Will the Red Sox win the World Series this year? What are their chances?

Will the Red Sox win the World Series this year? What are their chances?

What are their chances of going all the way, if they win their first game of the playoffs this Friday?

Aha! I have a chance to apply Bayesian probability theory!

I recently reviewed Nate Silver’s excellent The Signal and The Noise: Why So Many Predictions Fail – But Some Don’t , which at its core, advocates we adopt Bayesian probability methods for forecasting complex events. Like Red Sox World Series championships.

Nate Silver’s Big Idea

Silver’s big idea is for us to move away from “I have the explanation and I know what’s going to happen,” to a different way of understanding the world characterized by “I can articulate a range of outcomes and attach meaningful probabilities to the possible outcomes.”

Bayesian probability

Bayes’ theory, Silver explains, helps us come up with the most accurate probability of some event occurring. Fortunately, it’s not too complicated.

The Red Sox, of course, defy all probabilities

As we approach the MLB playoffs I’m fully aware of the irony of applying rational Bayesian probability to something as totally irrational, magical, and unlikely as Red Sox playoff outcomes.

My childhood and young adulthood consisted of them repeatedly snatching defeat from the jaws of victory. Both the Game Six World Series loss in 1986 to the Mets and the 2003 ALCS loss to the Yankees[1] defied all semblance of probability – we didn’t need a mathematical theorem to tell us that.

At the time, all we knew was that God personally intervened in baseball outcomes and that she enjoyed torturing us. And we hoped that God had plans for our redemption, some day.

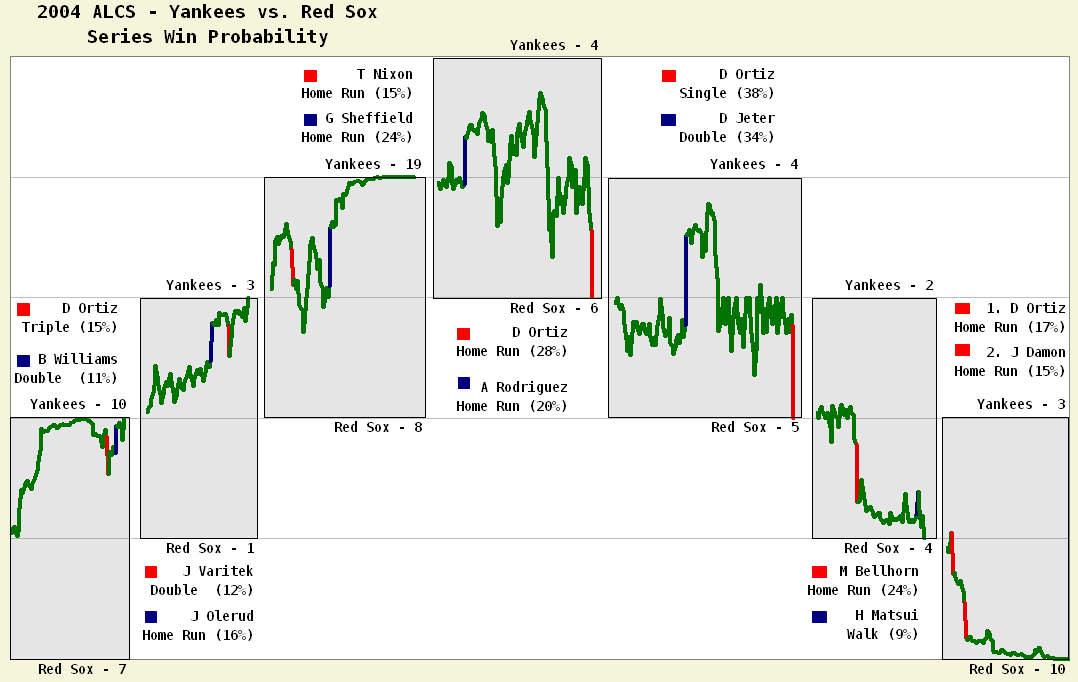

We know now that, like the biblical story of Job, Red Sox Nation suffered for a reason. We now own the Greatest Sports Victory of All Time, coming back impossibly from devastating losses in the first 3 ALCS games in 2004 to vanquish the Yankees and sweep the Cardinals.[2] No sports victory has ever been as sweet as that. It was all so improbable. No math could ever explain that magic.

And yet, I insist we try to learn Bayesian Probability today

Fine then.

To use it, we need to define three known (or assumed) variables, in order to come up with a fourth, unknown variable, which is the thing we want to know, the probability of an event.

The known or assumed variables will be:

- X = an initial estimate of the likelihood of an event. This is called a ‘prior’ since it’s our best guess of some probability prior to further investigation. Before the playoffs even begin, how likely are the Red Sox to become World Series Champions?

- Y = The probability that if some condition is met, the event will happen. In other words, how probable is it that a team that won the World Series had originally won their first game of the playoffs?

- Z = The probability that if that same condition is met, the event will not happen. For a team that did not win the World Series, how probable is it that they won their first game of the playoffs?

