My friend Pete Kovac got so peeved about Michael Lewis’ Flash Boys that he wrote a response, in the form of a book, called Flash Boys Not So Fast – An Insider’s Perspective On High Frequency Trading.

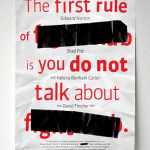

The highly unusual part about this book is that high frequency trading up until now has basically been like Fight Club, in so far as the first rule of high frequency trading is that nobody talks about high frequency trading.

The highly unusual part about this book is that high frequency trading up until now has basically been like Fight Club, in so far as the first rule of high frequency trading is that nobody talks about high frequency trading.

Well, here’s Pete actually talking (ok, writing) about it. He agrees with my objection to Flash Boys, which is that Lewis appears to have not gotten any access to actual real live high frequency traders, in the course of investigating his book. Which is kind of a problem.

Pete’s formal bio is as follows:

“Kovac was COO of the electronic market making firm EWT from 2004 to 2011, managing regulatory compliance, risk management, finance, trading operations, and portions of the technology teams. During his tenure, EWT grew to one of the largest market making firms in the U.S., trading hundreds of millions of shares daily, an, together with its affiliates traded in over 50 markets worldwide. Kovac has been a frequent commenter to the SEC on regulatory issues.“

And Pete’s informal description of his role:

“I am an industry insider, the kind of person who could have saved Lewis from making some really basic mistakes. I started programming trading strategies in 2003. After years in the trenches, I moved into management and ultimately became chief operating officer of my firm, EWT. I handled regulatory compliance, risk management, finance, trading operations, and a portion of the IT and software development teams – and I had to know every aspect of the stock market inside and out. By 2008, our company was one of the largest automated market-making firms in the U.S., trading hundreds of millions of shares of stock daily, and had expanded into many other asset classes domestically and internationally. I left it all three years ago when EWT was sold to Virtu Financial (in which, in the interest of full disclosure, I still retain a small stake).

Those eight years at EWT provided me with a front row seat to all the events described in Flash Boys, and much more. During that time, I shared my experience and perspective in discussions with regulators and lawmakers here and abroad, advocating for the continued improvement of the markets discussed in the book. Many of my comment letters on these topics are publicly available on the SEC website. Even though I no longer work in trading, I can still get answers from a diverse set of close sources when a truly new question arises.”

So – If that’s intrigued you – you can download the book here.

Please see related posts

An Excerpt of a Quant Trader’s Critique of Flash Boys

The Katsuyama Revolution Continues

Please see related book reviews:

Inside the Black Box, by Rishi Narang

Post read (1936) times.