Michael,

I read your columns weekly. I was surprised, taken aback, and disappointed in your opening sentences in a recent column.

You knew you had RE taxes to pay in January but apparently didn’t save (I call this self-escrow) during the year. It’s my belief that people read your columns and look to you as a knowledgeable resource and someone who would provide good guidance.

To not save in advance of a known annual obligation and to, willy-nilly, say “We have a home equity line of credit…” [aka a HELOC] is to enable most homeowners to do the same and then to incur interest cost on the balance. This creates a never ending cycle of debt since the homeowner would not likely have the excess funds to both pay off the balance due and save for the next year. Instead, homeowners are encouraged to not save in advance. What about homeowners that don’t have a HELOC?

I’m disappointed. Thoughts?

Warm regards, Larry Estes, Houston TX

Michael,

On a recent visit to my local bank the Branch Manager inquired if I had an Equity Line of Credit. I understand the concept. I can use an amount of equity in my home to pay for whatever and pay back the bank over time at some rate of interest. I recall seeing one of your recent articles in the Sunday Houston Chronicle about paying a tuition payment using an equity line of credit. What are the good, bad, and ugly benefits and issues with an equity line of credit? My banker showed me an example of $50K for 60 months at 8% interest.

Pete Thompson, The Woodlands

Hi Pete and Larry,

These are great questions & comments. I am a big fan of HELOCs, which I mentioned recently in a story about paying my real estate taxes.

Willy-Nilly Condoning Irresponsible Behavior

To address Larry’s criticism head-on:

Yes, the best scenario for paying bills is to always have sufficient savings on hand for expenses, and to not use any debt. No arguments there. That just isn’t a world in which I currently live. So, we make different choices. My choices may appear to be giving permission to readers to be willy-nilly incurring debt and living beyond their means. But that isn’t my intention. So, readers, to be clear, try to pay for everything with savings. For the rest of you, the HELOC can be a tool, however imperfect, that is better than the alternative.

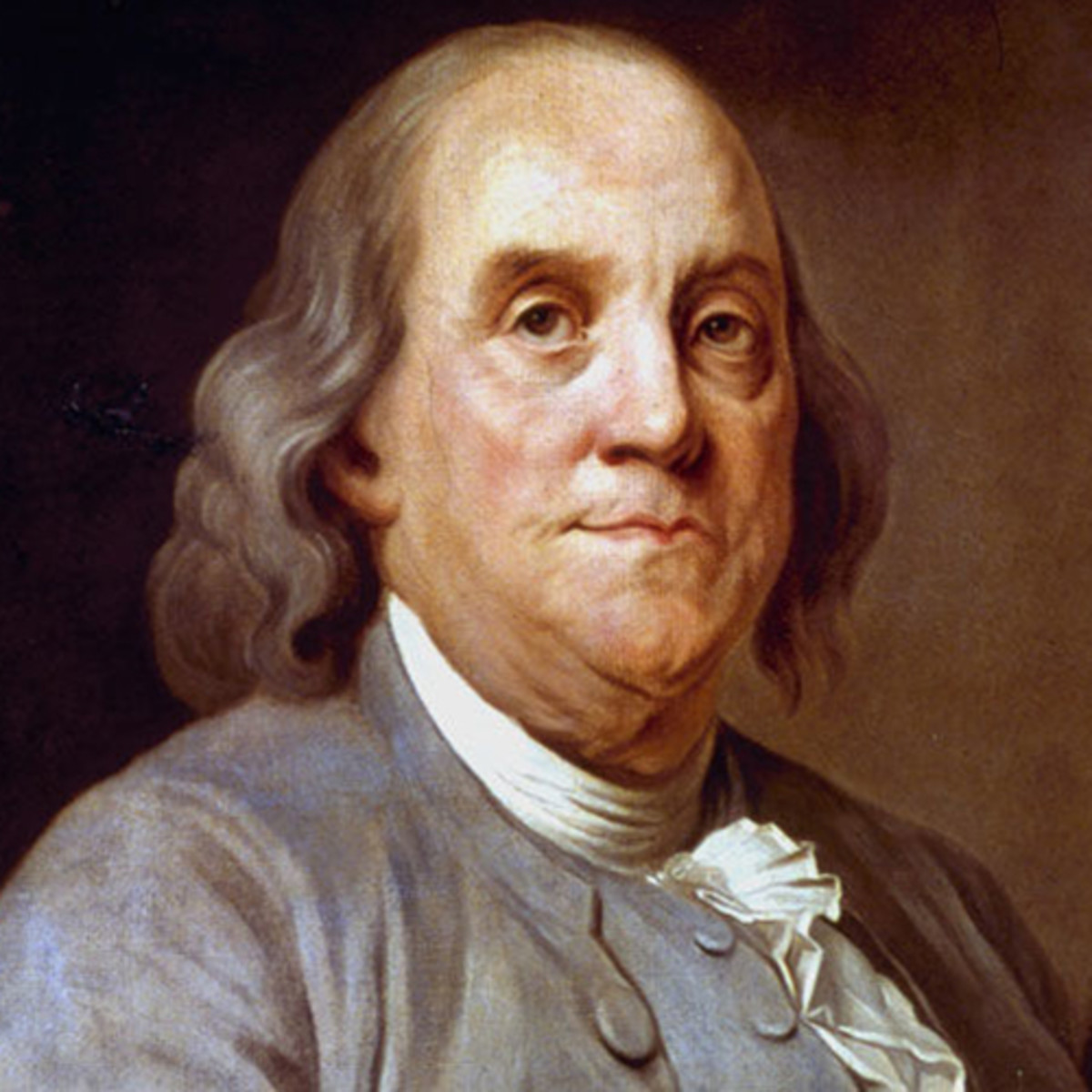

First, some definitions. “Home equity” is the difference between how much a home is worth and how much debt – usually a first mortgage – is on the home. If your house appraised at $300 thousand and you owe $200 thousand in a first mortgage, we say that there is $100 thousand of home equity. When home values go up, that creates the happy situation of additional home equity which then provides the collateral against which home equity loans or home equity lines of credit may be offered. Lenders are most often comfortable making 80 percent loan-to-value real estate loans. You can probably get a competitive interest rate on a $40 thousand HELOC in this scenario, since it stays within the 80 percent of home value rule.

