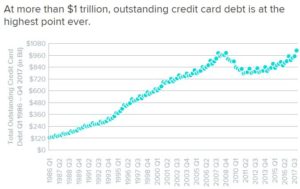

Congratulations, America, we did it! We finally broke the $1 trillion barrier for household credit card balances, according to a recent WalletHub Report.

This is a somewhat less impressive than Roger Bannister’s breaking of the 4-minute mile barrier in 1954 (RIP Sir Roger, B. March1929 — D. March 2018), or Sir Edmund Hillary and Nepalese sherpa Tenzing Norgay’s shared ascent of Mount Everest in 1953. Unlike those incredible human achievements, we all did this one together. $1 trillion! When you think of how far we’ve come, there’s practically nothing we can’t accomplish when we all work together!

I bet you did your part. The average household’s credit card balance hit $8,600 – also an all-time high according to WalletHub.

The previous high point in US credit card household debt was the final quarter of 2008, just at the moment in the Great Recession when it all came crashing down. I’m not linking those data points through causation, I’m just mentioning interesting facts you might want to know.

I’m teaching a personal finance course this semester at Trinity University in San Antonio, and in the course of the discussion recently on personal debt and credit scores, one student asked a very good question:

What’s the best credit card for a graduating college senior to get?

She hopes to have a decent income soon and she wanted to start building up credit. Should she shop for the miles or the points? Should she worry more about balance limits or the interest rate? And which banks offer the best terms? I could tell from the reaction in the room that many students wondered the same thing.

Well. A mild rant ensued.

My answer, which I’m only somewhat happy with, involved trying to debunk the myth of “smart consumers” who maximize their mileage points or rewards programs, or who shop for the lowest rates on credit cards.

A low or teaser interest rate should be totally irrelevant, I said, because you shouldn’t carry a balance month to month. Don’t focus on the interest rate. Focus only on not carrying a credit card balance.

And the points and miles? These, I further ranted, are all tricks. All of them. They are equivalent to the tickets you win from playing games at Chuck-E-Cheese that allow you to accumulate enough to buy a plastic ring at the end of the birthday party. (Sadly, now you know how I spend my Saturdays.)

Yes, I admitted, I also benefit from travel miles and rewards points, and I also have a variety of credit cards in my wallet. To the extent psychologically possible, however, I try to ignore the various tricks and distracting “points” I’m earning.

Another student in the back row raised his hand. What about a credit card that offered 10X the rewards points, he wanted to know. Surely that would be worthwhile?

No. Stop. You are being tricked. There is no savvy points-maximizing strategy I can endorse.

I understand there are websites dedicated to all the different supposedly clever strategies around this stuff. For that matter there are many websites dedicated to people who dress up their pet hedgehogs in funny outfits – does that mean it’s a worthwhile activity? (Apologies to my 8 year-old who is obsessed with hedgehogs and recently pointed out these websites to me.)

The point is this: the best personal financial behavior tries as hard as possible to ignore the credit card marketing of points and rewards. Savvy consumerism doesn’t involve trying to maximize these things. The credit card companies are not dummies. The marketing wings of the credit card companies know, in fact, that we are the dummies. The credit card companies will get back from us much more than they pay out with their Chuck-E-Cheese tokens.

Anyway, that was my rant at the time.

But I wasn’t totally happy with my answer.

I’ve thought about “what’s a good credit card?” more since then and want to add a few thoughts I didn’t say that day in class.

Because not only are there no good credit cards, the question itself feels wrong to me. It makes me cringe in all my sensitive finance places. I think of the question as the equivalent of asking a nutritionist what the best candy bars are for a college student. Or asking a substance abuse counselor what the very best narcotics would be for a graduating senior to take.

Because not only are there no good credit cards, the question itself feels wrong to me. It makes me cringe in all my sensitive finance places. I think of the question as the equivalent of asking a nutritionist what the best candy bars are for a college student. Or asking a substance abuse counselor what the very best narcotics would be for a graduating senior to take.

They are all bad choices. Some could be less bad than others, but it’s really not the product itself that could be intrinsically good, or advisable. No responsible financial advisor, nutritionist, or drug abuse counselor should endorse any of these things.

Instead, the responsible counselor can merely advice around moderating or eliminating behavior in the use of those bad products. Yes, we can imagine consumers of credit, candy, and cocaine as fine people, enhancing their life or engaging in guilty pleasures in responsible ways.

Personally, I use credit cards because they are incredibly convenient. Fortunately for my family, I don’t abuse them. Our household balance is not part of the $1 trillion American problem.

Personally, I use credit cards because they are incredibly convenient. Fortunately for my family, I don’t abuse them. Our household balance is not part of the $1 trillion American problem.

And yes, I have been known to abuse Reese’s Peanut Butter Cups, in those stupid King-Sized 4-paks. Just sitting there, taunting me in the checkout line at the grocery store. It’s terrible, I know, but preferable to cocaine. I won’t judge you if you won’t judge me.

But make no mistake: Debt is a drug. We’ve never been more addicted than we are now. And many of us desperately need help.

A version of this ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts:

Post read (318) times.