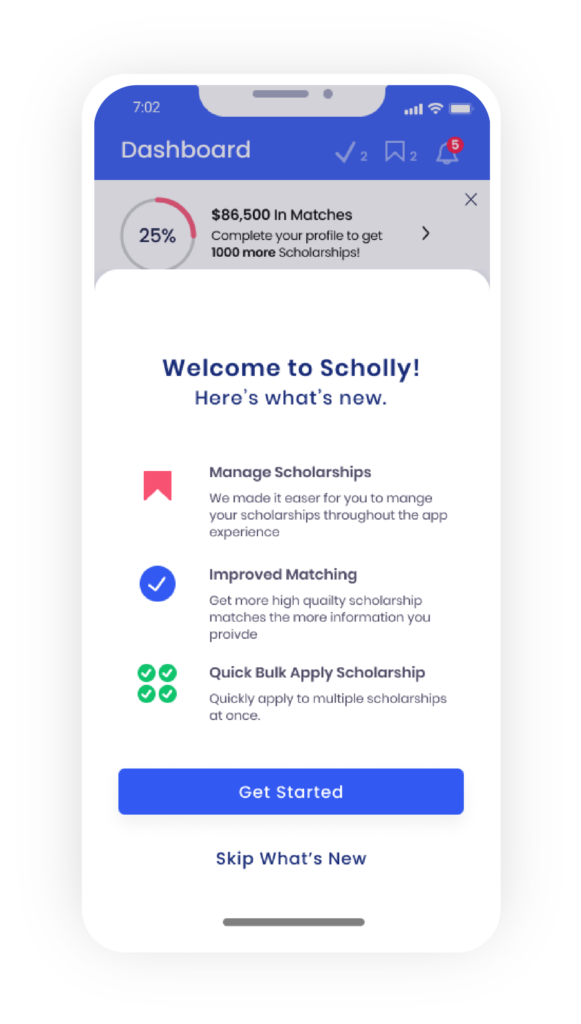

Sallie Mae, the national private student loan company, recently purchased scholarship search-engine Scholly specifically to address the problem of improving families’ return on investment of time and effort.

As Brian Babineau, Chief Brand Officer for Sallie Mae told me, “We found that efficiency is the problem. The biggest barrier to applying (for scholarships) is that kids don’t think they can win, so they might believe the ROI of their time is terrible. We want to make it easier for them to win, and also make them feel like winning is a possibility.”

Houston

At the Greater Houston Community Foundation website, high schoolers and their parents can efficiently seek opportunities that may be available specifically for them.

Courtney Grymonprez, Scholarship Manager at the GHCF, points me to the 48 listed scholarships on their site.

Most are narrowly focused on children of certain employers, or from a particular school or community, or who suffered from a medical condition, or who seek to pursue a specific course of study. That specificity means that for those students who qualify, the scholarships themselves may not be overly competitive to win.

“There are years when certain scholarships are not awarded, because nobody applied.

Sometimes there are scholarships for one particular high school. Local scholarships are the best way of having really good chances,” she says. High school guidance counselors, she says, are a good resource for finding these types of scholarships.

Outside of the GHCF scholarships she oversees, she recommends all Texans look at the Houston Livestock and Rodeo site, where funds raised from the event are available for higher education.

Grymonprez is quick to point out that not all scholarships there are targeted to agriculture or “rodeo themed” in any way.

San Antonio

Meanwhile, the San Antonio Area Foundation offers over 120 scholarships totaling $9 million for local students.

Their flagship opportunity, called “Legacy Scholarship,” is merit-based and worth $40,000 over 4 years, for 80 students from Bexar County planning to attend public or private university in Texas. That application is due during junior year.

Between December first and February 24th this year, however, is the most efficient way for current seniors in the San Antonio area to apply for scholarships from the SAAF. Through a single application, prospective students can make themselves eligible for dozens of scholarships. Actually, at SAAF, there are currently two applications.

According to Jennifer Ballesteros, the Executive Director of Scholarship and Relief programs at SAAF, students can submit both a “universal” and a “common” application through the SAAF. Some scholarships are administered solely by SAAF staff, while other scholarships are awarded in consultation with outside committees, which explains the difference between the two categories of awards. But students should absolutely apply via both methods to increase their odds of landing money. Just two applications, to put oneself in the running for over a hundred scholarships, seems efficient to me.

As with the Greater Houston Community Foundation, many scholarships through the SAAF are highly targeted to a student’s family background, choice of major, intended career, or a specific campus. As a result of this narrow targeting, some scholarships are less competitive and more easily won. Every year, Ballesteros says, “There is money left on the table, and we do want that money to be spent.” Bellesteros mentioned money for archeology majors, to cite one example, has gone unclaimed in the past. In terms of ROI, an uncompetitive scholarship is the best kind of scholarship!

Over at the scholarship search engine Scholly, sponsored by Sallie Mae, Babineau echoed this same theme. Some money is just out there waiting to be claimed.

“We want to change the narrative that scholarships are only for students with a 4.0 GPA and 1600 SATs,” says Babineau. “There are scholarships available for the person you are, the things you want to be and do, your hobbies. There are local scholarships available in your town. We are trying to create awareness around that.”

Accessing regional foundations, plus a scholarship search engine, feels like an important way to increase your student’s return on investment of time and effort.

I spent 6 minutes to create a profile on Scholly as a parent, after which the app returned with $131,250 in 11 “potential scholarships” for my child. After I inputted some more data – another 5 minutes – based on my oldest daughter’s extracurricular activities, academic interest and personal background, the app upped the amount to $151,750 in potential scholarships.

Scholly is just one of a number of scholarship search engines that parents and students could use to quickly identify plausible scholarships. While the “best” search engines may change over time, a Google search will quickly give your student a few places to begin.

The National Scholarship Providers Association, an advocacy group, claims that $100 million in college scholarships goes unclaimed each year.

Maybe this opens up the concept to a college junior or senior that hustling to apply for college scholarships is a very worthwhile use of time. Can 30 minutes of online work qualify them for $500? Can 2 hours of essay writing and filling out forms get you $2,000? A high schooler is unlikely to earn that much on a per hour basis in any other (legal) activity they could engage in.

A version of this post previously ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

San Antonio student who figured out the scholarship game

Post read (80) times.