Home equity lines of credit are revolving, meaning you can draw down and pay back the line – just like a credit card – as often as you like for a period of time, which is normally between 5 and 15 years. This makes it extremely convenient as an emergency back-up financial tool. The best and highest use for a HELOC is to have it in place, but to never draw down on it, unless an emergency or extraordinary opportunity arises.

Another version of this, which Pete’s banker may have been pushing, is a home equity loan (aka a HEL). This is far less attractive and useful than a revolving HELOC, in my experience and opinion. It’s just a second mortgage, and you get one if you must, but it isn’t as flexible, because it does not “revolve,” allowing for infinite drawdowns and paybacks.

If the choice is between paying for something in an emergency using a credit card versus paying for something using a HELOC, the preferred answer is almost always the HELOC. The interest rate currently should be in the 8 to 9 percent range, as compared to a 12 to 29 percent range for a credit card.

At the extreme end of the spectrum if you plan to default on your debts, a credit card would be better than a HELOC, since defaulting on a credit card only wrecks your credit, whereas defaulting on a HELOC could jeopardize ownership of your home. But I’m mostly assuming in a comparison between a credit card and a HELOC that you have a reasonable plan for paying off your debts in the long run, rather than defaulting on them.

Dangers

Because this is, like a regular mortgage, debt backed by the collateral of your home, you are putting your shelter at risk if you default. Do not do this lightly. In the 2008 mortgage crisis, HELOCs and HELs wreaked havoc with people’s personal finances, when they lost their job, defaulted on their debts, and faced foreclosure. Banks and investors similarly took massive losses on the portfolios of HELOCs and HELs they had extended. Debt is always somewhat dangerous, use with caution.

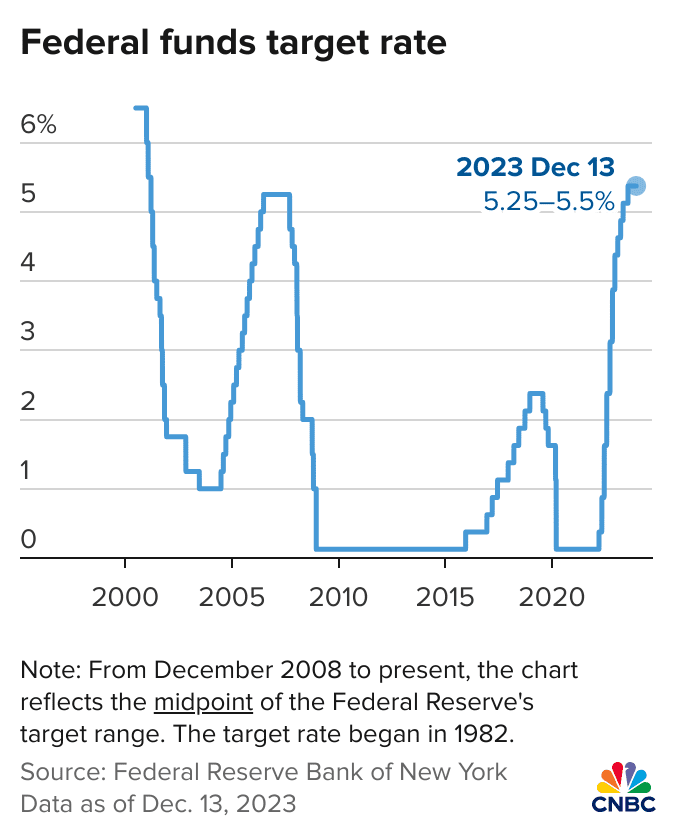

The second danger is more subtle, but very relevant today. The interest rate on a HELOC is generally “floating” not “fixed.” So that can be great in years like 2005 to 2022 with super low rates, but also not as great in 2023 and 2024 when rates float up to 8 or 9%. HELOCs have climbed from roughly 4.5 percent a few years ago to about 8.5 percent today. We have a balance on our HELOC, it’s at 8.5 percent, and as a result I don’t love it as much as I did 2 years ago.

Who is this best for?

There are people who must have a HELOC, people who should never have a HELOC, and then the rest of us.

People who must have HELOC: Entrepreneurs and owners of early-stage or small businesses. A HELOC is much easier to get than a small business loan, and every small business or early-stage company will struggle to get attractive, flexible, ready-to-use loans to deal with emergencies. If you are a small business owner or prospective entrepreneur, and you own a home with equity in it, then getting a HELOC is an absolutely key tool in your toolbox.

People who should never have a HELOC: If you have the pre-existing condition of constantly living above your means and maxing out your credit card, then a HELOC is going to, over time, turn this bad habit into a dangerous situation that puts your house at risk. Don’t get one.

The rest of us: If you have untapped equity in your home, and the ability to live within your means, the best type of HELOC is one in which it’s there for emergencies but you leave it unused. Since you don’t pay any interest on the untapped part of a HELOC, it doesn’t hurt you to have one set up. It’s more financially efficient to have an unused line of credit on a HELOC than it is to have an emergency fund sitting in cash. That’s kind of my long answer to reader Larry’s criticism.

A version of this post ran in the San Antonio Express News and Houston Chronicle

Post read (73) times.