I have something to say about the San Antonio Mayor’s race. My friend Mike Villarreal is running and he is by far the best candidate. He supports data-driven financial policies (rather than platitudes and rhetoric), he listens and acts across party lines and for the good of the whole (not just one constituency), and he’s an SAISD dad who know how important educating the next generation is to ensure long term financial future of the city. Please bear with me a bit for a meandering story about my friend, New York City, and the movie Jerry McGuire.

Fun with data analysis

Mike called me up one Saturday, about two years ago.

“Hey, can we meet for coffee?”

“Sure.” (Duh. I’m easy – a coffee addict.)

“I want to show you a project I’ve been working on with my laptop.”

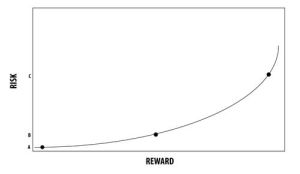

We ordered coffee at Halcyon in the Blue Star Arts Complex. He proudly toured me through the statistical regression model he’d spent the week programming on his computer. He excitedly pointed to the results of his model, indicating pockets of properties where property taxes were higher or lower than average – statistical outliers. What if we could apply these techniques at the city, county, or state level?

When we get together with our families for lunch or dinner, my wife and Mike get into intense conversations about statistical techniques. I can follow the conversation for a short while. I get a teensy bit lost when their statistics chat turns to the z-score, chi-squareds, or p-value.

Prove your ideas

Personally, I prefer making sweeping declarations based on a few pieces of partial evidence. I’m good at that. I guess that’s why I enjoy this column-writing gig.

My wife – more of a scientist-type – accuses me of grandiose pontificating based on little data. My response to her critique (only when she’s out of earshot): “Whatever.”

But my data-oriented friend Mike also frequently (though more politely) challenges my sweeping declarations.

“I liked what you wrote in the paper, but couldn’t you get some actual data or evidence to see if you’re right or not?” he asks me.

Or, “So, how would you go about proving that?”

A mayor I admired

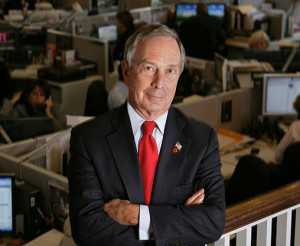

Speaking of public policy, I think fondly of a favorite mayor of my lifetime, Mike Bloomberg, who led New York City for eight years when my wife and I lived there.

Bloomberg was a Republican in a Democratic-dominated city. What mattered to me, however, was that he led New York for twelve years practically without reference to either party. Which is how a city should be run.

Bloomberg famously relied on data analysis and best business practices. He didn’t need to act out of ideology or loyalty to one party or another. Rather, when making decisions, he considered what worked best for the city.

Bloomberg showed that while Washington, DC stagnates with tired ideological gridlock, cities can innovate.

Why am I thinking of Bloomberg?

Mike Villarreal approaches policy as Bloomberg did. From the beginning of his campaign, Mike’s been fired up about the chance to lead the city in a non-partisan manner. “We don’t need a Democratic Party or Republican Party here, we need the Party of San Antonio” he told me last summer, when he focused one hundred percent of his efforts on running for this office.

To lead a diverse, growing, dynamic city, we need a leader who looks at all the evidence, weighs the choices, and makes the best decisions accordingly. We really don’t need a mayor who represents a limited party view, or a limited geographic base, or a limited identity.

Many talents

Beyond data-analysis, Mike has a number of talents that I admire.

I’ve watched him listen to people of all ideological stripes. He convenes alternate sides of an issue at the same table to listen to each other in search of common ground.

He takes political risks that more careful politicians would avoid, standing up to powerful forces – particularly in his own party – when it was in the public interest.

He understands first-hand the struggle of families pouring everything they have into raising children in this city. He grew here, his family did this for him, and he’s doing it for his own kids.

He’s a passionate competitor at board games, and a fired-up soccer dad.

But I guess what I admire most is his constant return to real, data-based evidence to back up policy ideas and ideals.

Antidote to cynicism

The worst thing about politics these days is our cynical belief – often borne out by experience – that our leaders make decisions based on campaign contributions, a perpetual “Show me the money!” mantra on their lips.

In a goofy way, I picture Mike in future policy meetings as a better version of the Cuba Gooding Jr. character in the movie Jerry Maguire. I picture him shouting in response to city lobbyists:

“Hey Mike, can I talk to you about my group’s housing agenda?”

“SHOW! ME! THE! DATA!”

“Excuse me, what San Antonio really needs for economic development…”

“SHOW! ME! THE! DATA!”

“Mr Mayor, the school district would like to request…”

“SHOW! ME! THE! DATA!”

OK, OK, Mike is not a yeller, so the analogy is not a perfect fit.

But if Mike Villarreal is the Cuba Gooding character for public policy, I guess that makes me the Renee Zellweger-character of financial columnists:

“Shut up. Just shut up. You had me at data-driven financial analysis.”

I know Mike will be a great Mayor for San Antonio.

Early voting begins April 27th. Please vote.

Please see related post from blogger, Concerned Citizen:

There’s a better choice for mayor of San Antonio – Mike Villarreal

A version of this post ran in the San Antonio Express News

Post read (2560) times.