Reading Jeremy Siegel’s classic on investing Stocks For The Long Run: A Guide To Selecting Markets For Long-Term Growth, I was reminded of three well-known investing aphorisms.

“Take the long view.” (Also related: “Successful people have long time horizons. Unsuccessful people have short time horizons.”)

“It almost certainly isn’t different this time”; and

“Read books, not magazines and newspapers (nevermind blogs or tweets) on investing.”

In taking the long view, Siegel presents the data and definitively settles the answer to the question of stocks v. bonds. He’s the guy that produced the 200+ years of data – going back to 1800 – that show the superior returns of stocks vs bonds or vs cash or vs (horrors!) gold.

Because it certainly isn’t different this time, Siegel himself draws upon work done in earlier eras that conclude, inevitably, the same way.[1] I had not previously heard of Edgar Lawrence Smith’s Common Stocks as Long Term Investments, which came out in 1924, but Siegel credits him with carefully and correctly building the earlier time series to show the overwhelming advantage of equities throughout modern times.[2] Siegel’s book – first published in 1994 – updates and extends the time horizon for considering the relative returns on different asset classes.

When I teach a night-school course for adults called “Get Rich Slow,” one of the visual lessons I employ is to show the relative returns of different assets according to different time horizons. The lesson of my visuals is the importance of taking the long view.

With a one-year timeframe, for example, stocks appear extremely volatile, especially compared to a ‘safe’ investment like bonds.

Widening the timeframe to a five-year horizon, however, you can see that in the majority of time periods stocks beat bonds, and typically quite handily.

Taking an even broader timeframe – such as ten years – the historic data shows that stocks are an overwhelming favorite over bonds. To prefer bonds over stocks through an investing decade is really to say that you believe a quite rare and unusual thing is likely to happen. You’re betting on the improbable. You’re betting, in fact, that you know “it’s different this time,” which is typically a losing bet.

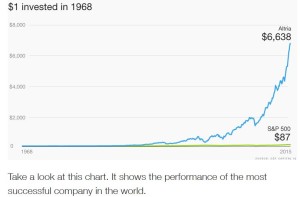

The power of Siegel’s book derives from him taking the longest view – from 1800 to today – to show that equities are the only way to build wealth.

Readers of Nick Murray’s Simple Wealth Inevitable Wealth – or readers of my review of that book – will not find the overarching message of this book any different in Siegel’s Stocks For The Long Run.

What readers of both books will find different is that – while Murray assumes the voice of accumulated self-evident wisdom and a bit of disdain to ‘prove’ his points – Siegel actually has done the proving (in so far as a long-dated data series can ‘prove’ anything in finance.) I’m sure Murray was deeply influenced by Siegel’s book and considers it the final word on long-term stock versus long-term bond returns. And it is.

The big idea

Both authors conclude that – in the long run – only stocks provide an increase in purchasing power over an investor’s lifetime. Meaning, only stocks grow your wealth. Bonds (and similar fixed income instruments) preserve nominal dollar values but might not even keep pace with inflation, and certainly cannot build wealth.

Risk, therefore, resides with bonds and the loss of purchasing power, not with stocks. Stocks – when held for the long run (and with diversification) – turn out to be not risky at all.

If you want the data and charts behind this idea that only stocks can build wealth, and are not risky, while bonds are the opposite, Siegel’s book brings the data.

Read books not articles

Siegel also comprehensively addresses major questions an intelligent investor might want to have answered, in a way that only a full book-length work can. Since you’re reading an article I’ll do my best to summarize each chapter in my own words, with a view to enticing you to read the whole thing.[3]

Chapter 1 – $1 invested in 1800 in US stocks becomes $260,000 in real terms (inflation-adjusted), while $1 in bonds becomes $563 by 1994. The value of that data point alone is worth the price of admission. Stocks in Britain, Japan, Germany – while responding to their own historical ups and downs – have a similar long-term upward trajectory.

Chapter 2 – Stocks, in contrast to bonds, have never offered investors a negative real return over 20 years. Bonds may offer a positive ‘nominal’ return, but after medium to high inflation your money invested in bonds may actually buy less than it did 20 years ago.

Chapter 3 – A broadly diversified portfolio – such as a market-representative index – offers lower risk than one or a few securities, assuming individual stocks are not perfectly correlated.

Chapter 4 – Stock prices respond to a combination of fundamental value (in the longest run) and investor sentiment (in the short and medium run), but neither approach provides certainty when it comes to investing. Dividends, it turns out, account for a tremendous amount of long-term returns to investors. Dividend Yield (dividends/price) offers an imperfect indicator of a good investment.

