The “Rent v. Buy” discussion offers endless opportunities for debate.

We can talk about the opportunity to buy a piece of the mythical ‘American Dream’ – on the path to acquiring key accessories like a white picket fence, 2.3 children, and a Viking stove.

We can talk about the extraordinary risks taken by mortgage borrowers borrowing to the maximum before 2008 and the devastating financial losses many suffered in the aftermath of that financial crisis.

We can talk about the pride of fixing up one’s own dwelling as an owner. Or just as easily, we can note the smug satisfaction of calling Bob the superintendent and ordering it done. Make it quick, Bob!

Some of these preferences derive from personal leisure time preferences, risk tolerance, or lingering Leave It To Beaver fantasies. I don’t have any comment on those factors.

I do have comments, however, on the financial implications of the Rent v. Buy debate.

Online calculators

You can find delightful Rent v Buy calculators online.

I prefer The New York Times’ calculator myself, but there are other great ones on various realtor’s sites as well as brokerage sites. Another site, BankRate.com walks you through a series of qualitative questions to determine suitability for home ownership versus renting. These are all fine and cool.

I do not recommend spending too much time with any of these online models, however, because ultimately the financial models depend on inputting assumptions about a bunch of unknowable future financial factors. Do you know what your income taxes and real estate taxes will look like five years into the future? Do you know the future rate of inflation, the rate of increase in rent, the insurance and repair costs of a home? I mean, if you had certainty and accurate insight into these things you’d be running a high frequency trading fund by now, not fiddling around with online rent v. buy calculators.

I’m in the ‘making things simple’ business, and I believe you only need to satisfy two conditions to make the move from rent to buy.

First thing: Do you have a steady, predictable income? If you do not, then home ownership is a terrible idea. It’s just too risky.

Second thing: Do you plan to stay in the same place for the next five years? If not, real estate values are too volatile to mess with, and the frictional costs of getting in and out of real estate ownership are too high – after factoring in brokerage, title, loan, and attorneys fees.

So that’s it: If you’ve got a steady income and plan to stay five years in the same place, then go for it.

Wait, I haven’t said this strongly enough.

Picture me for a moment like those commodity trading pits guys (who don’t really exist anymore) a phone in each ear and tie askew, hands gesticulating wildly and shouting “Buy! Buy! Buy!” into both phones simultaneously. That’s how strongly I feel about the financial advantages of home ownership, if you can satisfy my two conditions above.

In order of importance, here’s why home ownership offers powerful financial advantages.

Automatic Savings

I can’t prove this, but I’m convinced this is the most important financial reason to buy a home. Most of us have no extra money month-to-month, so the idea of putting money away for long–term investments is, let’s say, elusive. But when we own our home with a mortgage, we end up paying small chunks of principal in the ordinary course of paying for our shelter. Over 30 years many middle-class homeowners manage to sock away hundreds of thousands of dollars of wealth without much pain because it happens monthly, automatically, even sneakily.

Tax Advantages

Everybody talks about the mortgage interest tax deduction, which is fine, but not the most important tax advantage of home ownership. The most important tax advantage – by far – is that in most scenarios when you eventually sell your home, $250,000 of capital gains are tax free, or $500,000 for a married couple. No other financial asset offers that kind of tax-free growth in value. Not only that, but real estate taxes are deductible from federal income taxes, as are other mortgage expenses like ‘points.’ Home ownership is just a great big bundle of tax advantages, courtesy of your middle-class homeownership-pandering Congress. Thank you US Congress! We love you! Muah!

Inflation hedge

Hey gold bugs, you’ve got the wrong idea. Home ownership is an awesome inflation hedge, because you can reasonably expect the price of your home to go up in line with inflation. When you rent, inflation hurts. When you own, inflation helps. If you own a home, especially with a mortgage, you can be all, like, ”Inflation? Bring it on! I am hedged!”

Leverage

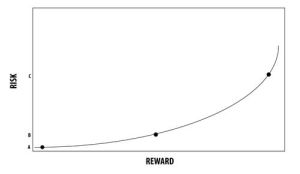

That’s finance-speak for buying more than you can actually afford, through borrowing. Of course being debt-free is a great idea that everyone should aspire to, but the leverage part of home ownership has long been a key part of middle-class wealth-building.

Outside of mortgages, lenders will never offer you 4-to-1 leverage, meaning the chance to buy a financial asset by only putting 20% upfront and paying off debt over time.

How does leverage work?

If you put down just 20% of the value of a thing, and then the thing goes up in value by 10%, with 4-to-1 leverage the value of your ownership in that thing increases by 50%. This is amazing! Obviously leverage (aka debt) is a double-edged sword and can lead to catastrophic losses if your thing goes down in value by 10% (or more!) But still. Leverage!

Small print disclaimer before my summary conclusion: I have not mentioned the issue of down payment (you need it!) and decent credit (you need it!) when deciding on Rent v. Buy. So there’s that to consider as well. But for now let’s focus on the simple message below.

Small print disclaimer before my summary conclusion: I have not mentioned the issue of down payment (you need it!) and decent credit (you need it!) when deciding on Rent v. Buy. So there’s that to consider as well. But for now let’s focus on the simple message below.

The four factors above make ownership awesome. If you have a steady income and five years in the same place, BUY!

Please see related posts:

Housing Part I – What we do when we own a home

Housing Part III – Big Opportunities

Please see related video on Rent v. Buy

Post read (2207) times.