So, anyway, how are finances for the State of Texas going these days?

[Editor’s Note…this post ran in the newspaper in the beginning of July 2020]

Pretty well, thanks for asking.

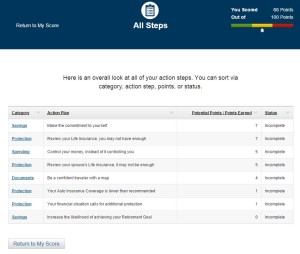

If you were to whiteboard the best financial practices for a big state, you would want three things. First, you would want transparency, both for officials making decisions as well as for citizens paying taxes. Next, you would want a conservative match balance between expected revenues and expected spending. Finally, you would want to ensure those revenues stayed strong and steady throughout an economic cycle.

In Texas, we’ve actually got significant amounts of financial transparency, which I’ll describe below. We’ve also got a conservatively-matched balance sheet, for specific reasons worth remembering.

Unfortunately, with the COVID-recession, there’s a lot to worry about when it comes to ongoing revenues. But, as Meat Loaf used to sing, two out of three ain’t bad.

Actually, that last statement is a bit exaggerated for the purposes of making a late ‘70s rock reference, so let me qualify a bit. I expected to find financial devastation at the state level, but instead found merely areas of concern.

Let’s start with the transparency part. The State Comptroller’s office supports a website all you Texas taxpayers should know about, called the State Revenue and Expenses Dashboard. This lets you create color-coded visualizations of all state revenues and expenses from 2011 to 2020. The “picture is worth 1,000 words” idea is that we can intuit changes over time, and relative sizes of fiscal categories, by building with and working with a visual dashboard that shows exactly what categories we want it to. The tool also lets you download data into a spreadsheet for further nerdy fun. Which I have done. And, oddly enough, enjoyed.

Some initial insights you can get from the Comptroller’s visualization tool.

- Transfers from the federal government are the largest single source of state revenue. (Sorry for you folks who believe in the sovereignty and self-sufficiency of the state.)

- The biggest source of locally-derived revenue is retail sales taxes, at 57 percent of taxes in 2019, and 26 percent of all state revenue. This means state revenues will be impacted by recessions, like this one.

- Oil extraction tax and gas extraction tax revenue is smaller than I expected, at about 3 percent and 1 percent of all state revenue, respectively.

A related page on the Comptroller’s website, the “Monthly State Revenue Watch” shows state taxes and other revenue sources updated monthly.

I know this is updated in real time because I checked it on July 1st, and the June 2020 numbers were already inputted. Impressive! So here is where we can get an idea of how well or how badly things are going in 2020.

Texas runs on a September 1st to August 31st fiscal year, meaning we have two months left in the year. Which further means we already know ten of the twelve months’ worth of numbers, to see any shortfalls versus budget projections.

If you were a worrying type person, you would ask questions like how badly the retail recession, and oil and gas industry disruptions, plus drops in hotel occupancy and car sales and car rentals might wreck state budget projections.

Tax revenue is down, it’s true. But it has not fallen off a cliff. Yet. Retail sales taxes are the largest single tax source, at 57 percent of all taxes. Collections through June are up slightly from 2019, although on track to fall short of the budget by about $2 billion of the projected $35.6 billion, on a total tax revenue base projection of $61 billion.

Again, because we can see ten of the twelve months of the year already, we can see from the transparency website that revenues will fall short by approximately $2 billion in franchise taxes and maybe $1 billion in a combination of oil and gas taxes, with smaller effects in other areas.

While this is not perfect and possibly a bit frightening, transfers from the federal government are already $4 billion above budget, with two months to go. So we could imagine this will roughly balance out this fiscal year ending in August.

I’m going through this partly because it is interesting on its own, but also partly to point out that the online transparency tools of the Texas state government are kind of awesome.

Now a word about the fiscally conservative setup of state finances in Texas.

Texas sets its state budgets two years in advance. Future state government spending depends upon a Comptroller estimate – known officially as the Biennial Revenue Estimate (BRE). This is due at the next legislative session in 2021. Unlike the federal government, Texas is highly constrained from borrowing at the state level.

The Comptroller, by constitutional mandate, must sign an oath to certify that the BRE contains accurate revenue forecasts for the next two years. The next legislature must, again by constitutional mandate, produce a spending plan that does not exceed expected revenues in the BRE.

Spare a moment to imagine the difficulty for the Comptroller of signing this next BRE. Like, there are so many different possible economic scenarios in 2021 as a result of the COVID pandemic.

Financial forecasting is extremely challenging right now. The chief financial officer of any given company must be pulling her hair out trying to estimate future revenue, but at least a private company can kind of wing it on future projections, and then borrow as needed, if things go awry. The Texas Comptroller may not wing it. And there are huge constraints on borrowing. The result has been conservative fiscal state management, which is good. The result in the future – I fear and expect – is a pretty austere two-year revenue projection and therefore spending plan beginning in 2021. This won’t be fun.

Between a pandemic, a recession, and specific oil and gas industry woes – not to mention the 17-year locusts and murder hornets surely set to arrive any moment now – I had expected worse financial numbers for Texas. Can we be blamed for flinching into a reflexive crouch of endless worry in 2020? With strong transparency and a fiscally conservative set-up, I feel a bit better about Texas, Inc, having seen the state’s transparency tools.

It’s safe to expect budgeting next year will be tougher than this year.

A version of this ran in the San Antonio Express News.

Please see related posts

Post read (214) times.