The unknown variable, what we’re trying to determine, is our closest approximation of the probability of the event happening.

4. I’ll call that unknown variable V. What is the probability of the Red Sox winning the World Series, if they win their first game on Friday?

The math formula of Bayes’ theorem, using these four variables, is:

V = (X*Y)/(X*Y + Z(1-X))

I understand that formula makes no sense in the abstract, so that’s why we’ll illustrate it with the Red Sox.

We need an example using numbers, please

Since it’s that time of year, I’ll ask the key question on everyone’s mind right now:

If they win on Friday, October 4th – their first game of the playoffs, will the Boston Red Sox go all the way on to win the World Series?

We can now define variables and assign probabilites

The variable V (This is the unknown what we’re trying to solve for)

V is the probability that the Red Sox win the World Series this year, if they win their first game of the playoffs.

Variable X, our prior

I will make our prior –the initial estimate for the Red Sox winning the World Series – 15%. If all 8 playoff teams had an equal chance of winning the World Series my prior would be 12.5%, the percent equivalent of 1 divided by 8. But given that the Sox had the best record in baseball this year – and they have studs like Big Papi and Pedroia – I have to boost their prior to 15%.

Variable Y, the conditional probability that the hypothesis is true

One of the requirements for using Bayesian probability theory is that we insert a conditional probability. We can simply express this hypothesis as “If this happens, this other thing is made more likely.”

In our example I’ll make the non-crazy hypothesis that there is some positive causal relationship between teams winning their first game of the playoffs and teams that eventually win the entire World Series.

Let’s assume we know, from historical data,[3] that teams that won the World Series had previously won their first game of the playoffs 58% of the time. That’s our variable Y.

Variable Z, the false hypothesis variable

The false hypothesis variable in this example would be made from the 7 of 8 teams that historically begin the playoffs but do not go on to win the World Series. Of these non-champions, what is the probability they won their first game? I’ll estimate this at 45%[4]

Putting it all together

Using Bayes Theorem, we can now revise our estimate of the Red Sox winning the World Series, after the first playoff game has been played.

If the Red Sox win on October 4th, we can plug in variables X, Y and Z to determine the new probability of a glorious Red Sox World Series victory, variable V.

Remember: V = X*Y / (X*Y + Z*(1-X))

Plugging in our known and assumed probabilities, we get the

following math:

V = (15% * 58%) / ((15% * 58%) + (45%*(100%-15%)))

Solving that in an Excel Spreadsheet we get

V = 18.5%

Summed up, if the Red Sox win their first game Friday[5], we would revise our probability of them winning the World Series up to 18.5% from 15%.

Intuitively, this makes some sense. There should be only a modest increase in the probability of a World Series championship after one game.

There’s a small positive correlation between winning the first game in the playoffs and eventually winning the World Series.

But even if it’s a blowout one way or another, let’s not get carried away. The chances of them going all the way is only up to 18.5%.

Anchoring effect of priors

We should note, and Silver emphasizes, that the anchoring effect of priors greatly influences our updated probabilities. In plainer English, our starting point for how we think the Red Sox are likely to do limits our ending point.

If we start with a prior that the Red Sox only have a 5% chance of winning the World Series, then their chances of winning the championship only jump to 6.3% after taking the first game, using my same assumed inputs.

Again using the same assumptions, if the Red Sox were 75% favorites to win it all, then a first game victory pushes them up to 79.5% favorites using the Bayesian Theorem.

Next Steps

If we want to follow the rest of the Red Sox playoff outcomes probabilistically, we’d take our revised prior – let’s say 18.5% after Game One – and come up with updated probabilities for variables Y and Z for Game Two. To use new Y and Z variables effectively we would need new historical data to determine the conditional probability of a World Series victory based on Game Two results.

Continued iteration

Nate Silver would advocate applying this constant iteration, revising our probabilities and priors as new information arrives, for a wide range of complex phenomenon that defy prediction. Will Mike Napoli’s beard change weather patterns inside Fenway? Is it not Nate Silver, but rather Big Papi who is the witch? Will super-agent Scott Boras release a karma-bomb press release on another client like he did with A-Rod during the 2007 World Series, effectively marking the beginning of the end for A-Rod? The probabilities change as the events unfurl.

Or not

Or conversely, we could just ignore all math, attach ourselves to one big idea, and never let go.

Because unrevised big beliefs, like sports fandom, do have their attractions.

Please see related post Book Review of The Signal and the Noise by Nate Silver

[1] Fie on you New York! Shaking my fist. Arggh!

[2] Incidentally, that 53 minute 30-for30 video of “the Greatest Sports Victory of All Time” I linked to on Youtube is totally awesome. Gives me the chils.

[3] I’m not a baseball stats geek with easy access to this kind of data, so I’m just making up numbers for the sake of illustration.

[4] Again, a stats geek could come up with the correct historical data to suggest a more accurate probability for the false hypothesis, but just work with me here a little bit on my completely made up numbers.

[5] And of course if my numbers were based on real data, rather than just picked out of the clear blue sky.

Post read (12366) times.