A version of this post appeared in the San Antonio Express News.

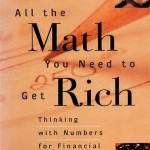

Nobody ever told me this, but I’ve always assumed that a first rule of writing is to never – ever – try to teach math through blog posts.

But I learned writing through blogging on the interwebs where a first rule of everything – always – is to involve kittens.

Today I would like to teach the compound interest math formula using the story of the feral kittens in my backyard.

Compound interest is the most important, most powerful, and never-taught financial concept in the universe. Compound interest is also how middle-class people can get rich slowly and inevitably, over a lifetime of ordinary earnings.

Please bow your heads with me. Forgive us, editors and readers for the math we are about to learn. Also, hey look, kittens!

Start with just a few kittens

When you start with a small number of feral cats – as I did in my backyard recently, and then neglect to ‘fix’ them right away – pretty soon the magical compounding power of the universe goes to work.

It feels like one day I noticed a couple of stray cats, then I blinked and went out for a cup of coffee, and suddenly my entire yard was overrun with the things.

How does this happen?

Just ignore their gawdawful screeches at 3am, and boom! 2 months later, you’ve got more kittens.

Mathematically, I can tell you precisely how it happens, using the “compound growth of kittens” formula. It’s a matter of gestation periods which I’ll call “N”, and a growth rate per gestation period, or “Y.”

Using the compound growth formula in practice

I start with two kittens.

(Important note: they must be different genders for the math to work. I’ll spare you the science behind that assumption. Just trust me on this point.)

Let’s say we know that kittens multiply at a rate of 20% per gestation period. And let’s say I wait three years – that’s 18 gestation periods, since cat pregnancy lasts 2 months.

(By the way, all you animal experts and cat-lovers out there who have their claws out to correct me on these assumptions, please recognize: This is all a feline metaphor and not guaranteed to be biologically accurate. Thank you.)

So like I said, my N is 18, and my Y is 20%.

With those assumptions, I can tell you precisely how many future kittens we’ll have, using the compound Kitten Growth Formula.

Here’s the math formula:

The future number of feral cats equals “1+Y,” raised to the power of N gestation periods, all multiplied by the original number of cats.

For algebraically-inclined folks, we would write this kitten-growth formula “Future Number of Kittens equals Original Kittens * (1+Y)^N.”

Plugging my assumptions into the formula:

The future number of feral kittens I can expect in three years (all else being equal)[1] must be (1+20%)^18, multiplied by my original 2 kittens.[2]

So, my compound kitten formula tells me that at the end of 3 years I can expect to have 53 cats. Absolutely swarming all over my backyard! Excuse me while I sneeze just thinking about it.

All of you readers following my math so far (seriously, both of you!) should try that out with a spreadsheet. When you change the percent kitten growth rate Y, or the number of gestation (compounding) periods N, you can see how the future number of kittens changes.

For example, if you start with four “Original Kittens,” and they grow at a rate of 25% per gestation period (that’s Y), and you neglect them for 5 years (so N=30 two-month gestation periods) then you can expect 3,231 kittens in your backyard. Roawrrr!

What about money?

Ok, back to money.

This compound growth formula is the key to understanding the importance of long-term savings and investment.

Allow me a few quick mathematical statements that you can prove to yourself on the spreadsheet you’ve taken out, using the compound interest formula.

Remember, your Future Money is just going to be “1+Y,” raised to the power of N, multiplied by your Original Amount of Money.

Hey, that’s weird, it works just like cats!

So, if you are 25 years old, and if you have $5,000, and if you can earn 7% on your money for the next 50 years (I understand, a lot of “ifs” but bear with me on the math part, because this can change your life for the better) you will have $147,285 in your account when you are 75.

Without you doing anything to your money, just neglecting it like a feral cat.[3] And $5,000 is just one years’ worth of contributions. Imagine making multiple years of retirement contributions when you are in your 20s.

If you buy a $200,000 house, experience 3% home-value inflation and live in that house for 40 years before selling, your house will be worth $652,407 when you sell.

Partly I’m mentioning these things because they illustrate, mathematically, how middle class people can build wealth slowly and inevitably.

More than partly, I’m hoping readers will be inspired to open up a spreadsheet and learn to use this formula to estimate the future value of their money. Or their future number of backyard feral cats, if they prefer.

In real life, since you asked, I noticed a couple of feral cats in my backyard last Spring. By this Winter, we had eight. A neighbor with great cat-catching & fixing skills (Shout out to Cannoli Fund!) caught and fixed all eight for us. Thank goodness for my neighbor because that cat growth curve was about to hit the stratosphere.

[1] As an economist would say. Although an economist would insist on say it pretentiously in Latin, with the exact same number of syllables, thus saving no time at all, but giving the illusion of fanciness: “ceteris paribus”)

[2] By the way, always use a spreadsheet when using compound growth formulas. Don’t simply try this with your catculator. Ahahaha! Catculator! I’ll be here all week folks. Don’t forget to tip your server. And try the fish.

[3] Picture your money, multiplying itself at 3am, while you (try to) sleep. Strangely, dreaming about Anne Hathaway in the last Batman movie.

Please see related post:

Compound Interest, Blood, Lust and Vampires – guest post by The Banker’s Wife

Rapunzel and Compound Interest

College Savings and Compound Interest

Post read (1671) times.