Texas leaders need to go back to middle school.

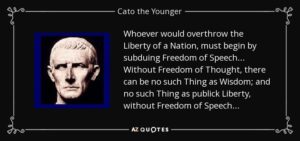

My sixth grader recently learned, and then recited to me, the 10 Amendments to the Constitution, beginning with the first and best known: The freedoms of religion, assembly, petition, press, and speech. The key point of all of these is a limitation on what government can demand from private citizens and businesses. You’re welcome for the refresher.

In a special legislative session in September 2021, the Texas legislature passed HB 20, which empowered the Texas Attorney General to regulate large social media companies based on what messages they promote or discourage.

The point of the bill, made explicit at the time by Governor Abbott, was to redress a perceived imbalance in social media coverage of political voices. “Silencing conservative views is un-American, it’s un-Texan and it’s about to be illegal in Texas,” Abbot tweeted.

Unfortunately, this is a grave misunderstanding of the First Amendment. As a constitutional matter, the government can not tell private companies what they can and cannot publish.

But don’t take it from me, a member of the fake news community. Take it from State Representative Giovanni Capriglione (R-Southlake). He was one of the few Republicans to vote against the bill.

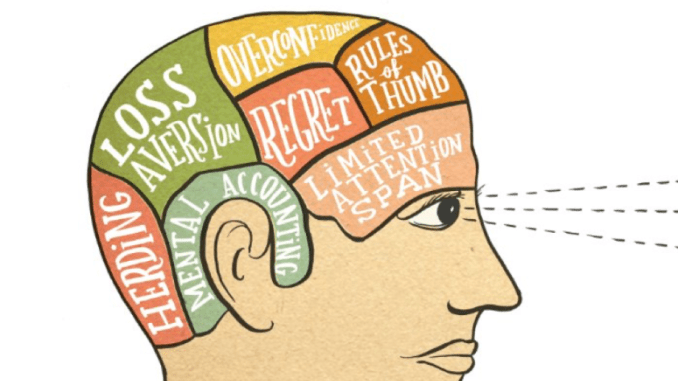

The problem of regulating social media companies, as Capriglione told me, “It is a slippery slope when we let the government say what we can say and think. Unfortunately this bill broadens that. And we let the government get into editorial moderation.”

Immediately following passage of the bill, Net Choice and The Computer and Communications Industry Association (CCIA) – private advocacy groups that count these social media companies as clients – filed to stop the bill from going into effect, winning an injunction in December 2021.

So here’s what happened this past week. Texas Attorney General Ken Paxton’s office won on appeal, lifting the injunction, putting the HB20 back into effect. At least until the next move, the AG of Texas can regulate large social media companies for, in effect, not being conservative enough. All Texans, all Americans should be worried about this, both on the left and the right.

Let’s remove this from traditional left/right politics. For example, you may personally prefer a better financial columnist in your paper each week. Your leaders in government may also want that. But your government does not have the right to regulate a media company just because the financial columnist is bad, and the better columnists are being “censored.” That’s not how it works. The First Amendment protects the media company from having any government regulate them based on a bad financial columnist. It’s as simple as that.

Matt Schruers is the President of the CCIA, which won in December, and then lost last week, the injunction against HB 20. They argue this is a basic First Amendment issue. “Ostensibly conservative officials are doing very unconservative things with respect to businesses that take positions that they do not like.”

I agree with Schruers and Capriglione. Private companies, like private citizens, get to express what they want. Government, in turn, does not get to force any particular message or messenger on private companies

Media companies in particular depend upon message curation, free from government dictates. Media curation free of government interference is a sacred part of the First Amendment.

All media companies engage in some curation, mostly to avoid their platforms becoming cesspools of spam, pornography, and disinformation. But also, media company control over what and who it allows on its platform is key to their function.

Capriglione says, “For me the conservative policy is that if the company isn’t doing what you like, you stop buying their product, or you create your own company. And you let the free market solve this. We don’t need the government to decide.”

As an example of what HB20 is aimed at versus what Capriglione says we need, look no further than recent headlines about Twitter, Elon Musk, and President Donald Trump.

A major thing that clearly inspired HB20 in the first place was the removal of Trump from Twitter, following the January 6, 2021 insurrection at the Capitol building.

Elon Musk, the presumptive incoming majority owner of Twitter (although on any given day who knows with him!?) has declared that deplatforming Trump was a mistake. Jack Dorsey, the founder of Twitter and a significant shareholder, says he agrees with Musk. It is reasonable to assume Trump will rejoin Twitter soon, and that’s fine. It should be up to Twitter to decide, not the government.

Trump’s team tried to build Truth Social as a new social media platform, which was mostly a grift and a failure. And that’s also fine. But the key point is that it would never be appropriate for the government to insist that Truth Social give equal voice to “progressive” voices. That’s not how we regulate media companies in this country! This is undoubtedly obvious to true conservatives, but somehow not yet to the Texas leadership that voted for and signed HB20, and the judge who lifted the injunction last week.

As a result, Capriglione continues, “I still think if you follow the constitution you can only come to one conclusion on how this should be done.”

Capriglione says, “Literally the beginning of the First Amendment is ‘The government shall pass no law…’”

Schruers said it well, “There are Republicans who regard that kind of government intrusion to be inappropriate. But there are other Republicans who would happily use the power of government to force private companies to disseminate the perspectives and viewpoints that they want.

I don’t think that’s particularly conservative, but there you have it.”

As Capriglione told me, “I’ve got an A+rating from the NRA. I’m 100% pro-life. I’m the one who wrote the bill to create the gold depository in Texas. [On HB20,] all you have to do is read the Constitution. It’s that simple.”

So what’s the next move? CCIA announced on May 13th that they and Net Choice filed an emergency appeal to the Supreme Court. A week later the Supreme Court granted a temporary pause, to allow another district court in Texas to address the rule.

Schruers commented as part of the filing: “It is unconstitutional for the government to dictate what speech a private company must disseminate whether it be a newspaper, TV show or online platform. The First Amendment is crucial to our democracy and the Supreme Court must now protect that principle from government actors who are too willing to sacrifice it on the altar of partisan posturing.”

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post

Texas joins recent trend to demand business be politically correct in Texas.

Post read (77) times.