Why is money today more valuable than money in the future? In this lecture to students at Trinity University (in San Antonio, TX) I review four reasons why in any real-world scenarios I can think of, a reasonable person would give me less than $100 today in order to receive $100 from me one year from now.

To dig into the math of compound interest, discounted cash flows, and interest rates (or yield) its useful to review the practical fact – employed in all banking, insurance, borrowing/lending, and investing activities – that money today is worth more than money tomorrow.

In order to not play hide-the-ball with this video, here are my four reasons for why money today is not equal, and is more valuable, than money in the future:

1. Expected inflation (aka expected loss of purchasing power in the future)

2. Expected return (holders of capital demand a positive return on capital)

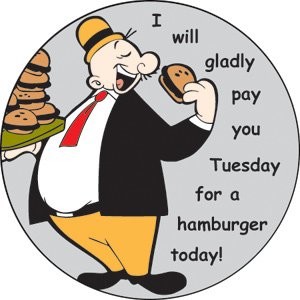

3. Risk of future payment (aka credit risk or counterparty risk)

4. Liquidity of capital provider (relative scarcity today raises value of money today for capital provider)

For all four of these reasons (and possibly more) holders of capital can demand a positive return, or interest rate, for the use of their capital. This justification for charging interest, or demanding a positive return on capital, or yield, is the foundation of every financial transaction.

Please see related posts:

Video: Compound Interest Formula – The Rainbow Bridge

Why doesn’t Compound Interest Math Get Taught?

Post read (7440) times.