I’ve heard zero public discussion of the effective nationalization of higher education lending over the last six years.

I’ve heard zero public discussion of the effective nationalization of higher education lending over the last six years.

In 2010, with the Great Recession crisis still fresh in our minds, amidst the passage of the Affordable Care Act (aka ACA, or Obamacare), the federal government all but eliminated the private sector student loan business and replaced it with federal funding by the US Department of Education.

While you were mistakenly panicking that President Obama would take away your guns during his administration (Side note: there’s ongoing evidence that he didn’t), the federal government quietly took over the student loan business from the private sector.

I have competing reactions to these developments with strong reasons for government involvement in higher education lending but also reasons for caution.

Student loan background stats

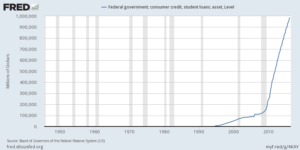

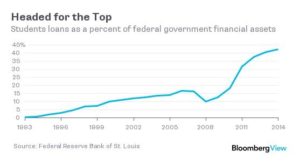

The amount of federal student loans owned by the United States federal government has reached more than $1.2 Trillion in the past year. I have a difficult time counting that high. Meanwhile, private student loans for higher education now account for only about 9 percent of the market.

Before 2010, the federal government subsidized or guaranteed many student loans, while a private-sector bank actually made the loan and carried it on its books.

Under the George HW Bush (#41) administration, the federal government jumped into the direct lending business as a pilot program, having previously (since the 1950s) mostly done subsidizing and guaranteeing of private lending. Since then, and in an accelerated way since 2010, private banks have become minor players, with the federal government dominating over 90 percent of higher education lending.

That $1.2 Trillion in federal student loans represents more than one third of all federal government assets.

If the US Department of Education were a private bank, it would be the fifth largest in the country based on student loan assets.

Payments from the US Education Department to collections firms – those dealing with defaults or slow-paying loans – reached approximately $1 billion in both 2014 and 2015.

Payments from the US Education Department to collections firms – those dealing with defaults or slow-paying loans – reached approximately $1 billion in both 2014 and 2015.

Good reasons for government involvement

I suppose societally we favor the subsidy and provision of post-secondary student loans for at least three reasons, having to do with equality of access, our national myth of upward mobility, and economic efficiency.

Equality of access means the belief that any student – regardless of what kind of family they were born into – should have a shot at higher education. Student loans make an attempt at equal opportunity possible. Government should tend to favor access more than the private sector.

The national myth of upward mobility is whatever version of the Horatio Alger story you endorse, the idea that we can – through study and hard work – improve our lot in life. Subsidized student loans would be an important leg up here, if you believe that story, and it makes sense we’d put money into our national myth.

Finally – and this one makes the most theoretical economic sense to me – we subsidize higher education because investments in human capital over, say, two decades, are just too long-term for individuals, or households, or the private sector to make. I mean by this the idea that higher education is analogous to basic science research. If you just left it to the ‘market,’ we’d get too little of it.

You sink all this money into developing kids’ brains upfront but without a payoff until two, three, or four decades later, and who’s got that kind of money? Societally we end up richer with highly educated people, so we shouldn’t leave it to the private sector to decide on the investment – because we’d end up with too little of it – is sort of the idea here.

Anyway, while these are strong cases for federal support for student loans, the recent takeover also provokes mixed feelings in me.

Despite acknowledging the advantages for the expansion of student lending, I think those should be weighed in a practical way against the problems that come from expanding government-run industries.

I’d posit at least three problems with the quiet federal takeover of college lending.

Government growth

I remain skeptical that governments are the best lenders to consumers and businesses. I’ve long been a skeptic of the outsized role of federal subsidies for mortgage lending and housing and by analogy I retain skepticism here.

Tuition inflation

Over the past 20 years, tuition and fees have risen on average from 179 percent (private universities) to 296 percent (In-state public universities), while consumer prices experienced 55 percent inflation over that time.

This trend began long before the effective nationalization of student loans, but has continued unabated. We should expect that with the federal government controlling the supply of student loans, the availability of student loan debt will tend to drive tuition-prices higher, just as it does the housing market.

But the next one is my biggest worry.

Potential for undue influence

I value independent-minded universities, for the same reason universities value tenure among their top faculty. But if I ran a College or University and I realized getting tuition payments depended entirely upon staying in the good graces of the US Department of Education (rather than private banking sources), it would dramatically influence my attitude toward the federal government. I don’t know of any particular undue pressure ever applied by the federal government, yet, but let’s just say we should expect universities to be much more compliant and responsive to Uncle Sam going forward than they were in the past. That’s not necessarily a good thing.

I think of this last point as the main reason I’m vaguely uneasy about the federal takeover of 90 percent of student loans. It’s kind of my Libertarian instinct I guess?

Thought experiment

Picture whichever Presidential candidate you loath – or just mistrust the most – winning this November. Now consider how that President could respond if universities seemed insufficiently – what’s the word – cooperative? Compliant?

Would those university administrators care to be reminded of where all their tuition funding is coming from? Would any of them like to have their student’s funding cut off by Uncle Sam?

Does that sound paranoid? This wouldn’t happen under good leadership, obviously, but doesn’t that make you a little bit nervous if, or when, we get worse leadership?

A version of this ran in the San Antonio Express News

Please see related posts:

Housing and Mortgage Subsidies – Are They Worth It?

Tuition Inflation – Really Scary Thoughts On College Savings

Post read (659) times.