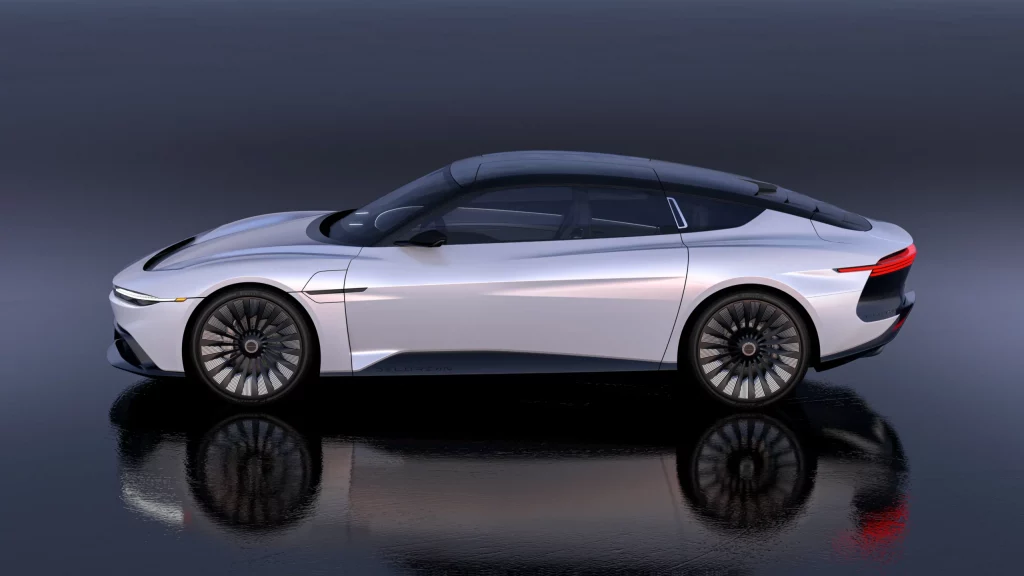

August was a big month for the DeLorean car company’s legacy. In fact, August 18 was a particularly big day on both coasts. On the west coast, San Antonio-based DeLorean Motors Reimagined hosted a public launch of its “Alpha5” concept car at the 70th Annual 2022 Pebble Beach Concours d’Elegance auto show.

Meanwhile on August 18 in New Hampshire, an alternate claim to the DeLorean legacy was announced as well. Kathryn DeLorean, original founder John Z. DeLorean’s daughter, launched the DeLorean Legacy Project, an educational engineering center with plans to build a signature tribute car, the Model JZD, first designed by Angel Guerra in 2020.

One of these is a for-profit business and the other is a historical tribute and non-profit educational project. Both are attempts to grapple with what this car brand meant in the past and what it will mean in the future. What is DeLorean’s true legacy?

Ever since its star turn in the famous Michael J. Fox movie, the DeLorean brand has operated in the boundary space between the past and the future. Any DeLorean project wrestles with this fact. A DeLorean-branded car is by definition a 40-year-old throwback while simultaneously marketing itself as a blast into the future.

The DeLorean of our imagination embodies this paradox. A retro-futuristic relic of discontinuous-time and liminal space.

The DeLorean Motors Reimagined folks know this. The name “Alpha5” – the prototype they debuted last week at Pebble Beach – uses “5” in the name because the company claims to have imagined 1990, 2000, 2010 DeLoreans (the Alphas 2, 3 and 4) that never were. That’s a cool made-up retconned legacy idea, actually.

Their signature tagline, “The Future Was Never Promised” to me sounds somewhat apologetic, as if anticipating and then responding to a disappointed fan who objects to their vision of the future for DeLorean.

Unfortunately, or maybe inevitably, it’s proving hard to satisfy the hardcore fandom that wants both retro and futuristic styling. So far it’s gone over about as well as did Hayden Christiansen’s Anakin Skywalker in the Star Wars prequels, as compared to the original Darth Vader narratives, another retconned remake that enraged original superfans.

