Editor’s Note: This post ran in the San Antonio Express News in January 2022. I’ve been going through my archives and posting stuff here I forgot to post. I think this one holds up, so I wanted to have it preserved here.

In January, the month named for the 2-faced god Janus, we face backwards – reviewing all of the things we did not accomplish in the past year – and we face forward, making a plan for what will change in the new year.

Investing, too, requires a two-faced approach. We face backwards at the cold reality of cash-flows in order to assess the probability of failure. This is the basis of “fundamental” investing. We also face forward at future possibilities, hoping that our optimistic projections will come to pass. This is the basis of “growth” investing.

Both fundamental and growth approaches are valid – even necessary. They operate in a yin and yang of mutual dependence that allows an investor to survive and thrive in different environments. Rely too much on a fundamental approach and you’ll miss the new, new thing, as buggy whips give way to combustion engines and CD Walkmans give way to Spotify. Rely too much on what might possibly come to pass and you’ll buy castles in the sky that crumble at the next dose of recession, interest-rate hike or supply-side shock.

I don’t know about you, but the last year of investment markets felt completely unbalanced, even unhinged. The year 2021 was the most unfundamental investing year of my lifetime. Like, the whole monkey barrel was hope, optimism, and future projections. Some people seem to enjoy heavy castles-in-the-sky investing. Cool, I guess, but it makes me deeply uncomfortable. This Tinkerbell-based approach – everyone just collectively believing strongly enough in magic pixie dust – is just not my style. It’s utterly bewildering. What did you think?

Now it’s a new year so maybe you will be tempted to dip your toes into the new magic pixie dust as well?. Maybe you, too, could triple your money flipping NFTs? Somebody’s brother’s neighbor you heard about just made a million dollars last year in cryptocurrency, right? That guy doesn’t even work and now he’s worth millions? It’s amazing.

The problem with unfundamental investing is not so much that I’m going to do it. I am personally not at risk of putting any of my real (admittedly fiat) money into NFTs or crypto. The problem with deeply unfundamental investing – even for those of us not tempted to try it – is that it leads to that most inevitable of feelings, the Fear Of Missing Out. FOMO has always been a primary driver of the growth side of investing. There’s no escaping it. Nobody wants to be left behind while a whole paradigm emerges magically from the Metaverse.

My antidote to FOMO is to remind myself – and thereby remind you – that doing the most boring, unsexy, incredibly lame thing with your investment portfolio actually produced an amazing return in 2021. And in 2020. And in 2019.

In the face of crazy NFTs, crypto, meme stocks – all of which I consider extreme Tinkerbell-based investing – can we review some basic facts on how well boring old index-fund investing went?

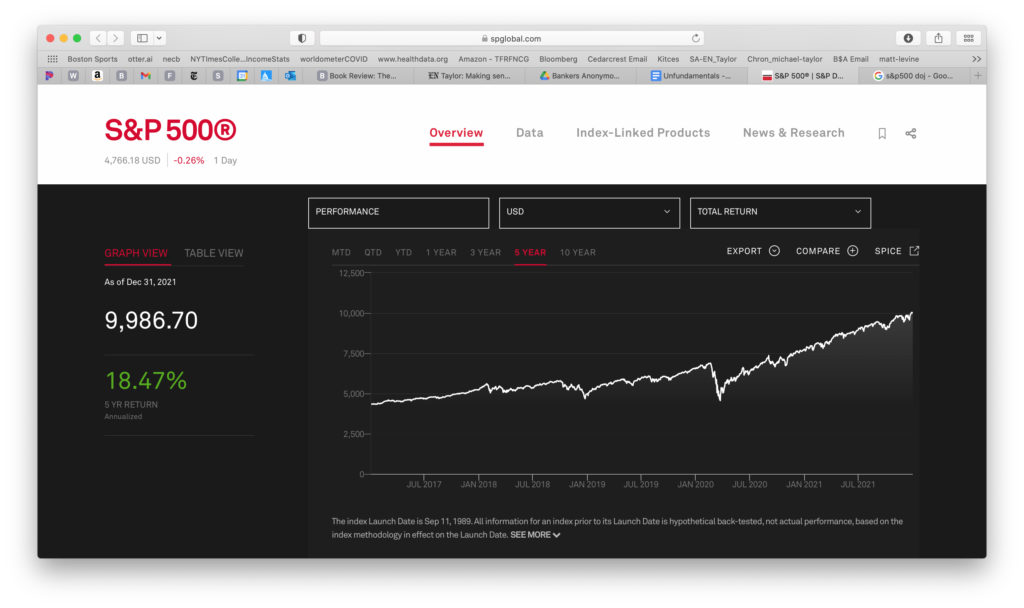

The annual total return on the S&P 500 index – a group of large stocks in the United States – in 2021, including dividend reinvestment, was 28.7 percent.

The 3 year return on that index has an annual rate of 26.1 percent.

The 5 year return on that same index was an annual rate of 18.5 percent.

I don’t know any other way to say this: Those results are freaking awesome.

The S&P 500 index continuously hit records throughout 2021. There are other major stock indices which registered higher or lower results, but the simple fact to remember is that doing the most boring, uncreative thing imaginable created blow-your-doors-off returns over the past 5 years. In the face of FOMO risk this is the most useful thing I can point out – how amazingly lucrative boring actually was.

You want to be a millionaire? If you could achieve last year’s S&P 500 index return for 10 years in a row (I know you can’t but just humor me on the thought experiment) you’d only need to start with $80,207 today.

I’m not saying 2021 stock market returns will be repeated in 2022. Or that the last 5 years say anything about the next 5 years. All I’m saying is that with a FOMO mindset, we might forget that the boring old U.S. stock market has been incredibly profitable in recent years, if you just bought and held. Zero Tinkerbell fairy dust was required.

And I also mean to point out in particular that if a 28.7 percent return over one year and 18.5 percent returns annually the last 5 years isn’t enough – I mean if you look at that recent past and say, “No, thanks, only crypto returns of 150 percent over 3 months can satisfy my need to get wealthy” – then I don’t know what to tell you. You may experience a very unsatisfying investment journey in the upcoming years. That’s just my guess.

With 2021 in the rearview mirror, and understanding that the future will not recreate the past, I have two concluding reminders. First, try to resist the Tinkerbell allure that has left us open-mouthed, gawking at the unfundamentals of fast speculative returns in pie-in-the-sky stuff. Second, doing the most incredibly boring thing, good old equity index investing, can have a powerful wealth-building effect on your net worth.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Making Sense of Financial Delusions – William Bernstein’s book and the year 2021

Post read (93) times.