You’ve been writing me a lot lately, wondering about bitcoin. What is this technology? What is it used for? Should you get involved?

But also, what is the right price for bitcoin? Is it a buy or a sell here? As of this writing, a bitcoin costs roughly $50,000, up from $10,000 a year ago. Could it go to $200,000? That’s only 200% up from now. It’s gone up 500% in the past year. So sure, why not? $200,000 sounds great.

That’s,,,not a prediction.

What do I think is the fundamental right price for bitcoin? I’d say, roughly, zero? I truly think zero is the fundamental correct price. But it could take a while to get there.

Now, blockchain – the innovative technology of which bitcoin is the best known example – may have real uses. I’m open to that idea. Blockchain allows for anonymous, distributed transactions which can be verified between parties that neither know nor trust each other. Theoretically, blockchain obviates the need for government regulation or third-party verification.

Applied to money, bitcoin – using blockchain technology – theoretically allows us to remove transactions from the purview or limitations of existing financial infrastructure.

Dollars, the theory goes, involve pesky government issuers, unreliable central banks, and the meddling institutions of the existing global finance system. To its proponents bitcoin – using blockchain technology – is like money unshackled by politics, regulators, and borders.

To be clear. I totally disagree with the need for unshackling. I think dollars are awesome. I even buy stuff and services with them! I’ve honestly never felt limited by dollars, except obviously by the amount of them that I control at any given time. By contrast, I believe bitcoins are – at their essence – useless. A useless fiction, and therefore a fraud. I prefer my fictions to be useful.

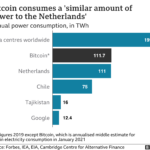

What is the real-world use of bitcoin? Bitcoin is not a useful store of value in the way that dollars are. Anything that can soar 500 percent in the past year – as Bitcoin has – can also drop 80 percent the following year. Or the following month. That makes it entirely inappropriate for “storing value.”

Could bitcoin be delightful as a pure gamble, like buying a lottery ticket? Sure. But no sensible person advocates lottery tickets as a store of value.

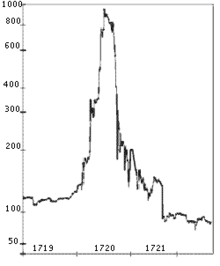

The South Sea Company was created by charter in 1711 with a mandate to engage in an implausible business, in a far off place, that none of its British investors had ever seen. It was just exotic and mysterious enough to capture the whiff and elan of possibly unlimited wealth. It enjoyed the imprimatur of the government of England, and for a time legitimately traded in English government bonds. Shares began at 100 British pounds, but reached 1,000 pounds a decade later. Fortunes were destroyed shortly thereafter, when the laws of financial gravity returned. We return to this cautionary financial story over and over because – while no two bubbles are alike – history does rhyme.

Bitcoin has all the makings of collective financial madness. Magical thinking! A difficult-to-grasp mysterious technology! Breathless media coverage of its ever-increasing price! Celebrities who might be buying it!

Bitcoin’s only plausible real-world use cases – as a medium of exchange rather than a speculation – are tax evasion, foreign-exchange-control evasion, drug dealing, prostitution, child-pornography, assassinations, arms-dealing, illegal gambling, and ransomware for computer hackers. As I have yet to engage in any of these activities, I have yet to find an actual use for bitcoin in my own life. But your mileage may differ, no judgment.

Incidentally, bitcoin is probably not even anonymous. One of the features of the blockchain is that all transactions are infinitely traceable and reproducible. That’s the plausible key to blockchain technology’s usefulness in the future – that all transactions and counterparts create a permanent record, visible to all counterparts.

But that feature of permanence undermines anonymity. A blockchain-sophisticated FBI should be able to see exactly who sold you bitcoin, and who in turn you sold bitcoin to. Your drug deal or tax evasion with bitcoin was not as anonymous as you thought it was after all! Haven’t you ever watched movies? This is neither business nor legal advice, but do you know what is anonymous, instead? A suitcase full of unmarked, non-sequential dollar bills.

Should you take my word for it on bitcoin? I can only warn you about my similar strong feelings in the past and how that worked out.

In the one and only market call I have ever made in this space in 7.5 years, I said Tesla was a terrible stock in 2015.

It promptly quadrupled in value. So I reiterated my hatred for that stock’s price in early 2020.

My bold call clearly triggered the value of that stock to septuple over this past year. You’re welcome.

I just mention this to say, you should probably speculate in the opposite direction of whatever I advocate, including, especially, about things like bitcoin. Bitcoin is far, far, stupider than Tesla shares will ever be. Naturally, Tesla announced last month that it had speculated with its corporate cash by acquiring $1.5 billion in bitcoin. Because LOLs. And YOLO. And FOMO.

Tesla CEO Elon Musk’s explanation for this speculation: “Bitcoin is almost as bs as fiat money. The key word is ‘almost’.”

[Ah, yes, such wisdom! What mysterious sagacity from 2021’s newest richest man in the world! Take all my money, please, you carnival-barking promoter of fictions!]

Never underestimate the power of greed and magical thinking to keep things irrational longer than you can stay solvent. Welcome to the monkey house.

Cryptocurrency enthusiasts like to point out that traditional “fiat” money like dollars, unmoored from a metallic base like silver or gold, is based on a collective fiction. In that sense, would-be sophisticates (and Musk) argue, the collective fiction of bitcoin is no worse than dollars.

Gold is also a collective fiction, albeit one a few thousand years old. Shells have made for a collective fiction in the past. The rai stones of Micronesia were a collective fiction. What even is money?

US dollars are also a collective fiction, except for the true fact that my government demands, and accepts, dollars for taxes. As far as I can tell, this is the basis for fundamental value in a currency. What my government accepts in taxes.

A convenient currency is more useful than barter. My local, state and federal governments do not currently accept extremely well-reasoned and delightfully funny finance writing as a means of discharging my tax obligations. I need to first convert finance columns to dollars, which my government then does accept.

When President Elon Musk declares in 2028 that we can and must make tax payments in bitcoin, then – and only then – will I agree that bitcoin has any fundamental value. It may well go to $200,000 (and beyond!) for all I know in the meantime. Unless and until Musk runs for President, I expect a zero value future for this particular collective fiction.

A version of this post ran in the San Antonio Express News.

Please see related posts:

Tesla is awful (January 2020 edition)

Tesla is not going to make it (2015 edition)

Hater’s Guide To Tesla (August 2020)

Bitcoin, Blockchain, and Bullocks

Post read (370) times.