The Delorean Motors Reimagined Instagram page hosts a relentless series of complaints about the Alpha5: that it’s not a real DeLorean, that it very clearly reused a 2019 design for a concept car called the DaVinci, that it looks like a Tesla, and that they didn’t honor the DeLorean design legacy. To satisfy your own schadenfreude, I invite you to visit their social media.

The most immediate challenge to their future business hit the company a week before Pebble Beach. Electric car company Karma Motors sued DeLorean Motors Reimagined and its top executives for stealing intellectual property and breaching the non-disclosure agreements they signed as Karma employees in 2021. For them to have a future, they will need to go back to address this past, in court.

Other fights over intellectual property

As one dives deeper into the obsessions of the DeLorean fandom online, the questions of intellectual property rights and legitimacy get even more convoluted. By the time it publicly launched in 2022, the San Antonio-based DeLorean Motors Reimagined had already teamed up in a joint venture with Delorean Motor Company of Texas, based in Humble. That company, led by Stephen Wynne, had long ago established itself as the successor to John Z. DeLorean’s bankrupted firm by buying up DeLorean parts and then over time acquiring lapsed trademark rights to the name, logo and design.

Sally Baldwin DeLorean, the administrator for John Z. DeLorean’s estate and his fourth wife at the time of his death in 2005, however, sued DeLorean Motor Company of Texas for improper use of intellectual property in 2014 and again in 2018. That case was settled in 2018 for an undisclosed amount, leaving DeLorean Motor Company of Texas in a strong position to claim intellectual property rights to the DeLorean name, brand, imagery and logo. Rights which it has now shared in a joint venture with DeLorean Motors Reimagined.

John DeLorean’s daughter Kathryn and a fan-favorite design

Kathryn DeLorean, JZD’s daughter, believes that Sally cheated on her father and also cheated her out of proceeds of her late father’s estate. Meanwhile, she has embarked on her own attempt to establish a DeLorean legacy, by working with a fan-friendly designer.

In November and December 2020, freelance automobile designer Angel Guerra of Spain launched a COVID-era fantasy idea: A 2021 DeLorean tribute to the 40th anniversary of the car.

In the online super fandom of DeLorean, Angel Guerra’s designs caught spontaneous fire. In Guerra’s telling, he reached out to Delorean Motor Company of Texas and shared his vision and even business plans for building a prototype within a year. When DeLorean Motor Company of Texas declined to pursue the idea, Guerra returned to his regular day job, working on European hyper-car auto designs.

Guerra was then surprised to hear a few months later that in fact DeLorean Motor Company of Texas was pursuing a new futuristic electric car joint venture. This turned out to be a group from Karma Motors that formed the executive team of DeLorean Motors Reimagined in San Antonio. Guerra’s comment to me on the formation of that venture, just a few months after he pitched Stephen Wynne of DeLorean Motor Company of Texas, was “what a coincidence.”

Guerra subsequently joined forces with Kathryn DeLorean to offer another kind of legacy. They hope students of design and engineering will learn from building his concept car, the “Model JZD.”

Angel Guerra and Kathryn DeLorean are careful in their public communications to disclose that the DeLorean Legacy Project is not affiliated with DeLorean Motors Reimagined (of San Antonio) or DeLorean Motor Company, Texas (of Humble).

They are not competing in any commercial sense. They represent a different claim, however, to the fandom of the DeLorean. In launching her legacy project, Kathryn says “There is no competition, I am a DeLorean, I’m making engineers, not engines.”

Now then, let’s go back to the future. Ten years from now, Whose legacy will we remember? Obviously, I don’t know.

But there’s a recurring pattern with this company. Kathryn DeLorean claims she was cheated out of her estate by her step-mother Sally Baldwin DeLorean. Sally Baldwin DeLorean claimed she was cheated out of intellectual property and royalties by Stephen Wynne’s company. Karma Motors feels cheated out of intellectual property by the executive team of DeLorean Motors Reimagined. Guerra feels cheated out of credit and inspiration by Wynne. Online superfans feel cheated out of DeLorean’s legacy by the new designs. And I’m worried about the public being cheated out of up-to-$1 million in city and county subsidies offered to DeLorean Motors Reimagined, a pure startup with no track record, entering an extremely difficult industry.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Post read (63) times.