Pete Kovac, a friend who worked for a quantitative trading firm, got in touch with me soon after Michael Lewis’s Flash Boys came out last Spring to let me know he thought the book had serious errors.

My friend became so alarmed at the Michael Lewis version of quant trading – which appears to have been quickly adopted by regulators and politicians – that he set out to write a response and correction to the flawed Lewis narrative.

What’s so interesting about Kovac’s response is that quant traders have generally shunned describing publically how they make money. As a result, they are at a huge disadvantage in telling the quantitative trading version of things when competing with a writer like Lewis. Yet, one of the weaknesses of Lewis’ book is that he appears to have had very little access to quant traders themselves. So how does a quant get his version of the truth out?

Kovac releases his book this week, and I’ve included an excerpt below.

To set up the excerpt – and for those who haven’t read Flash Boys yet – here’s a quick primer.

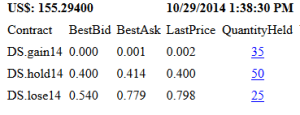

The premise of Flash Boys (reviewed here) is that a new set of quantitative (or algorithmic) firms emerged in the past decade that engage in an unfair technology race that allows them to front-run other investors. According to Lewis, the quant firms use a combination of:

- Paying exchanges for trading order flow to gain information milliseconds before other traders.

- Locating trading machines physically closer to central exchanges to get millisecond information advantages over other traders.

- Engaging in untraceable trading activity within a broker-sponsored ‘dark pool’ exchange to front-run slower traders.

- Sending rapid-fire trade inquiries and cancellations to exchanges or dark pools to manipulate market liquidity.

In addition, Lewis describes a plunky band of misfits led by Brad Katsuyama who cobble together an alternative stock exchange – The IEX – using old newspapers, string, and wadded up chewing gum to launch a better, fairer, slower exchange to keep out the quant trading baddies.

Kovac wrote his critique – excerpted below – to correct what he sees as the biggest errors of Lewis’ book.

Excerpt of Kovac’s Flash Boys Critique

I’ll link to the full book, available on Amazon, as soon as it gets posted.

Please see related book reviews:

Inside the Black Box, by Rishi Narang

Please also see related posts:

The Katsuyama Revolution Continues

Post read (2452) times.