A wise man wrote about investing: “performance may come and go, but costs are forever.”[1]

Let’s explore a bit how big these cost difference really become for your investment portfolio.

As a starting point, do you already have a sense for whether the cost differences between funds you may own are in the hundreds of dollars? Or maybe the thousands? Could they possibly be in the tens of thousands? Surely not more than that?[2]

(Here’s a sneak preview hint of the answer: Wall Street is very profitable.)

Differences over time

To illustrate cost differences, let’s pretend you are a 40 year-old with a $100,000 mutual fund investment that will earn 7 percent annual return in the market, over the next 30 years. I know, lots of assumptions that may or may not be true for you, but we have to start somewhere.

The first key thing to know is that the average actively managed mutual fund charges 0.8 percent as an annual management fee, while the average passively managed – or ‘indexed’ – mutual fund charges 0.14 percent per year, for a difference of 0.66 percent in fees, (this according to mutual fund giant Vanguard.)

Hundreds!

For a $100,000 investment, the cost difference in fees averages $660 per year.[3] So, I guess active management costs us hundreds of dollars per year, then.

Tens of thousands?

But wait. Annual management fee costs rise as your funds grows, so the annual fee differences grow as well. Using averages, you should expect to pay your mutual fund company $65,518 total in fees for an actively managed fund that returns 7 percent over a 30-year period, compared to $12,896 for a passively managed fund also growing at 7 percent.

Um, so you’re telling me the average cost difference between an active and a passive fund is $52,622 over 30 years? In the tens of thousands of dollars?

Yes, yes I am telling you that.

Hundreds of thousands!?

But just wait. Even that comparison underplays the differences in costs. Since you are attempting through your investments to grow your money on your money, the lost growth on the money you pay in fees each year actually drags down performance even more than it at first appears.

The difference in final performance, considering the compounding effects of fees paid out of your investments, leads to a $124,141 wealth difference at the end of 30 years.

Wait, what!? Yes, you noticed that. The all-in cost of your mutual fund may end up larger than your original investment.

Pick any assumptions

You could test a wide variety of assumptions and the differences will be dramatic, even if the final numbers vary.

Crank up the annual return assumptions, and the differences become even bigger. Crank up the number of years invested, and the differences become even bigger. Crank up the amount of money invested, and the differences become even bigger. Crank up the management fee of the actively managed fund to a very typical rate, rather than the average 0.8 percent, and the differences become even bigger.

Millions?!?

How about a $1 million stock portfolio, returning 10% over 40 years, paying 1 percent for active management instead of 0.14 percent for indexing? (By the way, these are not crazy assumptions for many people) The wealth difference at the end of forty years, making the simple choice about active versus passive investing, is $11,602,001.

In a related question, have you ever wondered how Wall Street got so big?

Active versus Passive

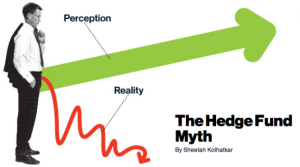

Now, clever readers will notice something I’ve not yet addressed in my comparison of low-cost versus high-cost mutual funds.

What if I adopt the assumption of the mutual fund industry itself – which is built on the idea that a good reason to pay more in fees is to get better performance? Meaning, if an actively managed fund can earn 8 percent per year instead of the 7 percent per year from an index fund, then my cost comparisons become irrelevant in the face of superior performance. Right?

Ok, that’s possible.

All you have to do, therefore, is be confident about two things:

- Active managers typically outperform passive managers.

- You, specifically, (or your investment advisor) have the skill to know, ahead of time, which active managers will outperform passive (aka index) funds over the next thirty years.

Unfortunately for the mutual fund industry’s underpinning assumption – these turn out to be absurd ideas most of the time, for most funds, and for most people.

I’ll start with assumption number one, about the consistency of outperformance of active managers over time. The quick answer is that about 3 percent of mutual funds that achieve top performance over any five year period also go on to achieve top performance in the following five year period. Sadly, the vast majority of actively managed funds underperform their benchmark over the long run. And the longer the run, the fewer the outperformers.

On assumption number two, whether you or your advisor can select the rare winner among active managers, I don’t know. I mean, who am I to say?

Ok fine, I’ll say it: You can’t, and you won’t.

[1] Reminds me of the politically incorrect joke from the 1980s about the difference between love and herpes.

[2] Please don’t call me Shirley.

[3] That’s $100,000 times 0.66 percent, but you already knew that.

Please see related posts:

The Simplest Investment Approach, ever, by Lars Kroijer

Lars Kroijer on having an ‘edge’

Post read (351) times.