I conducted an experiment a few months back to test a long-held theory. The ubiquitous funny advertisements with the green lizard have led me to believe I could save money by calling up my automobile insurance provider and asking them to reduce my costs. (FWIW I don’t use that company. I have a different one, and I’m loyal to mine.)

Long story short, it worked. At the end of my phone conversation with my provider I’ll pay $20.07 less per month. To state some obvious math, that’s $240.84 per year.

I think my choices are prudent for me, but they are not free-lunch choices. I made a series of calculated gambles based on what I know about insurance in general, my particular car, and my personal financial situation.

This all started from a conversation over coffee with a reader two weeks ago. He mentioned that since the 1980s he’d declined to pay for collision insurance on his car, and that he calculates having saved at least $30,000 since then as a result. That got my attention. I realized I haven’t deeply studied the different components of auto insurance. Maybe you haven’t either. Now’s your chance to get a little nerdy with me.

For starters, auto insurance is required by law in every state. The required part of auto insurance is liability insurance. That’s for when you damage someone else’s body, car, or property. In Texas you’re allowed to buy a minimum of $25,000 in coverage per person or car, and $60,000 per incident. I pay to insure well over the minimum amounts and I didn’t mess with this liability part of my auto insurance policy.

The second part of auto insurance – which turns out to be optional in some cases – is collision insurance. That’s the amount you’ll receive if your car gets damaged.

Here’s where insurance theory and two other personal finance theories came into play. I’ll hit you with all three theories. First, insurance is expensive, so buy the least you can while still avoiding catastrophic financial risk. Second, don’t buy too much car. Third, try to buy so little car that you can avoid having a car loan. This third part is admittedly rarely achieved, but something to strive for. Because if you can eliminate your car loan, you have more options with collision insurance.

If you have a car loan, your lender makes you buy collision insurance, naturally, because the car acts as collateral for your loan. A smashed up car makes for poor collateral. If you don’t have a car loan, however, you can decline collision insurance.

I don’t have a car loan. I also don’t have a valuable car. In combination, that means I’m not terribly worried about losing many thousands of dollars in value if I wreck it. During this process I looked up trade-in value for my 11 year-old Hyundai Elantra with 95,000 miles and learned it’s worth $1,800 to $2,500. I don’t expect my insurance company to shower me with much more than that amount, in the event of a total wreck. And I’m not dropping $7,000 in repairs into this automotive beauty in that event either. Both of these factors mean I should keep my collision insurance to a minimum. I declined to pay for any collision insurance this week, because that suits my particular circumstance.

A fourth rule of personal finance came into play on the issue of comprehensive coverage. The rule is that it helps to have money in order to save money.

I saved a small amount when I upped my comprehensive coverage deductible from $500 to $1000. A few definitions might be helpful to explain what this means. Comprehensive coverage protects me if something other than another motorist hits me, such as hail damage, a tree falling, or flooding. The deductible is the amount I’m on the hook for, in the event of needed repairs. My upping the deductible is really a result of being able to handle the financial hit if a bad thing happens. If I didn’t have either savings or decent lines of credit, I wouldn’t be able to responsibly increase my deductible. But I do, so it’s cool. That’s the “it takes money to save money” thing.

A few other fine-print things I considered during my auto insurance conversation.

I continue to pay for vehicle damage if I’m hit by an uninsured motorist, although I lowered my coverage to the Texas state minimum of $25,000. As I mentioned, my car ain’t worth $25,000, so I’m probably over-covered there.

I continue to pay $1.65 per month for towing and labor. Between a history of dead batteries and flat tires, it feels like I need a tow or jump start more than once a year. So I’m getting my full money’s worth there, if history is any guide.

I also learned that our household auto insurance premiums won’t jump in six months when my eldest gets her learner’s permit. But they will jump in 1.5 years – quite a bit – when she gets her full license. I could hear the empathetic pain over the phone in the auto insurer representative’s voice when I told her my daughter’s age.

So that will be a future auto insurance cost increase. In the meantime, I was happy to squeeze out a bit in savings while I could.

A version of this ran in the San Antonio Express-News and Houston Chronicle.

See related posts:

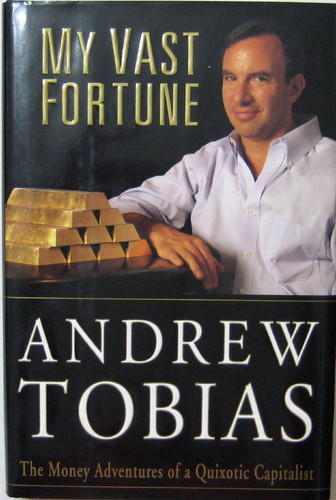

Book Review My Vast Fortune by Andrew Tobias

Buying a Car Part I – Not Getting Fleeced

Post read (183) times.