I am attempting to model good financial writer behavior by inserting some actual boring tax policy discussion into presidential politics. From what I can glean from media over the past year, the presidential race was declared an entirely policy-free zone. But we should care a lot about boring tax policies!

Now that Biden is heading to the Presidency 1 what the heck did he promise in terms of tax policy changes?

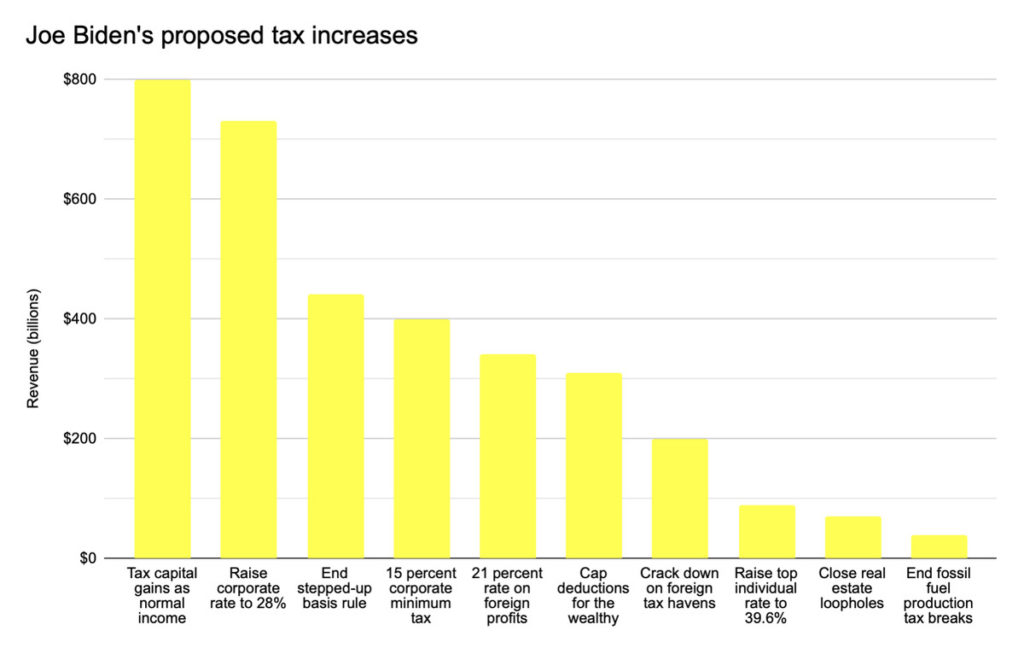

Biden’s proposals on two headline tax rates essentially indicate a rollback of marginal tax rates to Obama-era levels.

For individual taxpayers, Biden proposes a 39.6 percent top tax rate. That’s up from the current 37 percent. This represents a return to the top income tax rate in effect through 2017.

Biden also proposes a 28 percent corporate tax rate, an increase from the current 21 percent corporate tax rate. Still, 28 percent represents a lower corporate tax rate than the United States had on the books between 1994 and 2017.

Biden’s most common campaign slogan with respect to taxes was that people making less than $400,000 per year will not pay higher taxes. Obviously, by implication, he’s warning us (promising us?) that higher income folks will see a rise in their taxes. This rise comes most clearly from targeted changes that would affect the wealthy, and/or the more highly-compensated among us.

For individuals making more than $400,000 per year, Biden proposes a 12.4 percent payroll withholding tax specifically for Social Security. I think that’s mostly where Biden’s $400,000 claim comes from since it’s a new, and clear, tax hike.

More subtly, but probably more importantly, Biden proposes taxing capital gains more highly in certain cases. Taxes on money made from selling appreciated assets – capital gains – are potentially more important to wealthy folks than taxes on earned income. Biden’s plan would charge higher capital gains taxes for households that make more than $1 million per year.

Currently, capital gains tax rates are lower than earned income tax rates. Which, if you ask me, has a lot more to do with who funds political campaigns than it has to do with the moral or economic merits of taxing wealth at a lower rate than income, or any other justification for rewarding capital over labor. Biden’s proposal doesn’t upset that apple cart – this traditional tax-code preference for capital over labor. Rather, it says that if you make more than $1 million per year, you don’t get a tax break just because you make money on your wealth rather than on your labor. I’m probably wrong to think this but I feel like if you earn over a million dollars per year, you can survive (maybe, barely) paying a regular tax rate like the people who make a living through their labor. Call me a Socialist, whatever.

Also in the category of tax proposals applying to the few, but sadly not me: Biden has proposed that people worth between $50 million or more would pay a 2 percent wealth tax, rising to a 6 percent tax rate for those with a $1 billion net worth. This seems terribly unfair. Specifically, unfair in the sense that I wouldn’t get to pay that tax. I aspire to pay that tax some day. I want to be in a position to pay that tax. And, I will promise to not complain about it, when the time comes. You can hold my feet to the fire on that one.

Another Biden proposal affects folks who inherit wealth. This proposal is captured by the phrase “eliminating stepped-up basis,” and the meaning is that inherited assets would not continue to enjoy a massive tax break. Like the capital gains tax proposal, this is a targeted tax change that has huge implications for wealthy heirs as well as the folks who do estate planning. It has very few implications for non-wealthy people who do not inherit highly appreciated assets.

Finally, Biden has not specifically made estate tax proposals, but he did sign off on some Biden/Sanders “unity” principles in July 2020, including rolling back estate taxes to 2009 levels. Those 2009 estate tax levels were set by the Socialistic Bush/Cheney administration.

There are a few other detailed tax credits and exemptions, but that covers most of Biden’s big tax proposals.

Now, the Political Reality

After January 2021, there’s a strong chance that the Senate remains in Republican hands, making most of Biden’s tax proposals backburner issues.2

Sweeping tax reform is also not something I’ve noticed is a priority for Democrats. Between COVID emergency stimulus, health care plans, and a Green New Deal, tax reform isn’t really on-brand for the 2021 Democratic Party. Still, we should at least understand where the incoming President’s head is at, with respect to tax reform.

A version of this post ran in the San Antonio Express News.

Please see related posts:

Let’s have an adult conversation around taxes

Post read (160) times.

- Barring the unlikely success of Trump’s slow attempt at a coup. Which, I don’t know, might work. But I hope it doesn’t. ↩

- As of this writing two Georgia Senate run-off races will happen in January. Democratic candidates would have to win both to allow for a 50-50 split in the Senate (tie-broken by Vice President Kamala Harris). It feels like something as complex as comprehensive tax reform is unlikely to pass with this kind of squeaker of a vote majority, even in the unlikely event that Democrats win both races. ↩