Chapter 5 – Small capitalization stocks might provide superior returns compared to large capitalization stocks in the longest run, but are certainly more volatile, and might underperform for significant amounts of time. Value stocks might provide superior returns compared to growth stocks in the longest run, but the evidence is still mixed. Ironically and contrarily, negative earnings and non-dividend paying stocks might also offer above-market returns, historically. Buying an IPO at the initial price usually is rewarded (if you sell right away) but buying at the first days’ closing price is usually punished.

Chapter 6 – While many investors would do well to pay attention to a stock’s price/earning ratio, sometimes buying a huge PE stock turns out well, while conversely a low PE stock can just as easily evolve into a complete loser.

Chapter 7 – The tax code, and in particular the tax on capital gains, heavily rewards long term holding of stocks compared to short-term stock holding, or compared to holding bonds.

Chapter 8 – For US investors, investing only in the US is akin to remaining undiversified in a single industry, with the US making up only a third of global equity market capitalization. The lesson: diversify by geography.

Chapter 9 &10 – Leaving the gold standard in the 20th Century appeared to auger the beginning of inflationary pressures, but stocks have served as an excellent long-term hedge against inflation, preserving and enhancing purchasing power over the long run, which bonds certainly to not do.

Chapter 11 – Timing the business cycle via stock investing would be theoretically super-profitable, but also appears nearly impossible.

Chapter 12 & 13 – Wars, political shifts, and economic data releases all affect stock prices in the short run, but rarely in predictable ways. Short-term news is only effective when compared to an aggregate of market expectations.

Chapter 14 &15[4] – The combination of futures trading and financial technology explains much of the short-term market fluctuations, including in some cases crashes such as observed in 1987.

Chapter 16 &17 – Some people subscribe to ‘technical’ techniques such as ‘charting,’ and Siegel even allows for the possibility of using factors such as “200-day moving averages” as a guide to buying and selling, but I’ll editorialize these chapters and say that’s crazy talk. Siegel also describes some long-standing efficient-market anomalies such as the “January effect” of small-stock outperformance in January, or a notable market underperformance on Mondays, but again I’ll editorialize and say pay no attention to that.

Chapter 18 – Picking successful stock mutual fund managers who consistently outperform the market has proven extremely difficult. Getting warmer…

Chapter 19 – Siegel saves the best for last. For holding periods above ten years, stocks have overwhelming advantages over bonds. The risk of holding stocks (measured by the standard deviation of real returns) actually shrinks to below bonds after ten years. For investors with a long horizon, rational behavior would call for holding 100% (or even more!)[5] of one’s investment portfolio in stocks.

Given the typical underperformance of managed stock mutual funds, most investors would do better with an index fund, an idea with which I am familiar.

The best personal finance books of all time

If you’re looking for the classics of personal investing and want to read the fewest number of books with the greatest impact, I think my short list goes something like this, in some order or another.

A Random Walk Down Wall Street, by Burton Malkiel,

Simple Wealth, Inevitable Wealth, by Nick Murray,

The Intelligent Investor by Benjamin Graham, and

Stocks For The Long Run by Jeremy Siegel.

None of these are controversial picks and only Simple Wealth Inevitable Wealth is not a perennial in this type of list. If you’re looking for classics on the importance of saving money and controlling spending as a path to wealth, the two that stand out are The Millionaire Next Door by Thomas Stanley, and George Clason’s The Richest Man In Babylon.

Please see related posts:

Stocks vs. Bonds – The Probabilistic Answer

Book Review: A Random Walk Down Wall Street, by Burton Malkiel

Book Review: Simple Wealth, Inevitable Wealth, by Nick Murray

Book Review: The Intelligent Investor by Benjamin Graham

Book Review: The Richest Man in Babylon by George Clason

Book Review: The Millionaire Next Door by Thomas Stanley

[1] Even if history does not repeat itself, it probably rhymes.

[2] Smith’s work was roundly attacked and discredited following the market crash in 1929, and the scars of that era prevented people from seeing that he was, in fact, correct. Siegel draws on his work and extends it.

[3] Note: I read the 1994 edition (since that’s what my library had) and I know Siegel has updated it five times since then with probably a lot of good new stuff. On the other hand, taking the long view, the messages can’t be all that different.

[4] This is probably the most dated portion of the 1994 edition I read, and I’m guessing the most updated in the 2014 Fifth Edition, since financial technology has evolved quite a bit in 20 years.

[5] For a person comfortable with risk and a 30-year investment horizon, Siegel says a 134% allocation to stocks is theoretical optimal. How does one do that? Leverage, of course. Ok, let’s just stop right there, put the leverage down, and nobody gets hurt.

Post read (1584) times.