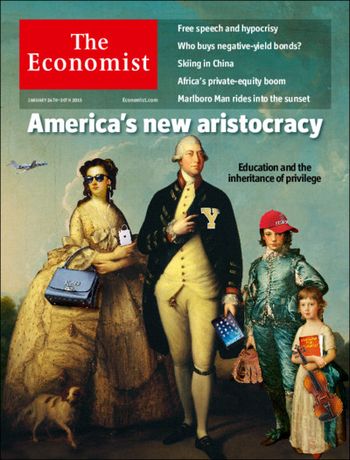

I went online recently to explore certain hard-core taboo subjects. I looked up words we don’t talk about in polite company. Certainly not in front of the children. Words like Trust Fund. Inheritance. Aristocracy.

I’m interested in the fact that when it comes to these concepts we don’t openly agree on what kind of society we want.

I’m interested in the fact that when it comes to these concepts we don’t openly agree on what kind of society we want.

For example, it’s clear to me from the major tax reform of December 2017 – which raised the estate tax exemption for a married couple to $22.36 million from the previous $11.18 million exemption – that we as a society want more trust fund kids. Trust fund kids are great. Surely, despite our political differences, that’s something we can all come together around as a nation?

Trust Fund

Speaking of which, in the past year I agreed to be a trustee for some family members. I received copies of their “Last Will and Testament” documents. I’m really a “backup” trustee, in the sense that I’m a trustee only in the unlikely circumstance that my relatives die young, while their children are quite young themselves.

A Wall Street Journal article on trust funds lists two big mistakes in estate planning:

- Choosing the wrong trustee.

- Giving money too early to young people.

Clearly my relatives did well picking a good trustee. But what is the right age of inheritance?

A main point of the written will on which I am named trustee is to ensure that if my relatives die early their two children do not receives big piles of money at too early an age. They stand to receive one-third of the inheritance upon reaching their 30thbirthdays, and the remaining two-thirds of their inheritance upon their 35thbirthdays. If their parents live a long and full life, the children will inherit money significantly older than that, there will be no restriction on their inheritance, and my own role becomes unnecessary, as we all hope it will be.

The idea here, according to my relative who asked me to be the trustee, is to delay as long possible the pile of money that her girls could inherit. I asked my relative how and why she chose those ages of inheritance. Why not 25? Or 45? Why not give it all to them?

Says the mother of the girls, “I just came up with those ages based on my own experience and my reading that most young people who inherit money lose it before long. We ran them past the attorney and he seemed to agree, so we went with it.” So not a lot of science, just recognizable common sense.

I hope you realize I was being sarcastic above about trust fund kids. My relatives – like most thoughtful people – don’t want to create trust fund babies either. They want their children to become hard-working adults whose professional lives are already in full swing – their mid-30s – before they get money that could demotivate them or encourage bad habits.

I hope you realize I was being sarcastic above about trust fund kids. My relatives – like most thoughtful people – don’t want to create trust fund babies either. They want their children to become hard-working adults whose professional lives are already in full swing – their mid-30s – before they get money that could demotivate them or encourage bad habits.

When you jump down the rabbit-hole of the trust fund sub-genre of personal finance literature you’ll find interesting articles like “Confessions of A Trust Fund Baby.”

If you’re in the further reading mood you could look up online “What is it like to be a trust fund baby?”

I’ll summarize for you a few of my findings based on this reading:

- Coke, booze, Ecstasy, and clubbing really is more plentiful among the trust fund set.

- It’s a lot easier to take certain poorly paid jobs, in certain expensive cities, if you have a trust fund.

- Money is a delightful safety net, but cannot confer meaning.

As a reader of Anthony Trollope and Jane Austen novels, I suppose I’ve long had this interest in trust fund kids. None of the main characters in these 19thCentury romances actually works for a living. The only question is how much annual income they may each depend on without working, and what suitable romantic matches may be made to help or hinder their continuing in the style to which they’ve become accustomed. This was all discussed in the 19thCentury without shame and without a sense that being a trust fund kid implied you were a wastrel. In fact, not working for a living was the key sign that you were a worthy person, a gentleman or a gentlewoman.

As a reader of Anthony Trollope and Jane Austen novels, I suppose I’ve long had this interest in trust fund kids. None of the main characters in these 19thCentury romances actually works for a living. The only question is how much annual income they may each depend on without working, and what suitable romantic matches may be made to help or hinder their continuing in the style to which they’ve become accustomed. This was all discussed in the 19thCentury without shame and without a sense that being a trust fund kid implied you were a wastrel. In fact, not working for a living was the key sign that you were a worthy person, a gentleman or a gentlewoman.

In the 20thand 21stCentury by contrast – and in contrast to my sarcastic comments above – we mostly carry a combination of worry about and contempt for trust fund kids. That’s not necessarily fair to the kids – they didn’t choose to inherit the money. But I think it’s interesting that our collective attitude is at odds with the direction of estate tax legislation.

Estate Tax Changes

The tax-free inheritance number has climbed dramatically since 2000. When President George W. Bush came into office, children of wealthy parents could inherit up to $1.35 million tax free. The estate tax – the tax imposed on amounts above that exclusion – stood at 55 percent.

Under Bush, the exemption number began to climb steadily year by year to $4 million, while the tax rate fell to 45 percent. During the Obama era, the tax exemption jumped further and then climbed annually to $10.86 million. Meanwhile, the tax rate dropped to 40 percent. Now with the 2017 reform, lucky heirs can inherit from their parents up to $22.36 million, tax free.

Under Bush, the exemption number began to climb steadily year by year to $4 million, while the tax rate fell to 45 percent. During the Obama era, the tax exemption jumped further and then climbed annually to $10.86 million. Meanwhile, the tax rate dropped to 40 percent. Now with the 2017 reform, lucky heirs can inherit from their parents up to $22.36 million, tax free.

Our tax system is increasingly designed to return us to the 19thCentury, even if the way we think about wealth concentration and inheritance remains rooted in the 20thCentury. As a country it feels like we have this weirdly bipolar and contradictory attitude toward trust fund kids.

I think we should just admit we prefer an aristocracy. The plain fact is we’ve steadily reformed our tax laws throughout the 21stCentury so that we can have more of it.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Inequality in America – The Video

Book Review: The Upside of Inequality

Post read (660) times.