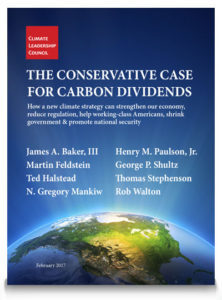

Earlier this month, a blue ribbon panel of US statesmen released “The Conservative Case for Carbon Dividends,” as a way to address climate change, reduce US regulations, and to provide additional funds for working-class people.

Earlier this month, a blue ribbon panel of US statesmen released “The Conservative Case for Carbon Dividends,” as a way to address climate change, reduce US regulations, and to provide additional funds for working-class people.

The first interesting thing about the proposal is to note the resumes of the authors, each of whom boasts serious conservative policy bonafides.

Harvard economist Martin Feldstein, Ronald Reagan’s Chairman of the Council of Economic Advisors, joined with Harvard economist Gregory Mankiw, who held the same post under George W. Bush. Hank Paulson, Treasury Secretary under W, joined with Secretaries of State James Baker (under W) and George Shultz (under Reagan). To round out the conservative business credentials, Thomas Stephenson a partner at Sequoia Capital and Rob Walton, the former Chairman of Walmart, respectively, also authored the proposal.

The proposal is bold, conservative, and has a little something for everyone.

First, something for you climate-change people.

If you’re concerned about the melting ice cap, rising sea levels, and irreversible damage worldwide, the proposal would tax carbon-emitting industries at a starting rate of $40 per ton at the point of production – such as a refinery, a coal mine, or a port. The obvious economic incentive here would be to reduce the production of carbon emissions. In addition, taxes on carbon would ratchet upward over time.

“The idea for a tax on carbon dioxide emissions from industry has been on the back-burner for a long time among climate scientists and professionals in the oil and gas business,” says Kelly Lyons, professor of Biology at Trinity University in San Antonio, “and it’s something we could all get behind.”

The conservative authors argue that Obama-era regulations – a mishmash of auto-industry emissions targets, punitive regulations on coal production, financial incentives for “green energy,” and the occasional symbolic pipeline-squashing – lead to business uncertainty, higher costs, and executive branch overreach. And then it’s inevitably followed by back-lash and/or repeal, as is happening now. A carbon tax, by contrast, addresses the entire problem at once and puts a known, predictable, price on carbon reductions for the entire economy.

The conservative authors argue that Obama-era regulations – a mishmash of auto-industry emissions targets, punitive regulations on coal production, financial incentives for “green energy,” and the occasional symbolic pipeline-squashing – lead to business uncertainty, higher costs, and executive branch overreach. And then it’s inevitably followed by back-lash and/or repeal, as is happening now. A carbon tax, by contrast, addresses the entire problem at once and puts a known, predictable, price on carbon reductions for the entire economy.

To gain popular buy-in, next the authors propose distributing the carbon tax revenue back to American families in the form of a dividend – rather than to fund government programs. Money, obviously, appeals to wide swathes of the left and right. The proposal estimates a family of four would receive $2,000 in the first year. As the carbon tax rate increased over time, the dividends would increase as well.

The authors note the dividends would offset higher consumer costs due to the carbon tax. Just as importantly, I’d say a dividend makes for good political optics.

The Treasury Department estimates that the bottom 70 percent of households would be net beneficiaries, financially, from carbon dividends.

Third, in what I interpret as a nod to the current direction of trade policy proposals, the authors call for a “border carbon adjustment” fee that somewhat resembles proposals for something I wrote about recently, the “destination-based cash flow tax with border adjustments.” In the carbon-dividend context, however, the point of a border adjustment fee is not necessarily nationalist trade policy, but rather to nudge other countries to also get with the program of reducing their carbon emissions.

Finally, to attract the support of a traditional conservative base, the carbon dividend would almost completely replace or phase out the EPA’s suite of regulations regarding carbon dioxide emissions. The business rationale for this plan rests on the idea that less regulation, replaced by predictable market signals, would spur investment in the private sector. The authors claim the freer market approach stands in contrast to traditional Democratic solutions of larger government and greater regulation.

Ok, so let’s be real for a moment: “carbon dividends” is a clever rebranding of “carbon tax,” which forms the core of this proposal. The tax would raise costs for energy producers such as coal and oil and gas extractors.

As part of this rebranding, the authors chose the fiscally conservative approach of redistributing funds collected going back in the form of “dividends” to taxpayers, rather than using the revenue stream to fund existing government programs.

Dr. Lyons doesn’t love the dividends approach, noting that “not everyone would agree that dividends should be sent back to consumers rather than invested in research and development on solar and wind, although I can see why giving people money back makes political sense.”

Do I think this idea will pass a unified Republican Congress and Executive branch, despite its thoughtful conservative origins? A key Trump cabinet member could be a natural ally.

Rex Tillerson, Secretary of State and formerly the CEO of Exxon, has backed the idea of a carbon tax, at least when compared to a mishmash of federal regulations on the oil and gas industry.

No doubt under a Republican president Jeb Bush, John Kasich or even Marco Rubio, these blue ribbon statesman would be guiding a conservative consensus toward a cleaner energy future. But that, right there, is probably the most interesting thought inspired by this conservative proposal.

Another way to view this carbon tax proposal would be as a reminder – and a metaphor for – the true power of Establishment Republicans right now.

Another way to view this carbon tax proposal would be as a reminder – and a metaphor for – the true power of Establishment Republicans right now.

Shultz. Baker. Feldstein. Paulson. Mankiw. That’s a batting order of heavy hitters, a murderer’s row of Republican Statesmen. They made the Reagan administration what it was. They made the Bush Administrations what they were.

Which is to say, the Republican Establishment is now like a coastal city of the future, swamped and under water. The Establishment has been covered by the rising tide and heated rhetoric of an “America First” populism that disdains markets, globalization, and science.

I’d say this thoughtful conservative idea doesn’t have a snowball’s chance in Haiti of ever becoming law.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post:

Border-adjustment Tax – An untested idea

Post read (169) times.